Orient Commercial Joint Stock Bank (OCB) has just announced information on bond issuance results on September 12, 2024.

Accordingly, the bank has successfully mobilized VND 2,500 billion in bonds coded OCBL2427014 with a term of 3 years in the domestic market. The bond lot is expected to mature on September 12, 2027. The issuance interest rate is 5.5%/year.

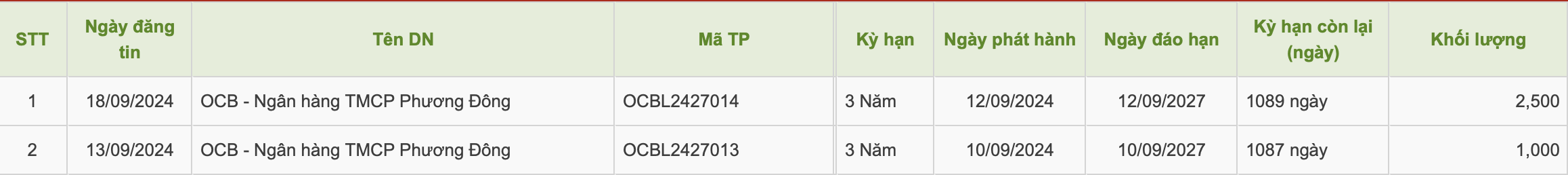

From June to September 2024, this bank issued a total of 14 bond lots to the market with a total value of VND 17,800 billion. In September 2024 alone, OCB successfully mobilized 2 bond lots with a total value of VND 3,500 billion.

OCB bond information issued in September 2024.

Previously, on September 10, the bank issued the OCBL2427013 bond lot worth VND1,000 billion, with a term of 3 years, expected to mature in 2027 with the same issuance interest rate as the above lot.

On the other hand, OCB also announced that it had repurchased VND 1,000 billion worth of bonds coded OCBL2225017 before maturity, issued in 2022, with a term of 3 years and expected to mature in 2025.

In early September, the bank also announced the results of the repurchase of two bond lots with codes OCBL2225013 and OCBL2225014. Accordingly, the bank repurchased the two bond codes above with a total value of VND2,000 billion, corresponding to each code having a face value of VND1,000 billion.

Of which, the OCBL2225013 bond lot was issued on August 30, 2022, with a term of 3 years, expected to mature in 2025. The issuance interest rate is 5.4%/year. The remaining bond lot was issued on August 31, 2022, with a similar term and an issuance interest rate of 5.4%/year.

According to updated information on the Hanoi Stock Exchange, from the beginning of 2024 to present, OCB has repurchased 15 bond lots before maturity with a total value of VND 13,400 billion.

According to the semi-annual bond interest and principal payment report for 2024, this bank spent about VND511 billion to pay interest and VND5,400 billion to pay bond principal.

According to VIS Rating's corporate bond market overview report, in August 2024, the volume of new bond issuance increased to VND57,700 billion, from VND46,800 billion in July 2024. Commercial banks issued a total of VND51,300 billion, continuing to account for the majority of new issuances.

Of the bonds issued by banks in August 2024, 40% are subordinated bonds eligible for Tier 2 capital, issued by banks. These Tier 2 capital bonds have an average maturity of 8.1 years and interest rates ranging from 5.5% to 7.6% in the first year. The other bonds are unsecured bonds with a maturity of 3 years and fixed interest rates ranging from 5.2% to 7.7%.

Source: https://www.nguoiduatin.vn/ocb-hut-them-2500-ty-dong-tu-kenh-trai-phieu-204240918155250272.htm

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)