According to Mr. Le Quoc Ninh - Chairman of the Consumer Finance Club, General Director of MB Shinsei Finance Company Limited (Mcredit), in the past time, the operations of consumer finance companies have encountered many difficulties and obstacles. Therefore, by the end of the first quarter of 2023, the growth rate of outstanding consumer finance loans compared to December 2022 decreased (-3.8%), bad debt increased and is at risk of increasing.

Speaking at the seminar "Current situation and solutions for healthy development of Vietnam's consumer finance market" organized by Nha Do Tu Magazine on the morning of April 25, Mr. Le Quoc Ninh stated that with a population of 100 million people and a young average age (33.7 years old), Vietnam is considered one of the countries with a potential consumer finance industry.

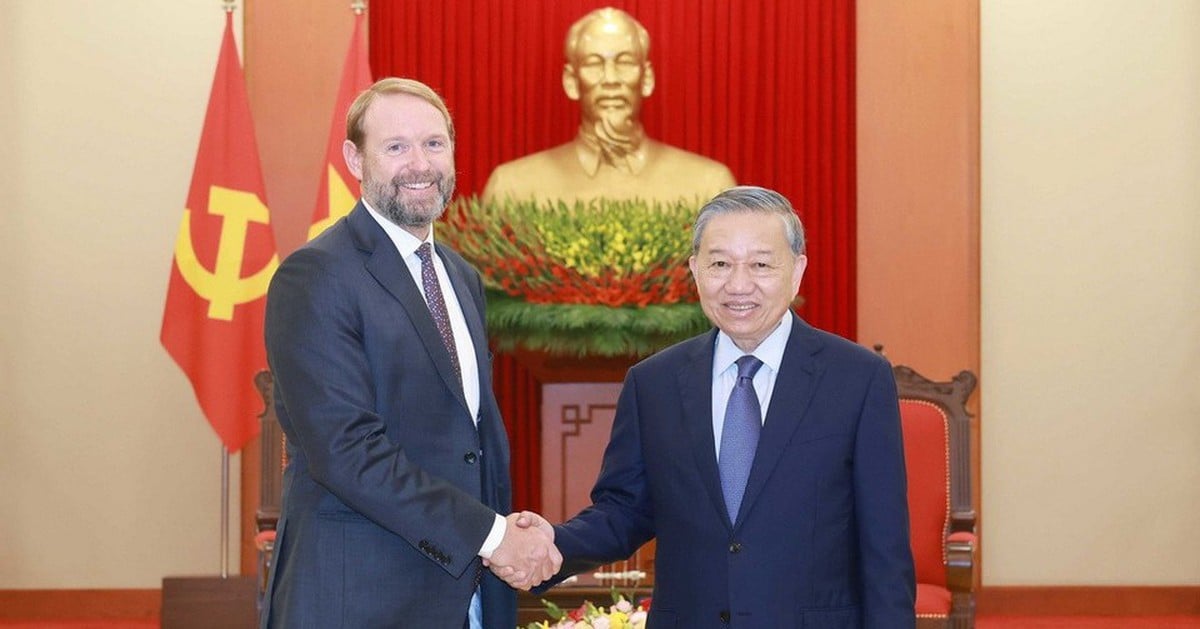

|

| Mr. Le Quoc Ninh, Chairman of the Consumer Finance Club, General Director of MB Shinsei Finance Company Limited (Mcredit) spoke at the Seminar. |

In recent times, consumer finance companies licensed by the State Bank have continuously improved their financial capacity, innovated technology, and expanded their networks in export processing zones - industrial parks, rural areas, remote areas, etc. to provide capital for disadvantaged people in a timely manner to ensure essential needs.

As a result, by December 31, 2022, the total outstanding debt of 16 finance companies licensed by the State Bank of Vietnam reached over VND 220 trillion, accounting for 1.87% of the total outstanding debt of the entire economy and 8.5% of the outstanding consumer loans of the entire system. Although accounting for a very small proportion, it has supported about 30 million people to access loans with an average outstanding debt of about VND 35-50 million/person. It can be seen that consumer credit activities in general and the activities of legitimate consumer finance companies in particular have played a very important role in socio-economic development, improving the quality of life, thereby implementing a comprehensive financial strategy.

In addition to the achieved results, according to Mr. Le Quoc Ninh, the operations of consumer finance companies licensed by the State Bank still face many difficulties and challenges. Specifically, regarding lending activities, consumer finance companies licensed by the State Bank are strictly managed because they are regulated by general legal regulations such as the Enterprise Law, Investment Law, and must also comply with the Law on Credit Institutions, limits to ensure operational safety and other regulations of the State Bank.

|

| Overview of the Seminar |

However, many companies not licensed by the State Bank have taken advantage of the names of licensed financial companies to expand their networks into difficult areas, approach people, and lend capital at very high interest rates in many forms such as: Quick loans, cash loans at any time, offering very attractive interest rates but inserting other very high costs... Not only that, when collecting debts, they have used all kinds of aggressive acts and tricks to force people to pay. This phenomenon has seriously affected the image and reputation of financial companies, leading to many difficulties in lending activities.

Regarding capital mobilization activities, compared to banks, consumer finance companies are limited in many areas (receiving personal deposits, providing payment services, etc.). Finance companies are only allowed to mobilize from corporate deposits of over 12 months, while businesses tend to deposit money in banks to enjoy additional financial services. Therefore, to attract corporate deposits, finance companies must mobilize at high interest rates, thereby affecting the lending interest rates that borrowers have to pay.

Regarding debt collection activities, illegal debt collection is an act that needs to be condemned, any consumer lending company that violates the law needs to be strictly handled, even have its license revoked to create fairness and transparency for the market. Recently, the police force has been very active, contributing to suppressing black credit crimes, strictly handling debt collectors. However, along with the recent situation where the authorities have conducted inspections of a number of headquarters, branches, and expanded offices of financial companies licensed by the State Bank, it has seriously affected the reputation and image of the company, leading to debt collection activities being stagnant, bad debts increasing, some customers deliberately use this news to boycott, claiming that the debt collection activities of these consumer finance companies are illegal, delaying debt repayment and challenging debt collectors when repeatedly reminded to pay their debts.

The rate of borrowers "not paying their debts" is increasing; meanwhile, there are no sanctions against these customers and it is difficult to file a lawsuit with low-value debts. In addition, recently there has been a phenomenon of "collective" debt default from a group of customers after information that the investigation agency prosecuted a number of "terrorist" debt collectors, and offensive debt collection has flourished, causing negative impacts on the market and greatly affecting the debt collection activities of financial companies. By December 31, 2022, bad debts of financial companies licensed by the State Bank increased by 23.09% compared to December 31, 2021 and tend to increase in the coming time.

In addition, the company's debt collectors are psychologically affected by being threatened by customers, confused and worried because of conflicting information (arrests, investigations, etc. from inspections by authorities). The rate of employee resignation is high, recruiting employees is more difficult than before, due to many reasons such as social prejudice about the job, life risks when working, family impact, etc.

The fact that customers are late in paying their debts forces consumer finance companies to increase their costs for debt collection, including operations, human resources and legal costs. In addition, according to regulations of the management agency, lending institutions are required to set aside provisions based on the actual bad debt situation, affecting the ability to grow their business. As a result, lending interest rates are forced to be adjusted upward, directly affecting borrowers.

Mr. Ninh said that due to the impact on image and reputation when financial companies licensed by the State Bank are being equated and treated like companies in the above group 2, many businesses that are depositing money at financial companies withdraw their money, which has significantly affected the lending capital of financial companies.

With the above difficulties and problems, by the end of the first quarter of 2023, the growth rate of outstanding debt compared to December 2022 decreased (-3.8%), bad debt increased and is at risk of increasing.

Source

Comment (0)