It is expected that debt indicators by the end of 2024 will be within the ceiling and safety warning thresholds decided by the National Assembly. If the North-South High-Speed Railway Project is implemented, the country's public debt, government debt, and foreign debt will all be lower than the permitted level.

|

| The North-South high-speed railway project has a total preliminary investment of VND1,713,594 billion (about USD67.34 billion). Illustration photo: ChatGPT |

Foreign debt gradually decreases

The investment policy for the North-South High-Speed Railway Project is expected to be presented to the National Assembly at the 8th Session, opening on the morning of October 21.

Although the total preliminary investment of this super project is 1,713,594 billion VND (about 67.34 billion USD), some experts believe that with its current potential, Vietnam will avoid the risk of falling into a "debt trap" like some countries that borrow foreign capital.

Looking at the Government's report on public debt situation recently sent to National Assembly delegates, this assessment has a basis.

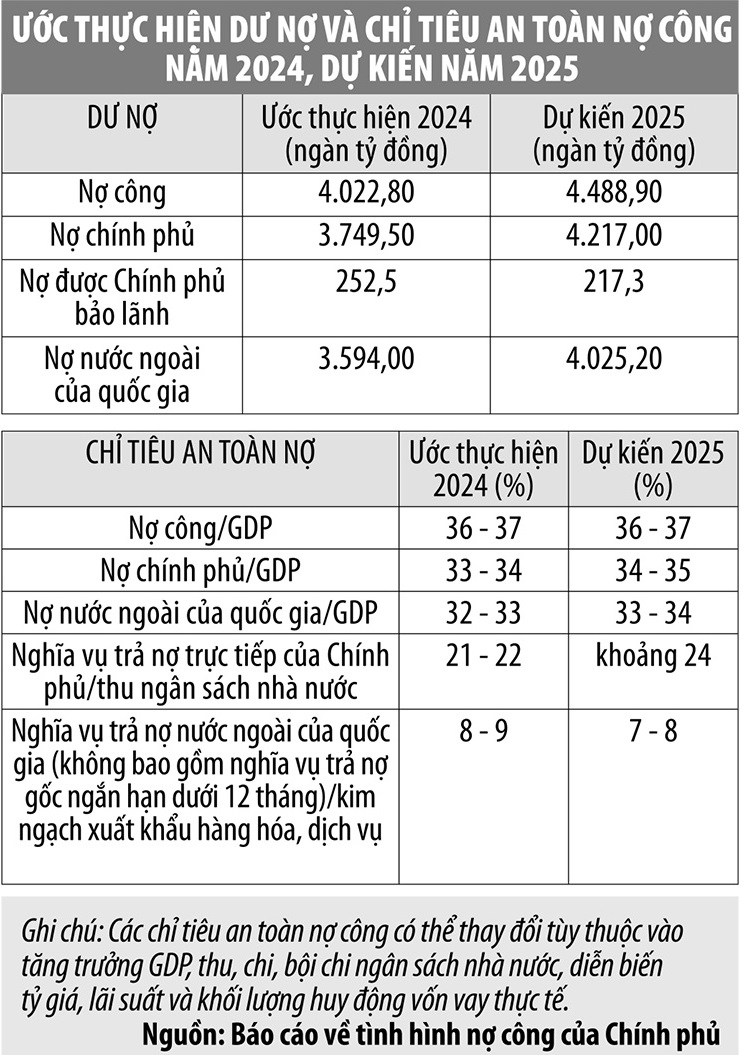

According to the targets approved by the Central Government and the National Assembly, the annual public debt ceiling shall not exceed 60% of GDP, the warning threshold is 55% of GDP. The government debt ceiling shall not exceed 50% of GDP, the warning threshold is 45% of GDP, and the country's foreign debt ceiling shall not exceed 50% of GDP, the warning threshold is 45% of GDP.

The Government expects debt indicators by the end of 2024 to be within the ceiling and safety warning thresholds decided by the National Assembly. Specifically, public debt/GDP is estimated at 36 - 37%. Government debt is about 33 - 34%/GDP. The country's foreign debt/GDP is 32 - 33%, the Government's direct debt repayment obligation is about 21 - 22%/state budget revenue. The country's foreign debt repayment obligation is about 8 - 9%/export turnover.

Notably, in terms of structure, the Government said that domestic debt accounts for 76% of outstanding government debt, mainly government bonds.

By June 30, 2024, the government bond holding ratio of insurance companies, Vietnam Social Security, investment funds and financial companies will reach 62.5% of total outstanding debt, the rest will be commercial banks, securities companies, investment funds and other investors.

Foreign debt is estimated to account for 24% of outstanding government debt, with the main creditors being bilateral and multilateral development partners such as Japan, South Korea, the World Bank, and the Asian Development Bank. The foreign debt portfolio is mainly ODA loans and concessional loans signed with long terms and preferential interest rates.

“The Government's debt repayment in 2024 will be fully implemented as committed, within the budget approved by competent authorities,” the Government report stated.

The Government also acknowledged some limitations, such as foreign borrowing costs being higher than the average domestic borrowing costs and potential risks of exchange rate fluctuations between foreign and domestic currencies. Disbursement of public investment capital and foreign capital was low, with the estimated disbursement of public investment capital in the first 9 months of the country reaching 47.29% of the plan, of which foreign capital disbursement reached 24.33% of the plan.

According to the Government, the above limitations are mainly due to subjective reasons, problems related to public investment and bidding have not been thoroughly resolved, while strict compliance with domestic laws is required for loan agreements.

For 2025, the Government's forecast is that by the end of the year, public debt will be at 36 - 37% of GDP, government debt will be at 34 - 35%, foreign debt will be at 33 - 34%, and the Government's direct debt repayment obligation compared to budget revenue will be about 24%...

It is expected that the total borrowing demand of the Government in 2025 will be VND 815,238 billion, an increase of 20.6% compared to the Government's borrowing plan in 2024. Of which, borrowing from the central budget to cover the budget deficit and repay principal is VND 804,242 billion, an increase of 21.9% compared to the 2024 estimate; the rest is foreign borrowing for re-lending.

The Government's direct debt repayment obligation is expected to be about VND 468,542 billion, of which principal repayment is about VND 361,142 billion and interest repayment is about VND 107,400 billion.

The report also outlines solutions to strengthen public debt management, including continuing to implement solutions to accelerate disbursement of public investment capital, flexibly using appropriate mechanisms, policies, and tools in accordance with legal regulations to ensure the goal of mobilizing sufficient domestic and foreign capital sources for the needs of the state budget.

|

Debt obligations do not increase much when building railways.

With a preliminary total investment of VND 1,713,594 billion (about USD 67.34 billion), how the North-South High-Speed Railway Project will impact public debt is certainly a big question that needs to be satisfactorily answered.

In the Draft Proposal for approval of the investment policy of the North-South High-Speed Railway Project (Project) sent to the National Assembly, the Government stated that the 2019 Project Pre-Feasibility Study Report proposed the form of investment under the public-private partnership method for vehicles and equipment; public investment in infrastructure, in the context of the economic scale reaching 266 billion USD, public debt equal to 56.1% of GDP.

However, the size of the economy in 2023 will reach 430 billion USD, public debt will be low, about 37% of GDP. It is expected that by the time of construction in 2027, the size of the economy will reach 564 billion USD, so resources for investment in the Project will no longer be a major obstacle.

The Government has also made a preliminary assessment of the Project's impact on public debt safety indicators when implementing the Project investment, showing that by 2030, all three criteria (public debt, government debt, and national foreign debt) are lower than the permitted level.

Specifically, the largest public debt is 44% (the allowable level is 60%), the largest government debt is 43% (the allowable level is 50%), and the largest foreign debt is 45% (the allowable level is 50%). The two criteria on the country's foreign debt repayment obligations and increasing budget deficit (average budget deficit is 4.1% of GDP, the target is 3% of GDP; direct debt repayment target is about 33 - 34% of GDP, the target is 25% of GDP).

In the period after 2030, with the assumed growth and public debt safety targets as in the period 2021 - 2025 (GDP growth rate of about 6 - 6.5%; public debt ceiling of 60% of GDP; state budget deficit of 3% of GDP), it shows that the Project meets the public debt target (about 52 - 53% of GDP compared to the assumed public debt ceiling of 60% of GDP).

Indicators of government debt, national foreign debt, and budget deficit increase (government debt is about 51 - 52% of GDP, compared to the assumption of 50% of GDP, national foreign debt is about 53 - 54% of GDP, compared to the assumption of 45% of GDP, average budget deficit is 4.1% of GDP, compared to the assumption of 3% of GDP). Debt repayment obligations do not increase much compared to the scenario of no investment in high-speed railway (with investment, it is about 67 - 68% of GDP; without investment, it is about 60 - 61% of GDP).

The draft also clearly states that the above scenario for assessing public debt safety indicators does not take into account the Project's contribution to GDP growth during the construction period (according to calculations by the Ministry of Planning and Investment, it is about 0.97 percentage points/year compared to not investing in the Project).

The above scenario does not take into account the investment costs for vehicles and equipment that Vietnam Railways Corporation will be responsible for paying off debts, revenue from land exploitation in areas developed according to the public transport system (TOD), and commercial exploitation (estimated at 22 billion USD). These factors, according to the Government, will contribute to improving all macro-financial indicators.

The Pre-Feasibility Study Report of the North-South High-Speed Railway Project has proposed a number of specific mechanisms and policies for the Project.

Among the mechanisms and policies under the authority of the National Assembly, the first proposed policy is that during the implementation of the Project, the Prime Minister decides to use capital sources from government bonds, local government bonds, ODA capital, and foreign preferential loans.

The second policy is that the Project is allocated sufficient capital through many medium-term public investment plans in accordance with the time and progress of the Project implementation. The Prime Minister decides to adjust the medium-term and annual public investment plans of the central budget between ministries, central agencies and localities to allocate capital for the Project in case the total medium-term and annual capital as decided by the National Assembly remains unchanged.

Third policy, if necessary, the Government shall submit to the National Assembly for decision to adjust the budget deficit target and the Government's direct debt repayment obligations to mobilize capital for the Project.

Source: https://baodautu.vn/no-cong-va-duong-sat-toc-do-cao-tren-truc-bac---nam-d227712.html

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)