Improving access to affordable trade finance could increase Vietnam's import and export turnover by more than US$55 billion per year, according to the study "Trade Finance in the Mekong Region" recently released by the International Finance Corporation (IFC) and the World Trade Organization (WTO).

| ADB increases trade finance limit for Eximbank to $75 million Global trade finance gap to widen to $2.5 trillion by 2022 |

Domestic trade finance remains low

A joint report by the IFC and the WTO shows that domestic trade finance in Vietnam is not only not popular but also expensive, fragmented and only provides basic services. In 2022, banks in Vietnam only provided trade finance for 21% of the country's total import-export turnover of 731 billion USD.

It is worth noting that banks primarily support domestic enterprises engaged in regional trade rather than large multinationals engaged in global trade. Many subsidiaries of multinationals in high-growth, high-value sectors such as electronics and apparel are less dependent on trade finance in which domestic banks act as intermediaries.

|

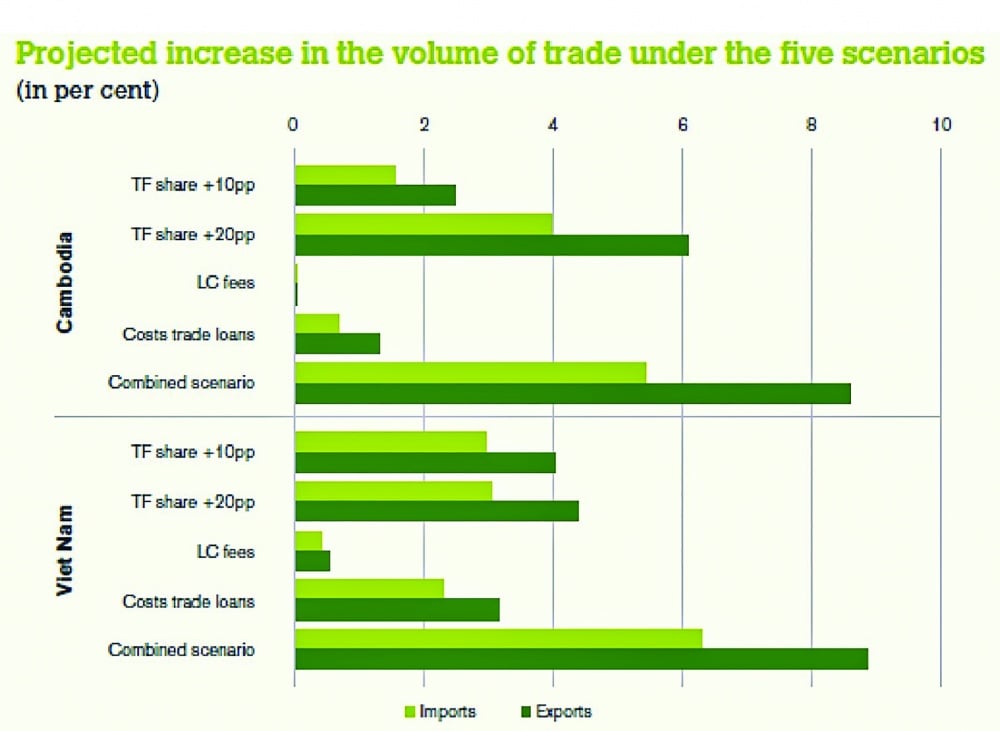

| Forecast of scenarios affecting import-export turnover increases depending on the level of improvement in trade finance (source: Joint report of IFC and WTO) |

According to the IFC-WTO study, according to the survey responses of import-export enterprises, high collateral requirements and complicated appraisal processes are two of the main reasons why they do not seek support from banks. On the supply side, in 2022, Vietnamese banks rejected an average of 12% of trade finance requests - mainly from small and medium-sized enterprises (SMEs) - equivalent to about 20.3 billion USD in unmet demand. The reason is attributed to the lack of collateral and high credit risk. In addition, the trade finance activities of new banks mainly revolve around traditional instruments, while non-traditional instruments - such as supply chain finance and based on digital services - are not widely used, which is also a factor that makes domestic trade finance not as expected.

| The study, titled “Joint IFC-WTO Report: Trade Finance in the Mekong Region,” is part of a series of regional trade finance surveys. The study uses a survey of banks in three lower Mekong economies, including Vietnam, Cambodia, and Lao PDR, to examine the trade finance gap in these countries and suggest solutions to expand trade finance, analyzing opportunities from trade finance to promote trade, growth, and improve people’s livelihoods. |

In order to clarify the current situation and opportunities for expanding trade finance for Vietnamese enterprises, thereby supporting domestic manufacturers and importers and exporters to increase international trade with more active support from banks, recently in Hanoi, the report authors from IFC and WTO had a discussion with representatives of policy makers, management agencies as well as commercial banks in Vietnam. According to Mr. Thomas Jacobs, IFC Country Director for Vietnam, Cambodia and Laos, since Vietnam's domestic trade finance is currently focused mainly on domestic manufacturers, expanding the scope of trade finance will not only help improve the competitiveness of Vietnamese import-export enterprises but more importantly, promote production, enhance integration into the global supply chain and spread the benefits of trade more evenly among domestic manufacturers.

Mr. Marc Auboin, a WTO expert, said that in developed countries, the level of trade finance usage is up to 60%, while in developing countries, including Vietnam, trade finance is only about 20%. According to this expert, Vietnam's import and export have grown very rapidly in the past 10 years, requiring domestic trade finance activities to contribute more to this process, especially when the country's participation in the global value chain is increasingly larger.

Boosting supply chain finance

In fact, most trade finance activities are only carried out through traditional tools, Ms. Tran Thu Trang, senior economist of IFC, said that the room for promotion in the coming time is that banks can focus on developing new tools such as supply chain finance and innovative digital services to reduce costs and improve accessibility. This expert said that if the supply chain finance tool is well exploited, it will create many advantages for SMEs - a sector that is currently facing difficulties and has less access to trade finance than large enterprises.

To develop such new financing instruments, the IFC-WTO joint report recommends: on the one hand, improving the legal framework to address collateral requirements, digital transactions, central bank conditions and accountability frameworks; and on the other hand, it recommends raising awareness among SMEs and domestic suppliers on how to access trade finance.

Commenting on solutions to increase trade finance in Vietnam in the coming time, Mr. Nguyen Quoc Hung - Vice Chairman and General Secretary of the Vietnam Banking Association emphasized that the banking industry does not distinguish between large enterprises or SMEs, but all want to lend and expand their customer base. However, the problem is that many SMEs still do not meet the requirements of banks, leading to high credit risks and banks being hesitant in providing trade finance. To improve this situation, businesses need to improve their ability to meet the conditions of credit institutions by improving transparency in financial reporting, governance, etc., thereby creating trust for banks in lending activities.

In addition, it is also necessary to soon complete the legal framework for trade finance activities. Mr. Nguyen Quoc Hung hopes that the Law on Credit Institutions (amended) recently passed by the National Assembly will open up more opportunities, and at the same time, he looks forward to the early issuance of decrees and circulars guiding this law to create conditions for trade finance activities to develop strongly in the coming time.

According to Mr. Dinh Ngoc Dung - Deputy Director in charge of Corporate Banking, SHB, when participating in trade finance activities in general and supply chain finance in particular, the bank will bring benefits to all parties, from optimizing the purchase and sale of goods, to providing products and services. Because in addition to participating in financing businesses, providing payment methods such as issuing L/C, factoring... the bank also participates in consulting customers on market access information and assessing the reputation of partners to minimize risks for all parties.

However, the limited management capacity and information transparency of enterprises are still a big challenge for banks in expanding trade finance activities. In addition, to expand this activity, banks will also have to invest a lot of money in digitalization and technology, while it takes a long time to recover capital in supply chain finance. However, SHB representative also hopes that with the efforts of IFC, enterprises and related parties, supply chain finance activities will develop strongly in Vietnam in the coming time.

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)