According to the report on the real estate market in Ho Chi Minh City and surrounding areas in the first quarter of 2024 recently announced by DKRA Real Estate Services Group (DKRA Group), in the first quarter of 2024, the real estate market in Ho Chi Minh City and surrounding areas recorded many positive developments in the land, apartment and townhouse/villa segments.

Many positive developments from the real estate market in the first 3 months of the year

According to Mr. Vo Hong Thang, Director of Consulting and Project Development Services, DKRA Group, in the first quarter of 2024, the residential real estate market in Ho Chi Minh City and surrounding areas recorded many positive developments in the land, apartment and townhouse/villa segments.

Most of the products traded on the market come from projects with complete legal documents, guaranteed construction progress and developed by reputable investors.

Specifically, in the first quarter, the primary supply of land in the segment increased by about 18% compared to the end of 2023. Overall market demand remained low, down about 40% compared to the previous quarter.

Of which, more than 80% of transactions are concentrated in Binh Duong and Long An, with products priced at an average of VND 16 - 22 million/m2. The primary price level has not fluctuated much compared to 2023, with common prices ranging from VND 14.5 - 23.5 million/m2.

“Secondary prices increased by about 1% - 3% compared to the end of the year, liquidity had positive changes after Tet, transactions focused on product groups - projects with completed infrastructure, legal documents and implemented by reputable investors in the market”, said Mr. Vo Hong Thang.

According to Mr. Vo Hong Thang, the new supply in the land segment in the second quarter of 2024 will have many improvements compared to the first quarter and will fluctuate between 550 - 650 plots, mainly concentrated in the vicinity of Ho Chi Minh City.

“Market liquidity continues to increase and achieve more improvements in the coming quarter. Binh Duong, Dong Nai, Long An, etc. are forecasted to continue to be the key markets in terms of supply and primary consumption in the second quarter of 2024. Primary prices remain stable. The secondary market has achieved many positive improvements in liquidity and selling prices,” Mr. Thang commented.

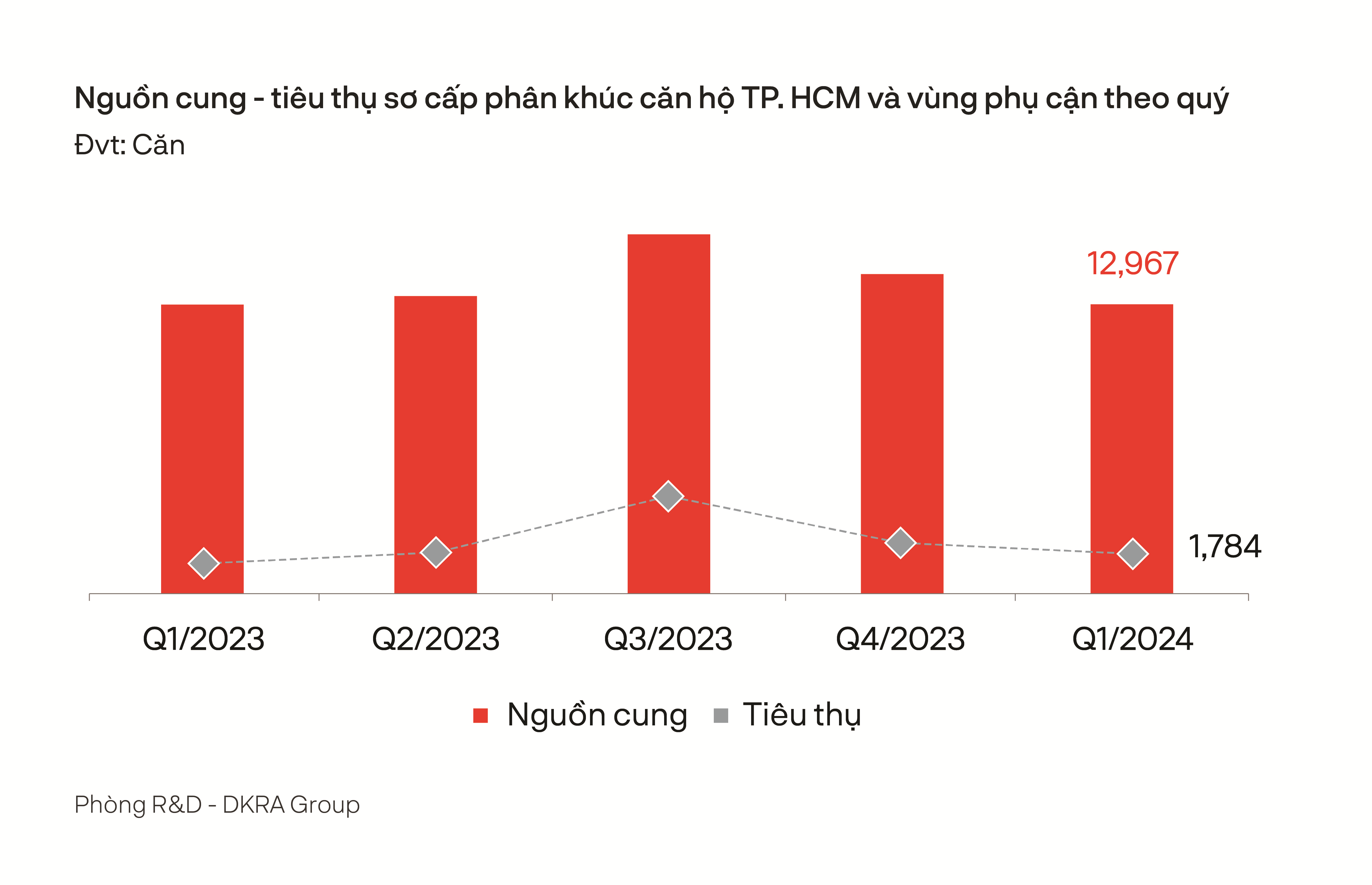

Regarding the apartment segment, the Director of Consulting and Project Development Services of DKRA Group recorded that there were 122 primary projects for sale (about 12,967 units) in the quarter, down 9.7% compared to the previous quarter and at the same level as the same period in 2023, concentrated in the markets of Ho Chi Minh City and Binh Duong.

In Ho Chi Minh City alone, most of the new supply in the quarter came from Grade A projects in the West and South areas.

“Market liquidity has clearly improved since the period after Tet. Transactions are mainly in mid-range projects that have completed legal procedures, rapid construction progress, convenient connection to the city center and have prices from 40 - 55 million VND/m2 in Ho Chi Minh City, from 30 - 35 million VND/m2 in Binh Duong. Primary selling prices in some projects increased slightly by 2% - 5% compared to the end of 2023, applied with many policies of quick payment discounts, principal and interest grace periods, etc.,” said Mr. Vo Hong Thang.

In the first quarter of 2024, the primary supply of land plots increased by about 18% compared to the end of 2023.

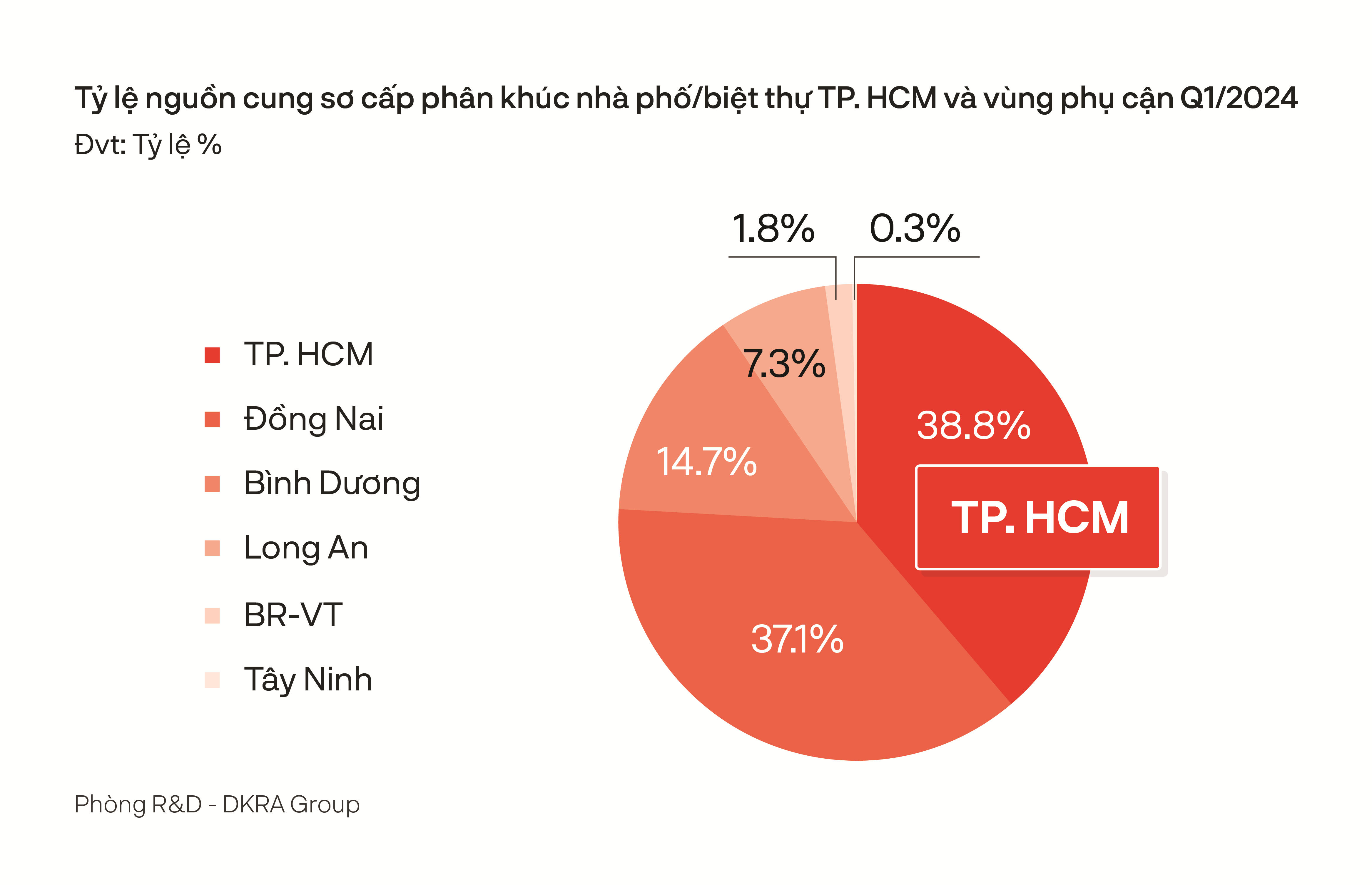

Similar to the land and apartment segments, Mr. Vo Hong Thang recorded a sharp decline in supply and consumption in the first quarter of 2024 compared to the same period in 2023 in most segments.

Specifically, in the resort villa segment, primary supply decreased by 8% compared to the same period, mainly concentrated in the Central and Southern regions. Overall market demand was low, with consumption decreasing by 15% compared to the first quarter of 2023 - the lowest level in the past decade.

Primary selling prices continued to trend sideways. The secondary market recorded an average price reduction of 15% - 20% compared to the contract price. Policies of profit/revenue sharing/commitment, interest rate support, and principal grace period were still widely applied to increase liquidity but were not as effective as expected.

The resort townhouse/shophouse segment recorded a continued decline in supply, with more than 97% of the primary supply in the quarter coming from inventory of old projects. The market has yet to escape the “dark zone” despite the many improvements in the tourism industry.

Primary prices did not fluctuate much and continued to trend sideways. The market continued to face many difficulties in liquidity and price increase potential when investor confidence and recovery in this segment were still very low.

Condotel segment, primary supply in Q1/2024 increased slightly by 6% compared to the same period last year, the main products still come from inventory of old projects. Overall market demand recorded the lowest level in the past 5 years. Primary price level did not fluctuate compared to the same period and remained high due to high input costs. Sales policies that focus on supporting cash flow such as extending payment schedules, principal grace period, interest rate support, etc. continue to be widely applied to stimulate market demand.

Forecast of many positive signals in the second quarter of 2024

According to forecasts from DKRA Group, the new supply of land plots in the second quarter of 2024 will have many improvements compared to the first quarter and will fluctuate between 550 - 650 plots, mainly concentrated in the vicinity of Ho Chi Minh City. Market liquidity will continue to increase and achieve more improvements in the coming quarter.

Binh Duong, Dong Nai, Long An, etc. are forecasted to continue to be key markets in terms of supply and primary consumption in the second quarter of 2024. Primary prices remain stable. The secondary market has achieved many positive improvements in liquidity and selling prices.

According to forecasts from DKRA Group, new supply of land plots in the second quarter of 2024 will have many improvements compared to the first quarter.

For the apartment segment, new supply is forecast to increase compared to Q1/2024, fluctuating at around 2,000 - 3,000 units, mainly concentrated in Ho Chi Minh City and Binh Duong. The class A apartment segment continues to hold a dominant position in Ho Chi Minh City while the class B and C segments lead the new supply in the market of neighboring provinces.

Market demand is expected to have positive changes. Primary prices may continue to increase slightly due to input cost pressures. Secondary market liquidity, as well as selling prices, have achieved many positive improvements.

The new supply of townhouses/villas is expected to be more prosperous than in the first quarter of 2024, fluctuating around 500 - 600 units. In particular, Binh Duong, Long An, Dong Nai, etc. are expected to continue to be the leading localities in the market.

The primary price level maintained a stable trend compared to the previous quarter. In addition, to stimulate market demand, investors also flexibly adjusted payment methods, sales policies, etc. to suit the actual situation. It is likely that the product group in the area bordering Ho Chi Minh City with a price of 3.0 - 5.0 billion VND/unit will attract a lot of attention from customers.

For resort real estate, condotel supply is forecast to increase slightly compared to the first quarter of 2024, fluctuating around 100 - 200 units, mainly concentrated in Ba Ria - Vung Tau and Quang Ninh.

Meanwhile, the supply of resort villas and resort townhouses/shophouses did not fluctuate much compared to the previous quarter, forecasting to provide the market with primary supply of 100 - 150 resort villas and 80 - 100 resort townhouses/shophouses, respectively.

Overall market demand continues to remain low, with the downward trend expected to last until the end of 2024. Primary prices remain stable and are unlikely to see significant fluctuations in the short term. Discount policies, interest rate support, principal grace period, lease commitments, etc. will continue to be widely applied in the coming quarter.

Source

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

Comment (0)