After half a decade of being promulgated, the Securities Law is planned to be amended by the Ministry of Finance in the Draft Law amending a number of articles of 7 laws.

Add a layer of investor protection

One of the most focused amendments to the Securities Law is the provisions to ensure transparency of information about transactions and “goods” on the exchange, thereby adding multiple layers of protection for investors. In particular, there are additional specific provisions on the responsibilities of organizations and individuals submitting documents or participating in the process of preparing documents and reports, in order to improve the quality of information provided to investors.

The bill also includes the illegal buying and selling of shares by insiders in the group of prohibited acts. Specifically, transactions by insiders of public companies, public funds and related persons who do not disclose information about the expected trading of shares and public fund certificates will be prohibited.

At the same time, legalize regulations on stock market manipulation from Decree 156/2020/ND-CP. Specific acts are listed as buying or selling securities with a dominant volume at the time of opening or closing the market to create a new closing price or opening price for that type of security on the market; placing buy and sell orders for the same type of security on the same trading day or colluding with each other to buy and sell securities without leading to an actual transfer...

The criteria for becoming a professional investor have also been added, requiring participation in securities investment for a minimum period of 2 years with a minimum trading frequency of 10 times per quarter in the last 4 quarters. The condition of a minimum income of 1 billion VND/year must be maintained for the last 2 years.

Explaining this change, Mr. Hoang Van Thu, Vice Chairman of the State Securities Commission, said that adjusting the standards for professional investors in the Securities Law is very urgent. Therefore, it is necessary to improve the quality of investors, especially in terms of risk assessment ability and understanding of businesses.

However, the Bill also adds provisions that professional securities investors include foreign institutional and individual investors, helping to expand the scope of this group of investors.

Contradictions on the Central Clearing Counterparty (CCP) Model

In this amendment to the Securities Law, one of the notable amendments is related to Point a, Clause 4, Article 56 on members of the Vietnam Securities Depository and Clearing Corporation (VSDC) in the direction of clarifying that commercial banks and foreign bank branches can be clearing members in both the derivatives market and the underlying securities market.

According to the representative of the Ministry of Finance - the agency drafting this draft law, during the process of drafting Decree No. 155/2020/ND-CP and Decree No. 158/2020/ND-CP, the unified view related to clearing members is that clearing members (including securities companies, commercial banks, foreign bank branches) are allowed to clear and pay for securities transactions on both the underlying securities market and the derivatives market.

As for clearing members being commercial banks and foreign bank branches, when clearing and paying for securities transactions on the derivatives market, this can only be done for that commercial bank or foreign bank branch.

“However, in the process of implementing the CCP mechanism, there have been different understandings between the banking sector and the securities sector on whether to allow commercial banks and foreign bank branches to be clearing members on the underlying securities market or not,” the drafting agency said.

This is the reason why it is necessary to amend and supplement the provisions in Point a, Clause 4, Article 56 to have a unified understanding. Thereby, allowing commercial banks and foreign bank branches to perform clearing and settlement of transactions on both the underlying and derivative markets.

However, at the meeting to review the proposal to build a draft law amending and supplementing a number of articles of 7 laws chaired by the Ministry of Justice, the State Bank proposed to stipulate that commercial banks and foreign bank branches only perform clearing on the derivatives market. The reason is that if they participate in clearing on the underlying market, it will create many risks in the relationship between banks and affect the liquidity of banks.

In fact, one of the two biggest problems in FTSE Russell’s decision to upgrade Vietnam’s stock market from frontier to emerging relates to clearing and settlement, the transfer of payment counterparties, and the handling of failed transactions. The solution to these requirements is to apply the CCP model.

Because this model cannot be implemented due to the need to adjust regulations on the operations of custodian banks, the current solution is that securities companies will provide payment support for foreign institutional investors (NPS).

However, in the long term, it is still necessary to completely resolve this issue through the CCP route so that VSDC can become the buyer of all sellers and the seller of all buyers. The key to this, according to Mr. Nguyen Son, Chairman of VSDC's Board of Members, is to complete the law so that banks can be direct clearing members in the underlying market.

Source: https://baodautu.vn/sua-luat-chung-khoan-siet-chat-hon-de-bao-ve-nha-dau-tu-d223258.html

![[Photo] Prime Minister Pham Minh Chinh meets with Brazilian President Luiz Inacio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/41f753a7a79044e3aafdae226fbf213b)

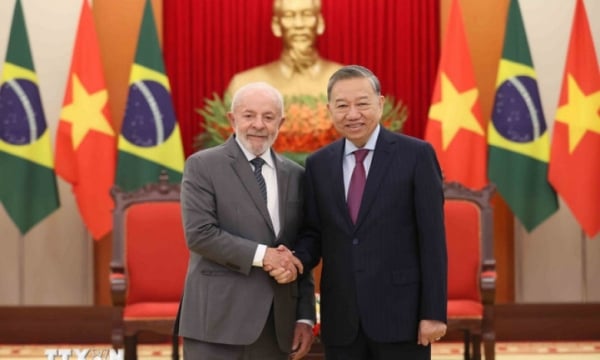

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Helicopters and fighter jets practice in the sky of Ho Chi Minh City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/3a610b9f4d464757995cac72c28aa9c6)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

Comment (0)