(NLDO) - Interest rates mobilized through the deposit certificate channel were pushed up to the highest level of 7.1%/year by a bank.

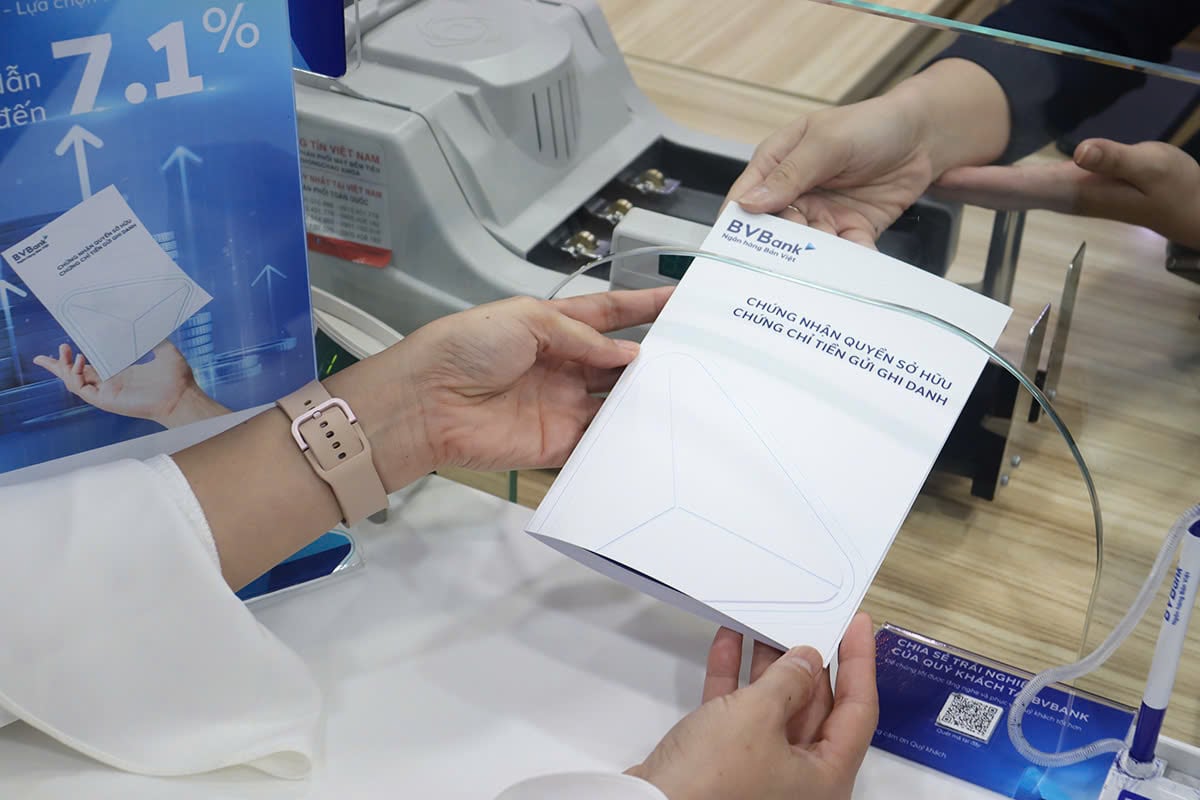

Interest rates continue to be adjusted upward by banks today. The Bank for Investment and Development of Vietnam (BVBank) has just announced the issuance of VND1,000 billion in deposit certificates for individual customers with interest rates up to 7.1%/year, in order to diversify deposit products.

Certificates of deposit issued by BVBank have a face value of 1 million VND, with deposits starting from only 10 million VND. Customers can flexibly choose to receive interest at the end of the term or monthly, with interest rates up to 7.1%/year for a 36-month term; 6.9% for a 24-month term or 6.7% for an 18-month term.

According to BVBank, when purchasing a deposit certificate issued by the bank, customers will be paid the entire balance before maturity, transferred, and mortgaged to borrow when they need capital before the maturity date. The principal will be paid by BVBank in one lump sum upon maturity; interest is paid monthly or once at the end of the term, depending on the customer's choice.

Banks boost capital mobilization through deposit certificates

"After the deposit term ends, the deposit certificate will not be automatically renewed. If the customer does not come to BVBank to pay on the due date, the system will automatically transfer all principal and interest to safekeeping, waiting for the customer to come and complete the procedure to receive it" - BVBank representative said.

In September 2024, Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) also issued VND5,000 billion worth of registered long-term deposit certificates with an interest rate of 7.1%/year for the first year. The following years are flexibly adjusted according to market interest rates. The deposit certificates have a face value of VND1 million, a term of 7 years (ie 84 months) and are not automatically renewed. The principal is paid once at maturity and the interest is paid periodically every year.

According to banks, capital mobilization through deposit certificates contributes to diversifying safe long-term investment channels, helping to optimize idle cash flow with higher profitability than traditional savings deposits.

In the trend of increasing capital mobilization to meet the lending demand that often increases at the end of the year, many other commercial banks also adjusted their deposit interest rates upward.

Ho Chi Minh City Development Bank (HDBank) is the next unit to increase deposit interest rates for many terms. In the latest interest rate table, HDBank increased interest rates by 0.3 percentage points for 6-month term, to 5.3%/year. Savings interest rates for 12-month term increased by 0.1 percentage points, to 5.1%. The highest interest rate when depositing at the counter at this bank is 6%/year for 18-month term.

If customers deposit online at HDBank, the highest interest rate is 6.1%/year for 18-month term.

Since the beginning of November, many banks have continued to increase deposit interest rates such as Agribank, Nam A Bank, ABBANK, Vietbank...

Source: https://nld.com.vn/lai-suat-hom-nay-20-11-mot-ngan-hang-tung-chung-chi-tien-gui-lai-toi-71-196241120124949812.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)