Forgetting the "fear" of the State Bank issuing credit notes, VN-Index increased by nearly 26 points

Investor sentiment became more stable and active trading cash flow helped the stock market have a positive trading session.

|

After 2 days of falling nearly 39 points, investor sentiment seems to have stabilized, helping the market to have a slight recovery on March 12 despite a relatively low liquidity. On March 13, the State Bank continued to issue treasury bills for the third consecutive day. However, the negative psychological effects from this move seem to no longer affect investor actions.

Right from the beginning of the trading session, many stock sectors recorded green and this pulled the indices above the reference level. However, caution still occurred when selling pressure sometimes increased and caused the indices to narrow the increase. However, demand was still quite strong. This helped the market trading become more prosperous. In the afternoon session, some pressure was also created and at times caused the market to shake. However, the sudden increase in demand pulled a series of stock sectors to break out, the increase spread evenly throughout the general market.

As in previous sessions, the export stocks group fluctuated in the most positive direction. Of which, DGC broke out early and was pulled up to the ceiling price, even with ceiling price buy orders. At the end of the session, DGC closed at 127,200 VND/share. DGC's increase pulled a series of stocks in the same chemical - fertilizer industry such as DDV, BFC, LAS... to break out as well. Along with that, the seafood group also recorded a strong increase of VHC with 4.3%, IDI increased by 3.1%, ANV increased by 2%. In the textile group, ADS or GIL were pulled up to the ceiling price. VGT increased by 4%, MSH increased by 3%...

Steel stocks, after a long break before, had a significant recovery this session. VGS and KVC hit the ceiling while HSG increased by 3.4%, NKG increased by 3%. The industry giant HPG also had a 2% increase.

Stocks in the securities group were not far behind when recording strong cash flows, including IVS, ORS, VDS, VIX or VCI being pulled up to the ceiling price. CTS increased by 5.6%, MBS increased by 5.4%, BSI increased by 4.8%...

Among large-cap stocks, FPT continued to surprise when it recorded an increase of up to 4.6% and matched orders of more than 5.4 million shares. FPT was only behind VCB in terms of the most positive impact on the VN-Index with 1.58 points. Meanwhile, VCB contributed 2.18 points when it increased by 1.7%. Banking stocks also had a relatively positive trading session. Names in this industry group such as TCB, VPB, ACB, VIB, TPB... all increased well.

On the other hand, not many large-cap stocks decreased in price. VJC was a rare name that decreased in price with 0.3%. VJC was also the code that had the most negative impact on the VN-Index with a loss of 0.04 points. The next codes with negative impacts were names in the midcaps group such as SBT, TCD, CAV...

At the end of the trading session, VN-Index decreased by 25.51 points (2.05%) to 1,270.51 points. On HoSE, there were 433 stocks increasing, 64 stocks decreasing and 61 stocks remaining unchanged. HNX-Index increased by 4.17 points (1.78%) to 238.2 points. HNX-Index had 136 stocks increasing, 40 stocks decreasing and 64 stocks remaining unchanged. UPCoM-Index increased by 0.76 points (0.84%) to 91.53 points.

|

| The top stocks with the most positive impact on VN-Index are mainly banking stocks. |

Leading the increase today were banking stocks, led by VCB, VPB, MBB, ACB, CTG, BID. FPT was also in the top 10 stocks with the most positive impact on the general index.

Market liquidity improved significantly compared to the previous session. The total trading volume on HoSE reached 982 shares, worth VND26,292 billion, 26.7% compared to yesterday's session. Of which, negotiated transactions contributed VND2,710 billion. On HNX and UPCoM, the trading value reached VND2,272 billion and VND836 billion, respectively.

VIX was the stock with the most matched orders in the market with 37.3 million units. Next, two securities stocks, SSI and VND, matched orders with 36 million units and 35 million units, respectively.

|

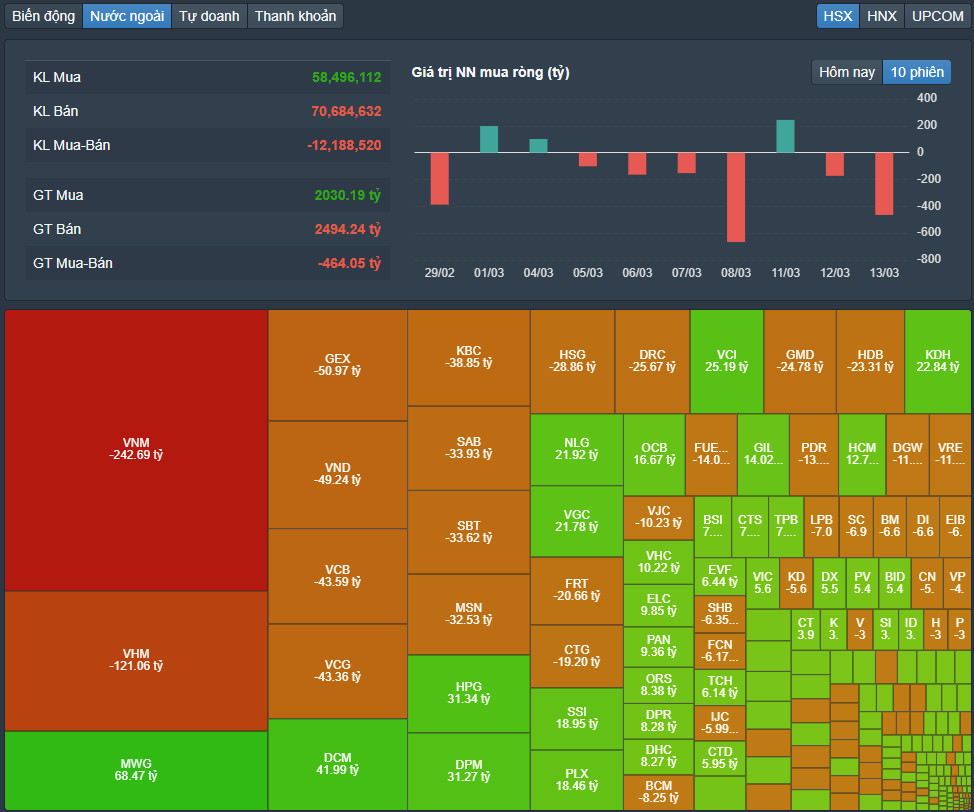

| Foreign block transactions on March 13. |

Foreign investors continued to net sell about 500 billion VND in the whole market, in which, this capital flow net sold the most VNM code with 243 billion VND. Next, VHM was also net sold 121 billion VND. In the opposite direction, MWG was net bought the most with 68 billion VND. DCM and HPG were net bought 42 billion VND and 31 billion VND respectively.

Source

Comment (0)