The Military Commercial Joint Stock Bank (MB - HoSE: MBB) has just reported the results of its private share offering. Accordingly, the bank has successfully offered 73 million private shares to two investors, the Military Industry and Telecommunications Group (Viettel) and the State Capital Investment Corporation (SCIC).

Specifically, Viettel bought 43 million MBB shares, increasing the number of shares held before the offering from more than 737.1 million shares to more than 1 billion shares, corresponding to an increase in ownership ratio from 18.514% to 19.072%, continuing to be the largest shareholder of MB bank.

Meanwhile, SCIC bought an additional 30 million shares, increasing the number of MBB shares it owns from 491.4 million shares to nearly 523 million shares, equivalent to an increase in ownership ratio from 9.425% to 9.862% and becoming the second largest shareholder of MB.

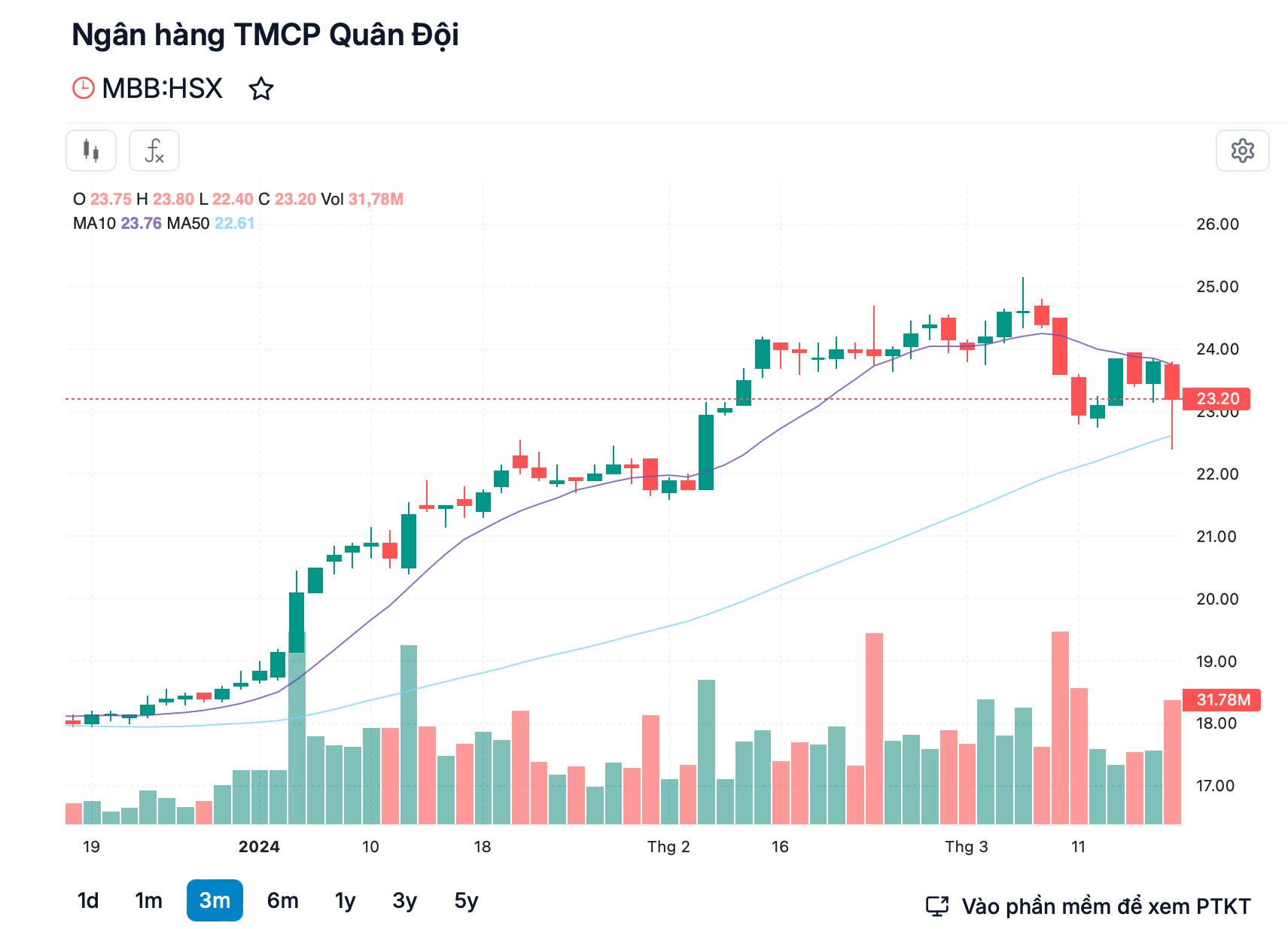

MBB stock price movements in the past 3 months (Photo: FireAnt).

According to MB, the total amount raised from the private placement is VND1,165 billion with an offering price of VND15,959/share. The closing date of the offering is March 14, 2024.

These newly issued shares will be subject to transfer restrictions for 5 years from the date of completion, unless otherwise provided.

Thus, at the end of the offering, MB's charter capital successfully increased by VND 1,165 billion, from VND 52,141 billion to VND 52,871 billion, ranking 5th in the entire banking industry, after VPBank, BIDV, Vietcombank and VietinBank.

Previously, MB's 2023 General Meeting of Shareholders approved the plan to increase charter capital from VND 45,340 billion to VND 53,683 billion by issuing 680 million shares to pay dividends at a rate of 15%; issuing ESOP shares and issuing a total of 135 million shares privately (divided into two batches of 65 million and 70 million shares), to two investors, Viettel and SCIC.

On the stock market, at the end of the trading session on March 18, MB shares decreased by 2.52%, stopping at VND23,200/share with a trading volume of nearly 31.8 million units. Thus, major shareholders of MB bought shares at a price of only 68.8% compared to the market price .

Source

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

Comment (0)