Sending information to insurance agencies, Mr. Nguyen Van Chuc, born in January 1988, asked that he had been working since 2012 and had paid compulsory social insurance since January 2012. He now wishes to quit his job at the company and participate in voluntary social insurance to receive a pension in the future.

Mr. Chuc plans to pay voluntary social insurance for another 9 years to reach 20 years of social insurance participation, meeting the participation time requirement to receive retirement benefits. He would like to ask, when he reaches retirement age, how will his pension be calculated?

When stopping paying compulsory social insurance, employees can participate in voluntary social insurance to receive pension later (Illustration: Huu Khoa).

According to Vietnam Social Security, the monthly pension level is stipulated in Article 56 of the 2014 Law on Social Insurance and specifically implemented for compulsory social insurance participants in Decree No. 115/2015/ND-CP, for voluntary social insurance participants in Decree No. 134/2015/ND-CP.

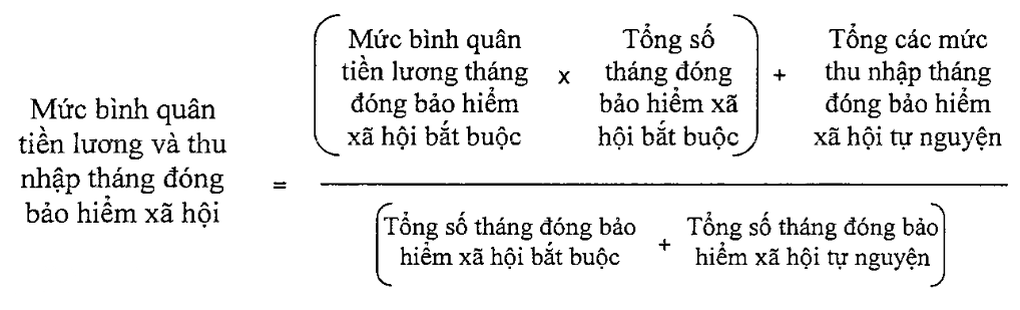

Accordingly, the monthly pension of employees who have both compulsory and voluntary social insurance contributions is calculated by multiplying the monthly pension rate by the average monthly salary and income for social insurance contributions.

Regarding the pension rate, for male workers retiring from 2022 onwards, it is calculated at 45% corresponding to 20 years of social insurance contributions, then for each additional year of social insurance contributions, an additional 2% is calculated, with a maximum of 75%.

With the plan to pay social insurance for only 20 years (including compulsory social insurance and voluntary social insurance), Mr. Chuc will receive a pension rate of 45% of the average monthly salary and income for social insurance contributions.

Article 5 of Decree No. 134/2015/ND-CP clearly stipulates the retirement regime for voluntary social insurance participants who previously paid compulsory social insurance.

Accordingly, the time to calculate retirement benefits is the total time of compulsory social insurance and voluntary social insurance contributions (excluding the time calculated for one-time social insurance benefits).

Clause 4, Article 5 of Decree No. 134/2015/ND-CP also clearly stipulates the formula for calculating the average monthly salary and income for social insurance contributions to calculate pension and one-time allowance as follows.

However, the calculation of monthly pension depends on many factors such as: total time of social insurance payment, monthly income development as the basis for social insurance payment during the entire period of social insurance payment until retirement, age, gender, retirement time, consumer price index of each period according to Government regulations...

Therefore, it was not until retirement that Mr. Chuc could accurately calculate his monthly pension.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)