Responding to questions from the Governor of the State Bank on the afternoon of November 11, Deputy Prime Minister Ho Duc Phoc assessed that monetary and fiscal policies are the driving forces of economic development. Conversely, economic growth or decline will directly affect credit institutions and the State budget.

According to the Deputy Prime Minister, the management of monetary and fiscal policies in recent times has been very reasonable. Monetary policy has been managed promptly, accurately and effectively; while fiscal policy has been implemented in an open and reasonable manner, so the results achieved have been good.

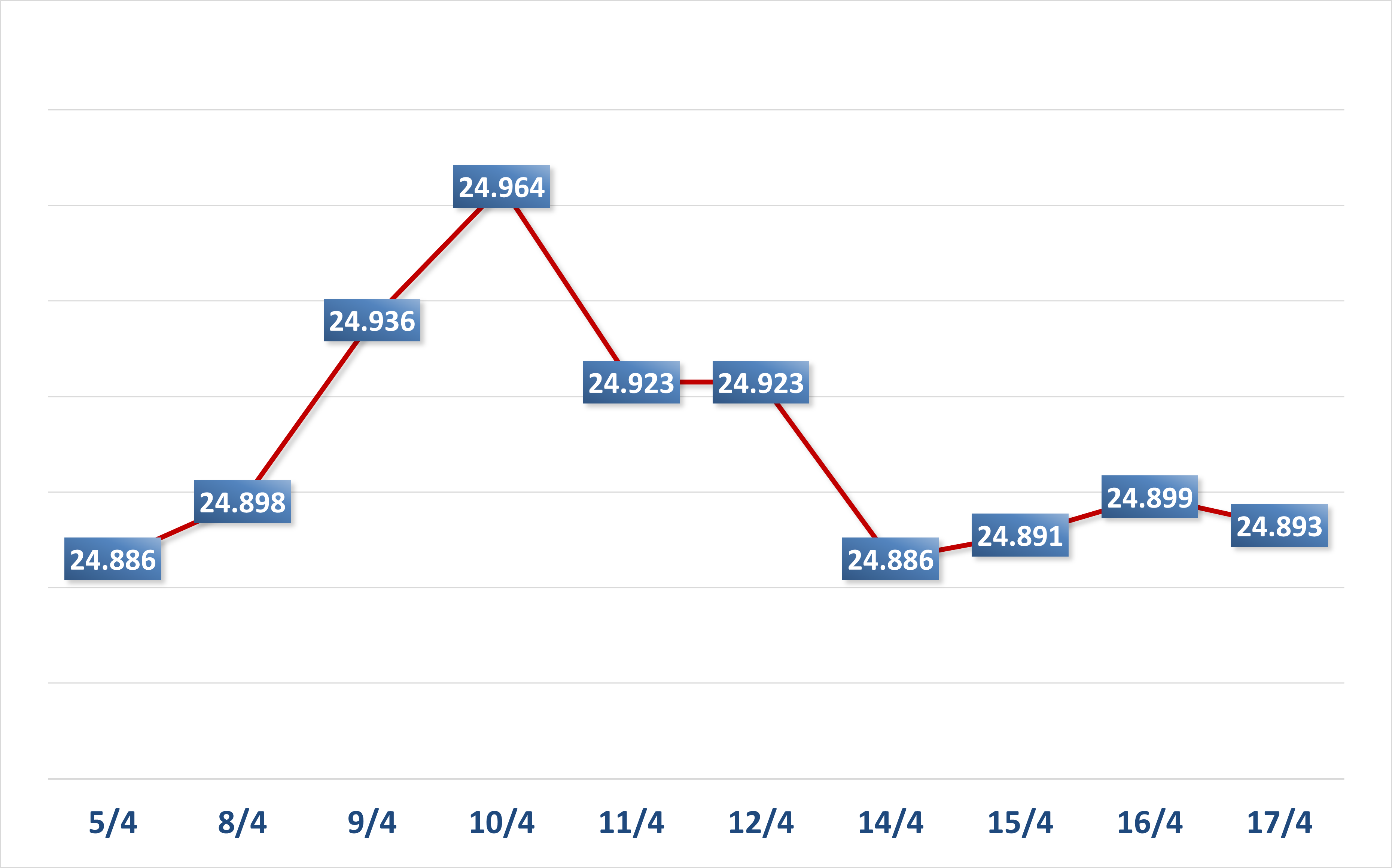

The proof is that in 4 years, we have exceeded the budget revenue by about 1 million billion VND, each year exceeding the previous year. We have also reduced taxes for businesses and people by nearly 800,000 billion VND. At the same time, we have maintained the exchange rate between USD/VND.

"Besides, we have handled 2 zero-dong banks and are preparing to handle 2 more zero-dong banks to stabilize the system and serve the economy very well," he emphasized.

Deputy Prime Minister - Minister of Finance Ho Duc Phoc (right).

He also added that this year our GDP reached nearly 7%, CPI was 3.88%, public debt was 37%. Budget revenue as of today (November 11) reached 99.4% compared to the estimate assigned by the National Assembly. Reaching 17.78% compared to the same period last year, state budget revenue compared to the same period last year increased by 255,216 billion VND. " We expect this year to exceed the minimum budget revenue by 300,000 billion VND compared to last year, creating additional resources for the economy, investing in building infrastructure such as highways and other infrastructures ".

Amending Decree 24 to facilitate the import of raw gold

According to the Deputy Prime Minister, the import and export of gold and the trading of gold have been regulated in Decree 24, dated April 3, 2012. However, realizing that the actual management situation is changing, the Government has directed to amend this Decree. "Currently, the State Bank has implemented the amendment of Decree 24, especially on the issue of import and export in the direction of tax incentives for domestic goods to develop and create conditions for importing raw materials for production. And when sold, it creates conditions for jewelry to be exported, " the Deputy Prime Minister informed.

Regarding the management of the gold market, Mr. Phoc said that according to Decree No. 123 dated October 9, 2020 of the Government and Circular No. 78 dated May 2, 2023, the Ministry of Finance has regularly directed the tax authorities, from last year to this year, to issue 5 documents to guide tax declaration and payment. Thereby, the management of invoices of gold selling enterprises has no difficulties or problems.

Recently, the market management agency has temporarily suspended a gold trading unit that could not prove the source of the raw materials. The source of the raw materials could be inherited from ancestors or stored in advance without counting. " We only handle it when we discover that the gold is smuggled gold. If we cannot prove that the gold is smuggled gold, we have no right to handle the gold shops ," he said.

In the coming time, we must conduct legal and transparent trading. At the same time, we must apply information technology to manage gold companies and shops and fight against gold smuggling. “ Gold is not a measure of currency, but gold is still a precious metal and is still a shelter for idle money, so we will strictly manage this area, ” he emphasized.

Loan solutions to support when there is no collateral

Also at the question-and-answer session, State Bank Governor Nguyen Thi Hong said that under the Government's strong direction, immediately after storm No. 3 (Yagi) passed, 35 credit institutions registered credit packages with a total value of VND405,000 billion to provide new loans and lower interest rates. Of which, about VND300,000 billion was reserved for new loans.

The decision by credit institutions to grant new loans to customers affected by the storm when there is no longer collateral is entirely within the authority of the credit institution, based on the credit institution's work with the customer.

The Governor of the State Bank requested that People's Committees at all levels closely coordinate to connect banks, businesses and people to have more information for credit institutions to make their own decisions in these cases. For business plans that have bad debt risks, credit institutions will also use professional measures to handle them according to current legal regulations.

“The fact that credit institutions have launched support packages shows that the banking industry is ready to implement solutions to remove difficulties for businesses and people after the recent storm,” said Governor Nguyen Thi Hong.

Video: Deputy Prime Minister Ho Duc Phoc answers questions

Source: https://vtcnews.vn/pho-thu-tuong-se-xu-ly-tiep-2-ngan-hang-0-dong-ar906750.html

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)