|

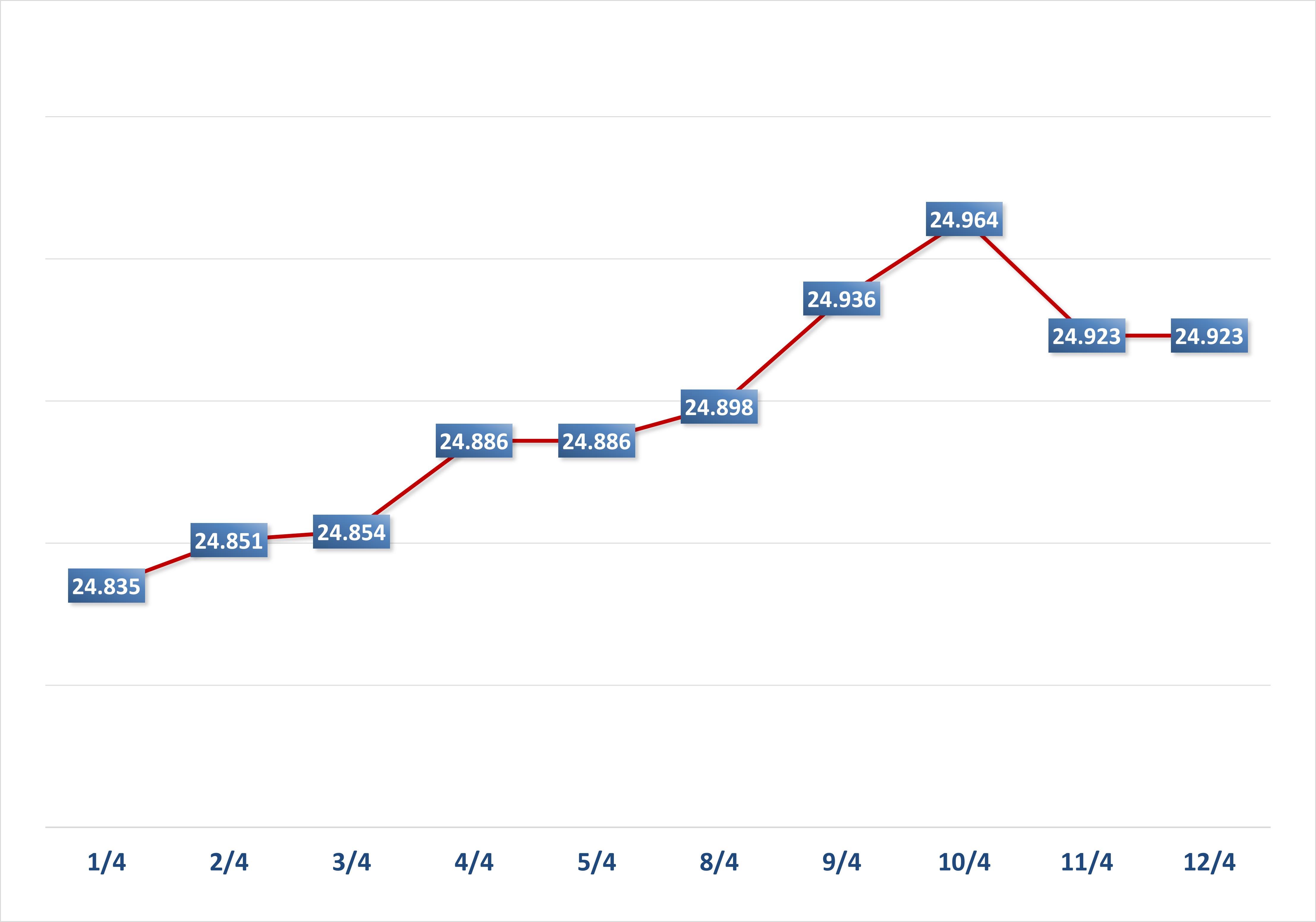

| VN-Index decreased 6.35 points in the trading session |

A slight recovery thanks to VIC and some small stocks at times pushed the index down to just 2 points below the reference, but selling pressure in the last minutes pulled the market down to close with a decrease of 6.35 points. Liquidity on HOSE only reached nearly 16 trillion VND. Foreign investors reduced their net selling by nearly 460 billion VND on all 3 exchanges.

Commenting on the underlying market, experts said that stocks in the Asia-Pacific region fell across the board as they awaited the US tariff rate expected to be announced on April 2. Domestically, the VN-Index fell more than 6 points as buying demand dropped sharply.

Technically, VN-Index continued to decline with low liquidity, reflecting the increasing concern of both buyers and sellers. The index still closed in the sideways range formed in the first half of March. The decrease in volume in this sideways range is consistent with the correction wave before the market can increase again. Investors can hold the current portfolio.

Regarding the investment strategy for the week from March 31 to April 4, 2025, VCBS said that in the week from March 24 to March 28, VN-Index continued to move sideways in the range of 1,320-1,340 points with liquidity decreasing gradually over each session. Cash flow recorded a clear differentiation when tending to look for individual stocks/industry groups with their own stories or expecting positive business results in the first quarter of 2025. Red dominated the week, combined with gradually decreasing liquidity, showing the existing cautious sentiment. The blue-chip group, considered the pillar group supporting the market, has not yet found consensus. However, the fact that some large-cap stocks (VIC, GVR, VHM, SHB) took turns supporting the general index during the week has partly helped VN-Index maintain the 1,320 point mark.

In the morning session of March 28, VN-Index continued to fluctuate within a range of about 5 points around the reference level. Although selling pressure dominated most of the trading time, thanks to the green color from large-cap stocks such as VIC and GVR, the general index was somewhat balanced and minimized the risk of falling deeper in the morning session.

Cash flow has not spread and maintained the typical divergence as in the previous sessions. In the afternoon session, the general momentum was somewhat weaker as active selling liquidity increased. By mid-afternoon, the general index suddenly fluctuated strongly and slid more than 8 points from the reference level, leading to a narrowing of the increase in some stocks compared to the morning session.

VN-Index ended the week below 1,320 points due to selling pressure from both domestic and foreign investors. At the end of the session, VN-Index closed at 1,317.46 points, down 6.35 points, equivalent to 0.48%. At the end of the week, VN-Index decreased 4.42 points (-0.33%) compared to the previous week.

Technical analysis, VCBS said that VN-Index ended the weekend session with a red Marubozu candle and lost the 1,320 point mark, showing strong supply in the market. On the daily chart, the general index cut below the MA20 line, while the CMF indicator approached the 0 mark from top to bottom, showing the weakness of the market in recent sessions. Along with that, the RSI and MACD indicators continued to decrease and showed negative divergence signals, so there is a high probability that VN-Index will continue to fluctuate next week and the nearest support level is 1,310 points.

On the hourly chart, the MACD and RSI indicators are both in the low zone, approaching the oversold zone, thus attracting cash flow to disburse again next week, helping VN-Index consolidate its momentum. However, the -DI line is anchored high above the 25 mark and the ADX line is approaching this mark, so if the cash flow does not disburse immediately and waits for clearer confirmation signals, the probability of the correction will not end immediately and the nearest support point is 1310 as stated above.

Regarding trading strategy, VCBS believes that the market has shown signs of weakening with many fluctuating and struggling sessions during the week, and this has made the general sentiment more cautious with trading activities becoming more quieter with each session. With the current developments, we recommend that investors closely follow market developments, and take the opportunity to restructure their portfolios by selling off blue-chip stocks that have been under pressure to adjust in the past, and at the same time, they can consider disbursing part of the stocks/industry groups that maintain convincing support levels and are not much affected by the current movement of the general index. Some groups can select stocks such as securities and rubber.

Source: https://thoibaonganhang.vn/dong-tien-mua-suy-yeu-vn-index-giam-them-635-diem-162008.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)