Tax - a close and important field

Tax is a field directly related to the daily life, production and business of each citizen and enterprise; therefore, it plays an important role in regulating the economy, contributing to sustainable development and social justice.

At universities, when studying taxation, in addition to being trained in basic knowledge of the economic sector, students are also equipped with general knowledge of economics, such as: microeconomics, macroeconomics, economic theories or application of information technology in tax management; are trained in theoretical research capacity and experience the knowledge learned in practice.

The training objective of this major is to train people with extensive knowledge, good capacity, creative spirit; have good theories about financial and tax aspects and professional skills; have a clear understanding of tax policies and tax operations; have enough capacity and skills to undertake work in tax departments, audits, economic management departments and enterprises and organizations related to tax agencies and tax planning.

In Vietnam, there are many universities that train in taxation and each school has a different training orientation. At the Academy of Finance, the tax training program is modern and specialized. In addition to the basic knowledge of the economic sector according to the curriculum framework of the Ministry of Education and Training, the academy's program also includes modern knowledge blocks on management and information technology such as: management science, economic management, applied informatics, internet and e-commerce...

When studying tax, in-depth knowledge of accounting and tax is designed by schools so that students can do well in tax management and tax consulting such as: accounting principles, financial accounting, tax, income tax, consumption tax, property tax and other taxes. Specific content in the courses is always updated with the latest knowledge of the specialized field.

To increase students’ practical skills and application, training institutions have also signed cooperation agreements with units such as the General Department of Taxation, the General Department of Customs and enterprises in auditing, tax consulting, etc., to cooperate in training and scientific research; in which, the outstanding activity is to send students to study the reality at tax and customs agencies at all levels. Schools also invite experts to exchange and share professional knowledge and working skills with students through exchanges and discussions.

In addition, training institutions regularly organize field trips to enterprises for students to directly experience professional work; create conditions and introduce students from the third year onwards to enterprises for internships so that they have the opportunity to work, and even receive a salary for the professional work they undertake.

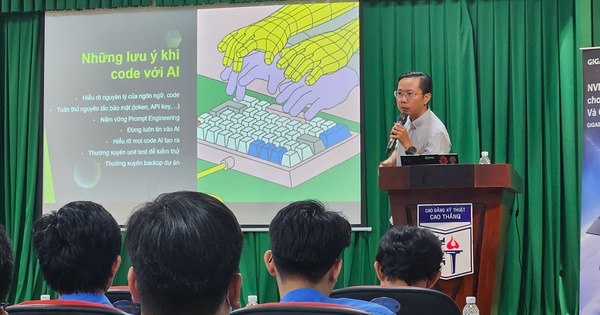

Ho Chi Minh City University of Industry, the tax training program is considered to be highly applicable, combining theory and practice in parallel, integrating real-life situations from businesses into teaching. The school pays great attention to and applies information technology to the major, helping students master the use of technology and specialized software to apply to future work.

The school also focuses on promoting cooperation with units and enterprises in both training, research and receiving interns; this contributes to creating quality personnel right after graduation.

Diverse job opportunities

According to training experts in the finance and banking sector, for many years, tax has always been one of the hot majors, with a large number of candidates registering while the quota is limited, so the benchmark scores are high.

In the digital economy, the trend of international economic integration along with the strong development of tax service industries creates an increasing demand for tax management, tax consulting, tax planning and tax agents.

Graduates majoring in taxation can take on a variety of positions in the fields of finance, accounting, and taxation, specifically: working as tax specialists at companies, corporations, or government agencies to manage, plan, and report taxes. This job requires in-depth knowledge of tax-related regulations and laws, tax consulting, providing tax consulting services to businesses and individuals, helping them optimize tax obligations and comply with legal regulations.

After graduating from a bachelor's degree in taxation, graduates can also become tax auditors working at auditing companies, checking and confirming the reasonableness and legality of tax reports, detecting errors or fraud; tax officers at tax agencies, working at state tax agencies, performing tasks related to tax management, tax inspection and supervision.

In addition, graduates can work in academic and research positions such as lecturers in universities and colleges, or researchers in tax research institutes and related fields. In terms of income, tax personnel are often paid high salaries compared to the general level.

Sharing about job opportunities for students majoring in tax, Associate Professor Dr. Le Xuan Truong, Head of the Tax and Customs Department, Academy of Finance, said that after graduation, students can work as corporate finance experts, specialized jobs at banks, insurance companies, financial agencies at all levels; corporate accountants.

However, to complete the job well, in addition to the knowledge and skills trained and practiced in the formal training program, experts say that students need to have flexible learning methods, actively participate in extracurricular activities to practice independent working skills, teamwork, event organization, presentation, situation handling, document drafting, use of modern information equipment, communication and behavior...

Along with that, students need to cultivate knowledge about other economic and social fields related to their major; cultivate professional ethics to always have the right attitude and behavior.

In the current trend of international cooperation, proficiency in foreign languages and information technology is a must. Therefore, right from the time they are in school, students need to establish a systematic and scientific learning path, take advantage of practice time and self-practice to both master professional knowledge and know how to work in practice.

Source: https://kinhtedothi.vn/nganh-thue-va-co-hoi-viec-lam-trong-nen-kinh-te-so.html

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)