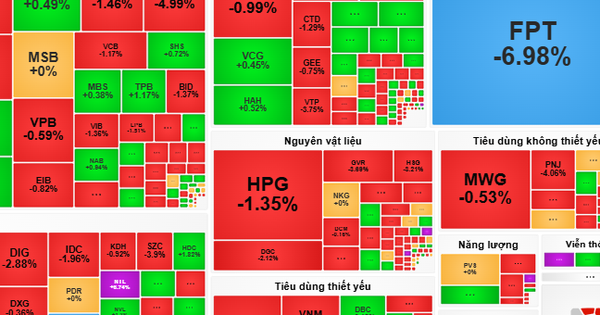

The Vietnamese stock market experienced a volatile trading week as strong selling pressure increased in the last session of the week, wiping out most of the week's accumulated gains.

However, VN-Index still ended the week of February 19-23 at 1,212 points, up slightly 0.2% compared to the session at the end of last week.

Vingroup stocks are the focus of the market after the news that Vinfast was granted land by India to build a factory. Notably, VRE has increased by nearly 13% after only one week of trading and is currently at its highest level in nearly 4 months. On the contrary, VIC and VHM have the most negative impact on the market, with VIC alone taking away more than 2 points from the general index.

With investors' profit-taking psychology, the average total trading volume reached 26,000 billion VND/session, up 29% compared to last week.

Notably, foreign investors returned to net buying VND185 billion on all three exchanges. Accordingly, foreign investors net bought VND1,688.57 billion on UPCoM, while net selling VND39.7 billion on HNX and VND1,463.41 billion on HoSE.

Giving advice to investors in the coming trading week, Mr. Ngo Quoc Hung - Market Strategy Department, MBS Securities Company and Mr. Dinh Quang Hinh - Head of Macro and Market Strategy Department, VNDIRECT Securities Company both said that investors should not panic and sell off stocks but should observe the market supply and demand developments.

Nguoi Dua Tin (NDT): The correction in the last session of the week ended the 7-session consecutive increase from 1,172 to 1,230 points. What is your assessment of the trading performance last week?

Mr. Ngo Quoc Hung : The market is in the 4th consecutive month of increase, since the beginning of the year there have only been 2 weeks of slight adjustment in the 1,180 point area. Although it decreased sharply at the end of the week, this is also the 3rd consecutive week of increase of the VN-Index.

Technical profit-taking pressure in the market at the peaks of August and September last year. In addition, the 1,230 - 1,240 point area is also a technical resistance zone in the uptrend since November 2023.

In my opinion, the series of 3 consecutive sessions of decline, including a notable correction at the end of the week, has not changed the market's upward trend. However, profit-taking pressure is likely to continue, and the market may test the support levels at 1,180 - 1,190 points in the upcoming sessions.

Mr. Dinh Quang Hinh: Profit-taking pressure increased sharply in the last session of the week after the VN-Index hit the resistance zone around 1,240 points. The market approaching the strong resistance zone and information about interest rates on the interbank market increasing sharply in the past few sessions have made investors cautious and triggered a wave of profit-taking.

The correction was also driven by strong net selling by foreign investors, concentrated in some large-cap stocks. Although it has just experienced a fairly strong correction session, I think investors should not panic too much.

VN-Index developments week 19 - 23/2 (Source: FireAnt).

Investor : After leading the market since the beginning of the year, last week, banking stocks were the major factor in dragging down the index. Do you think banking stocks will still be attractive in the future?

Mr. Ngo Quoc Hung : I think that the cash flow is still mainly concentrated in the banking group. However, investors need to be selective in selecting stocks after the past 2 months of increase because some stocks have passed the buying zone/point or the room for increase is no longer attractive.

In my opinion, besides the banking group, other stock groups are also worth noting, such as securities, which have seen a sharp increase in liquidity compared to the same period since the beginning of the year. Low interest rates make the stock channel more attractive compared to other investment channels. Or the industrial park real estate group with FDI capital flows, increased tax prices..., public investment, chemicals, oil and gas, steel, technology...

Since the beginning of the year, the market has increased by more than 100 points, but if the right stocks are not chosen, investors' accounts still cannot beat the market and may even be in negative status.

Mr. Dinh Quang Hinh: The increase in interbank interest rates is only temporary due to "local liquidity shortage at a bank" and does not represent the general picture of the system.

In the first market, some banks continued to lower deposit interest rates, while credit growth in January across the system was negative due to the early-year effect.

With credit demand currently not high, I believe that the pressure on deposit and lending rates will not be large and the recent increase in interbank interest rates is only temporary and will soon subside.

Investor: In your opinion, how will trading develop next week and what should investors do ?

Mr. Ngo Quoc Hung : For individual investors, there are 4 factors that can be applied to trading: Trend - Trend is your friend, Choice - Stock selection is more important than effort, Point - Patiently wait for the market to reach the buying area/point, make a decisive buy/sell decision to create trading positions at a good time, Quit - Stop at the right time is a hero!

Each investor's trading results are the most valuable information about each person's strengths and weaknesses, use it to find the right strategic advantage.

Mr. Dinh Quang Hinh: From a technical analysis perspective, the market has not lost its short-term uptrend as the VN-Index is still trading above the MA20 line and the 1,190 - 1,200 point area will be the market's support zone.

Therefore, investors should not panic and sell stocks but should observe the market supply and demand developments in the support zone of 1,190 - 1,200 points. At the same time, investors should not open new buying positions when the market has just experienced a session of strong fluctuations and needs to find a balance again .

Source

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

Comment (0)