Continuing to reduce registration fees for domestically produced and assembled cars is one of the solutions to support finance, encourage consumption, and restore the industry's growth rate.

|

| 50% reduction in car registration fees: Boosting purchasing power, creating momentum for re-production. (Source: VGP) |

The General Department of Taxation issued Official Dispatch No. 06/CD-TCT dated August 30, requesting Tax Departments nationwide to apply the registration fee rate for automobiles, trailers or semi-trailers pulled by automobiles and vehicles similar to automobiles manufactured and assembled domestically according to the provisions of Decree No. 109/2024/ND-CP dated August 29, 2024 of the Government.

The General Department of Taxation requests the Tax Department to proactively disseminate information to taxpayers in the area, and at the same time direct the Tax Branches in the provinces and cities to promptly implement the application of registration fee collection rates according to the provisions of Decree No. 109/2024/ND-CP mentioned above to contribute to stimulating consumption and continuing to remove difficulties for production and business.

Previously, on August 29, the Government issued Decree No. 109/2024/ND-CP stipulating the registration fee for cars, trailers or semi-trailers pulled by cars and similar vehicles manufactured and assembled domestically. Accordingly, the registration fee will be reduced by 50% for 3 months, from September 1 to November 30.

Accordingly, from the effective date of this Decree until November 30, the registration fee collection rate is equal to 50% of the collection rate prescribed in Decree No. 10/2022/ND-CP dated January 15, 2022 of the Government regulating registration fees. From December 1, 2024 onwards, the registration fee collection rate will continue to be implemented according to Decree No. 10/2022/ND-CP dated January 15, 2022 of the Government regulating registration fees.

This is the fourth consecutive year that domestically produced vehicles have enjoyed this policy. However, the implementation period this time is half that of previous adjustments (6 months).

The most recent implementation of a 50% reduction in registration fees according to Decree No. 41/2023/ND-CP in the last 6 months of 2023 has caused the number of domestically manufactured and assembled cars registered for the first time to increase by 1.6 times compared to the first 6 months of 2023, reaching 176,483 vehicles, an average of 29,413 vehicles/month (the first 6 months of 2023 were 107,194 vehicles, an average of 17,865 vehicles/month).

According to data from the Vietnam Automobile Manufacturers Association (VAMA), in the first half of this year, total sales of domestically assembled and manufactured cars reached only 67,849 vehicles, down 15% compared to the same period last year. Since April, sales of domestically assembled and manufactured cars have been 3-14% lower than completely imported cars.

The implementation of free trade agreement (FTA) commitments also puts pressure on the price and quality of imported vehicles. According to the representative of the Ministry of Finance, these are special difficulties in the current period. Therefore, if we only rely on resources and individual stimulus solutions of each enterprise, it will not be enough to create stability in maintaining output and sales, as well as the resilience to help the market grow again, evenly and sustainably.

Therefore, continuing to reduce registration fees for domestically produced and assembled cars is one of the solutions to support finance, encourage consumption; restore the industry's growth rate; create jobs, increase income for workers, and ensure social security.

Assessing the impact on state budget revenue, a representative of the Ministry of Finance said that this policy increases consumption, thereby increasing revenue from special consumption tax and value added tax, but may not be enough to compensate for the reduction in registration fees.

According to calculations, the policy could reduce the state budget revenue from registration fees by an average of about VND867 billion/month. In addition, this reduction in revenue could affect the state budget revenue balance of localities. According to the provisions of the State Budget Law, registration fee revenue belongs to the local budget.

The 50% reduction in registration fees for domestically produced and assembled cars is likely to increase the number of cars sold and registered, so the revenue from registration fees, special consumption tax, and value added tax may increase. However, the actual revenue from special consumption tax and value added tax is only concentrated in 8 localities - where there are domestic car manufacturing and assembly companies, while other localities have reduced revenue (localities have requested the central budget to compensate for this revenue shortfall to ensure local budget balance), thereby having certain impacts on the budget balance of many localities.

By the end of 2022, Vietnam will have more than 40 automobile manufacturing and assembling enterprises with a total designed capacity of factories in Vietnam of about 755,000 vehicles/year, of which foreign-invested enterprises account for about 35%, domestic enterprises account for about 65%, meeting about 70% of domestic demand for vehicles under 9 seats. By 2025, domestic market demand is expected to reach about 800,000 - 900,000 vehicles/year.

Reducing registration fees by 50% will help boost purchasing power, create momentum for re-production, reconnect the supply chain, and restore the industry's growth rate.

The policy also contributes to increasing the size of the domestic market, thereby stimulating demand for automotive auxiliary industrial products, contributing to promoting the development of many industries participating in the supply chain such as metals, mechanics, electronics, chemicals, rubber... Thereby, contributing to creating jobs, increasing income for workers, ensuring social security, and promoting economic growth.

Source: https://baoquocte.vn/giam-50-le-phi-truoc-bao-o-to-khuyen-khich-tieu-dung-phuc-hoi-toc-do-tang-truong-cua-nganh-284497.html

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

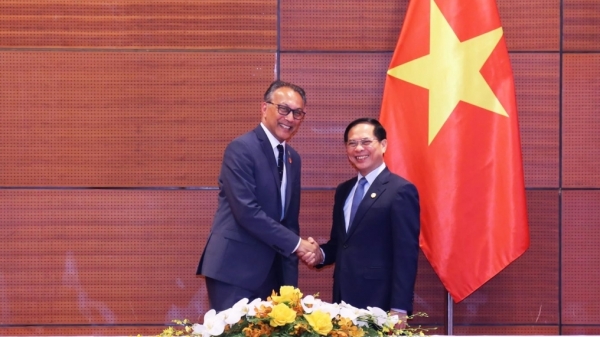

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)