Hanoi Stock Exchange has just announced information on the bond issuance of Petrolimex Joint Stock Commercial Bank (PG Bank – UPCoM: PGB).

Accordingly, PG Bank issued a batch of bonds with code PGBL2325001 on September 25, 2023. The issuance volume is 500 bonds, with a face value of VND 1 billion/bond, equivalent to a total issuance value of VND 500 billion.

The bonds are issued in the domestic market with a term of 2 years. The maturity date is September 25, 2025. The issuance interest rate is 7.5%/year with a term of 1 year. The depository organization is the Vietnam Securities Depository and Clearing Corporation. The offering subjects are individuals and professional organizations.

The issuer has the right to repurchase the bond before maturity and the bondholder has the right to resell the bond before maturity on the first interest payment date. Specifically, PG Bank has the right to repurchase part or all of the bond during the bond term. At that time, the bondholder is obliged to resell the bond at the request of PG Bank.

At the same time, the owner has the right to request PG Bank to buy back part or all of the bonds during the bond term.

The capital for the repurchase is taken from the funds obtained from PG Bank's business revenue and/or from other legal sources of capital.

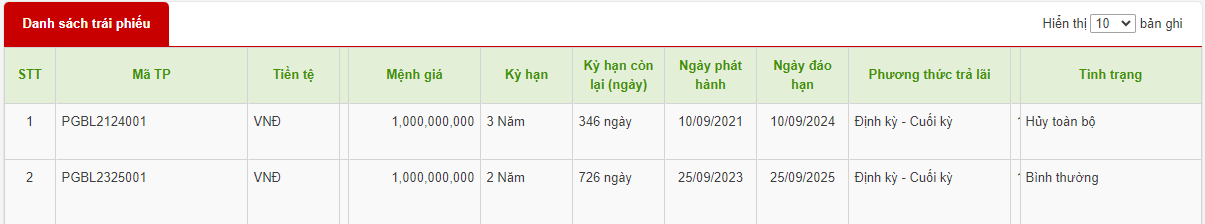

According to information from HNX, this is the second batch of bonds issued by PG Bank to the market. Previously, PG Bank's only bond batch was the bond lot coded PGBL2124001 issued from September 2021 with a term of 3 years, expected to mature on September 10, 2024.

2 lots of bonds were issued to the market by PG Bank.

This is a non-convertible bond, without warrants, without collateral and is not a secondary debt of the issuing organization. The actual issuance interest rate is 4.3%/year. The purpose of issuing bonds is to increase the scale of working capital to meet the demand for medium and long-term loans.

However, on September 11, this bank bought back all 500 outstanding bonds of this code with a total volume of 500 billion VND.

Regarding business performance, in the first 6 months of 2023, PGBank's pre-tax profit reached more than VND 303 billion, up 24% over the same period last year. After-tax profit also increased by 24% to nearly VND 243 billion.

As of June 30, 2023, PGBank's total assets reached VND46,987 billion, down 4% compared to the beginning of the year. Outstanding loans to customers increased by 4% to VND30,250 billion. Customer deposits decreased slightly by 0.1% to VND31,228 billion.

On the market, at the end of the trading session on September 29, PGB shares increased by 0.72% to VND 28,000/share with a trading volume of 1,387 units .

Thu Huong

Source

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

Comment (0)