4 times foreign investment

The State Bank of Vietnam (SBV) Ho Chi Minh City branch said that the amount of remittances to Ho Chi Minh City in the first 9 months of 2024 reached nearly 7.392 billion USD, an increase of 10.5% over the same period last year. Although the amount of remittances in the third quarter decreased slightly by 4.1% compared to the second quarter, this level was still equal to 78.1% compared to the whole year of 2023 (the year with the highest amount of remittances, reaching 9.46 billion USD). Of the amount of remittances, the source of remittances through economic organizations (remittance companies) reached 5.485 billion USD and transferred through credit institutions reached more than 1.9 billion USD. Of which, the amount of remittances transferred from Asia still accounted for the highest proportion (53.8%) and continued to maintain the best growth rate, up 24.1% over the same period. Remittances from the Americas increased by 4.4%; Oceania increased by 20%; Europe down 19.1% year-on-year…

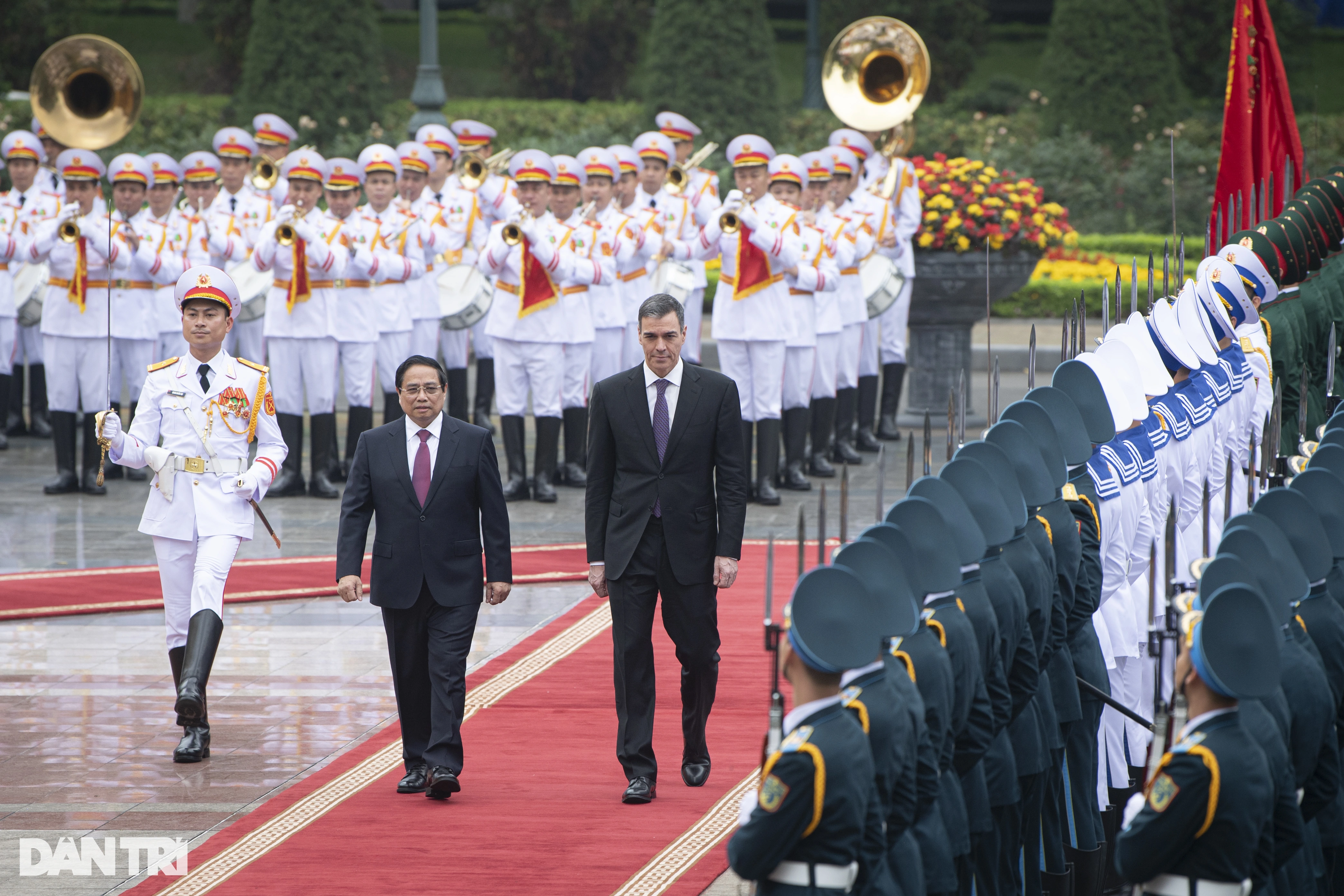

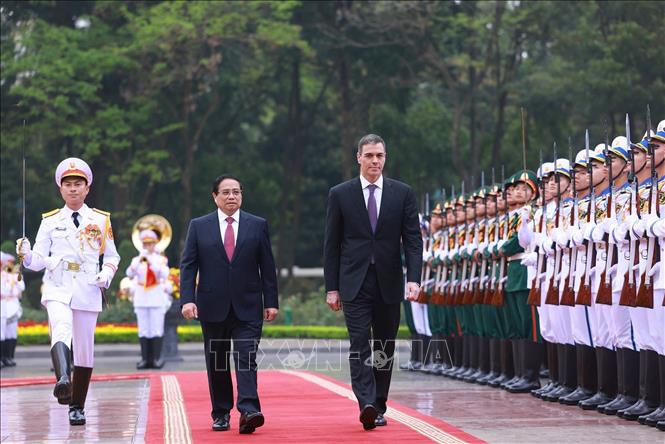

Attracting remittances will continue to be a bright spot for Vietnam.

Photo: NGOC THANG

Notably, the amount of remittances to Ho Chi Minh City in the first 9 months of 2024 exceeded the figures for the whole year of 2020 (6.1 billion USD), 2021 (7.1 billion USD) and the whole year of 2022 (6.6 billion USD). This amount of remittances is nearly 4 times higher than the amount of foreign direct investment (FDI) in the city (about 1.91 billion USD). In the period of 2012 - 2023, the amount of remittances transferred to Ho Chi Minh City through the system of commercial banks, economic organizations and remittance companies reached more than 65 billion USD, with an average increase of 3 - 7% / year.

According to the city's data and statistics over the past years, remittances to Ho Chi Minh City account for 38-53% of the total remittances nationwide. Thus, it is expected that in 2024, remittances nationwide will reach about 19 billion USD and this will be a record high achieved in 2022.

Mr. Nguyen Duc Lenh, Deputy Director of the State Bank of Vietnam, Ho Chi Minh City branch, analyzed: Although remittances to the city have decreased in recent quarters, it is forecasted that from now until the end of 2024, the growth rate will still be maintained. This forecast is based on actual statistics in recent years and the growth trend of remittances in the fourth quarter of each year, which is the last quarter of the year, with the traditional Lunar New Year holiday, so this source of money often has a high growth rate. Specifically, in the fourth quarter of 2021, remittances increased by 26.1%; in the fourth quarter of 2022, they increased by 12.7% and in the fourth quarter of 2023, they increased by 17.9%. It is forecasted that remittances will still achieve a growth rate of about 10% per year in 2024.

This trend, associated with the growth rate of remittances in the last quarter of the year, is often higher than in previous quarters. More importantly, the steady increase in remittances to Ho Chi Minh City over the years will create potential for the coming years thanks to positive factors from the mechanism and policies to attract remittances, policies to develop the labor market; policies for overseas Vietnamese to remittance payment services. Therefore, according to Mr. Lenh, to continue to create potential for the coming years, the current solution is to maintain and promote these positive factors. In which, doing a good job of communication is important, with the content of information and propaganda about policies, investment environment and the country and people of Vietnam, especially remittance payment services for overseas Vietnamese and Vietnamese people working and studying abroad to grasp and conveniently transfer remittances back to the country.

Currently, Vietnam has about 6 million overseas Vietnamese living, working and studying in 130 countries and territories. Of these, over 80% are in developed countries, with about 600,000 overseas Vietnamese having university degrees or higher. The lives of overseas Vietnamese are getting better and better and this is an important resource contributing to the development of the country.

Attractive investment environment for cash flow

According to the World Bank and the International Organization for Migration, Vietnam has received an average of 17-18 billion USD in remittances each year in the past 3 years. In the past 10 years, remittances have become a bright spot in Vietnam. Although affected by many factors, remittances to Vietnam have decreased in some years following the general trend of other countries, but it still maintains its position in the top 10 countries with the largest remittances in the world and in the top 3 countries receiving the most remittances in the Asia-Pacific region.

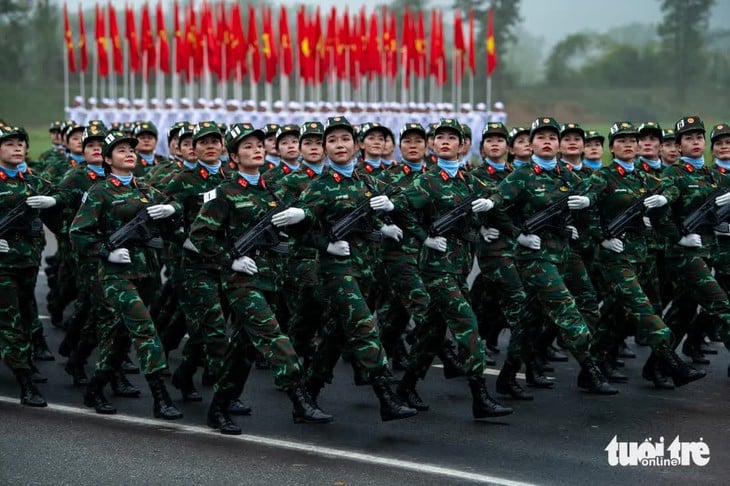

Remittances to Vietnam continue to increase. In particular, remittances to Ho Chi Minh City in the first 9 months of 2024 were higher than in both 2021 and 2022.

Photo: NGOC THANG

Looking at the whole picture, economist, Associate Professor, Dr. Dinh Trong Thinh (Academy of Finance) commented: The amount of remittances to Vietnam is still increasing, in which in 2022 it increased to a record of about 19 billion USD. In 2023, the global economy is difficult, so the cash flow of Vietnamese people to Vietnam will decrease but at a low level.

16 billion USD is also very high. This is a large source of capital to supplement investment in the domestic private economic sector. "The cash flow of overseas Vietnamese sent back to relatives and families for spending, construction, buying houses... also contributes greatly to ensuring the lives of many families, supporting social security in the country," said Mr. Thinh. Especially in recent years, the source of remittances has been almost equal to the FDI capital flow into Vietnam and has become an important source of contribution, increasing the flow of foreign currency to meet domestic demand. This helps Vietnam maintain a stable exchange rate policy, ensuring the country's foreign exchange reserves.

"Over the years, the Government has had policies to encourage and create conditions for overseas Vietnamese to feel secure in returning home to invest in business as well as to transfer money for investment or support relatives. Among them, the high proportion of remittances for investment shows that the business and investment environment in Vietnam is quite attractive. In particular, with the Law on Real Estate Business taking effect from August 1, allowing overseas Vietnamese to return to invest and do real estate business like domestic people, the remittance flow to Vietnam will continue to increase," Associate Professor, Dr. Dinh Trong Thinh expected.

Also appreciating the contribution of overseas Vietnamese with the annual remittances sent back to Vietnam, which have contributed to the socio-economic development of the country, economic expert, Professor, Dr. Vo Dai Luoc said that any country needs foreign currency for trade exchange, foreign exchange reserves, etc. The capital sent back by Vietnamese people working and settling in other countries is often first to help relatives and friends and then for investment. Savings interest rates in Vietnam are always high, up to 6-7%/year, more than double the interest rates in many countries. This is an attractive factor attracting overseas Vietnamese to send foreign currency back to the country, converting to Vietnamese dong to save for high interest rates. In particular, remittances from the US will increase in the coming time because this country has started to reduce interest rates and when this trend continues, the remittance flow to Vietnam will likely be greater than in recent years.

Continue to encourage and welcome remittances

The revised Land Law and the new Real Estate Business Law both have provisions to better protect the legitimate rights and interests of land users, such as expanding land use rights to Vietnamese citizens, including Vietnamese people residing abroad. Overseas Vietnamese who are Vietnamese citizens (those who still have Vietnamese nationality) will enjoy full housing rights like domestic citizens. In addition, overseas Vietnamese will be allowed to invest in and do real estate business like domestic citizens. Thus, overseas Vietnamese will be allowed to invest in building houses and construction works for sale, lease, and lease-purchase; invest in building technical infrastructure in real estate projects for transfer, lease, and sublease of land use rights with technical infrastructure.

For people of Vietnamese origin residing abroad but without Vietnamese nationality, they also have the rights and obligations of citizens regarding land; the common rights of land users; the rights and obligations of individuals using land; the rights to convert, transfer, lease, sublease, inherit, donate land use rights, mortgage, contribute capital with land use rights; receive land use rights; the rights and obligations of individuals using land, including individuals in the country and Vietnamese residing abroad who are Vietnamese citizens, are equal and equal... These regulations are opening the door for the flow of money from overseas Vietnamese to flow even stronger.

Associate Professor, Dr. Dinh Trong Thinh emphasized: Previously, regulations allowed overseas Vietnamese to buy real estate in the country, but many people had to ask relatives to stand in their names. Also because of concerns about complicated procedures and regulations, and not being able to stand in their own names, many people hesitated. Therefore, along with the recent incentive policies of the Government, the new regulations in the Real Estate Business Law will make it easier for overseas Vietnamese to own houses and land in the country.

This will help the amount of remittances to Vietnam to increase even more in the future. At the same time, the Government needs to continue to create favorable conditions and simple administrative procedures for overseas Vietnamese to return to Vietnam quickly or integrate easily. Or consider having more open regulations, allowing people of Vietnamese origin (even if they do not have Vietnamese nationality) to invest in Vietnam in some fields and industries like domestic people. That will further encourage and attract more remittances to Vietnam.

As an overseas Vietnamese who regularly lives and works in Vietnam, economic expert, Dr. Nguyen Tri Hieu commented: The biggest advantage of remittances is that they do not carry the same risks as foreign direct investment. Unlike foreign loans or ODA capital that must meet conditions to be received, remittances are voluntary cash flows, transferred one way from abroad without any conditions. Therefore, remittances are an extremely valuable resource, significantly adding to Vietnam's foreign exchange reserves, playing an important role in the country's economic development. Therefore, Vietnam has many policies to attract remittances. Recently, through the Committee on Overseas Vietnamese, Ho Chi Minh City has a project "Policy to effectively promote remittance resources in Ho Chi Minh City from now until 2030", which mentions the issuance of bonds to attract remittances for investment in infrastructure, healthcare, etc.

"Although the issuance is still in its infancy, this is the first time there has been a specific project to attract remittances to specific sectors. If issues such as interest rates, bonds, etc. are attractive enough to overseas Vietnamese, it will also be a solution to increase remittances to Vietnam. Up to now, overseas Vietnamese often send money back to their relatives and families. At times when domestic interest rates are higher than international interest rates, they send money back home to enjoy the difference. Currently, the USD interest rate is 0%, so this phenomenon no longer occurs. However, this flow is also increasing partly because Vietnamese people working abroad believe in the stability of the economy and see better investment opportunities in the domestic market," said Dr. Nguyen Tri Hieu.

Vietnam is in the top 10 countries receiving remittances.

For many years, Vietnam has been one of the top 10 countries in the world in receiving remittances. The State Committee for Overseas Vietnamese reported that the amount of remittances to Vietnam from 1993 (the first year of remittance statistics) to the end of 2023 reached over 206 billion USD, almost equal to the amount of disbursed FDI capital.Promoting remittance resources

The project "Policy to effectively promote remittance resources in Ho Chi Minh City from now to 2030" has comprehensive solutions and is of great practical significance. In addition to continuing to implement solutions to maintain the annual growth rate of remittances, promote and attract this resource, there are also solutions and orientations on the effective use of remittance resources. In which, research and propose the use of economic measures to attract and concentrate remittances for investment in developing programs and projects for the city's socio-economic development to bring higher and greater efficiency. To effectively implement this solution, information and propaganda work is also an important requirement to advise and inform people and beneficiaries to effectively use remittances. Remittances will have options for consumption to serve daily life; put into production, business, trade and services; save money or invest; buying local government bonds... Obviously, focusing remittance resources on developing socio-economic programs and projects will bring much higher efficiency and practical benefits to both the economy and the people. In this process, the effective use of remittance resources is also a solution to attract remittances for sustainable growth.Mr. Nguyen Duc Lenh, Deputy Director of State Bank of Vietnam, Ho Chi Minh City Branch

Thanhnien.vn

Source: https://thanhnien.vn/kieu-hoi-chay-manh-ve-viet-nam-185241018221318772.htm

![[Photo] Visiting Cu Chi Tunnels - a heroic underground feat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/8/06cb489403514b878768dd7262daba0b)

Comment (0)