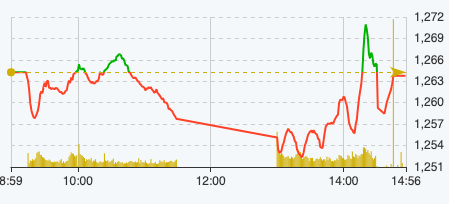

Red spread at the beginning of the session, VN-Index decreased slightly and fluctuated around the reference level. Showing that investor caution is still present in the market.

Most industry groups were in the red at the end of this morning's session, typically the retail, food and beverage and banking sectors. Notably, cash flow shifted to real estate stocks, helping these codes to flourish and liquidity to skyrocket.

At the end of the morning session on March 15, VN-Index decreased by 6.53 points, equivalent to 0.52% to 1,256 points. The entire floor had 229 stocks increasing and 213 stocks decreasing.

VN-Index performance on March 15 (Source: FireAnt).

Entering the afternoon session, negative sentiment prevailed, causing the market to plummet under pressure from the real estate and retail groups.

At the end of the trading session on March 15, VN-Index decreased by 0.48 points, equivalent to 0.04% to 1,263.78 points. The entire floor had 217 stocks increasing, 249 stocks decreasing, and 86 stocks remaining unchanged.

HNX-Index decreased 0.14 points to 239.54 points. The entire floor had 79 stocks increasing, 85 stocks decreasing and 77 stocks remaining unchanged. UPCoM-Index decreased 0.27 points to 91.35 points. The VN30 basket was divided with 15 stocks decreasing and 13 stocks increasing.

In contrast to the morning session, in the afternoon session, the real estate group faced downward pressure with the pull of two codes VIC and VHM of Vingroup. However, there were still some positive codes such as HDC, PVL, CLG, PVR, EFI hitting the ceiling and codes DIG, DXG, NVLL, CEO, TCH, HQC ending the session in green.

Although VCB is still in the top 2 stocks negatively affecting the market, profit-taking pressure in the banking group has eased. Most stocks ended the session up, with only a few stocks down 1% or less, such as EIB, SHB, VPB, LPB, OCB, and VCB.

The manufacturing industry group was quite negative when large codes such as HAG, DBC, MSN, VNM, ANV, QNS, FMC,… were all dyed red.

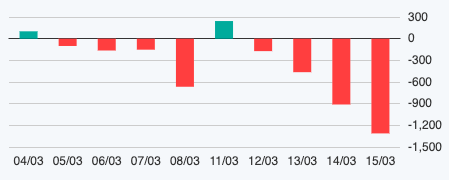

Foreign block transaction developments.

The total order matching value in today's session was VND30,599 billion, down 6%, of which the order matching value on the HoSE floor reached VND27,508 billion. In the VN30 group, liquidity reached VND9,539 billion.

Foreign investors net sold for the fourth consecutive session with a value of VND 1,311 billion today, of which this group disbursed VND 2,600 billion and sold VND 3,912 billion.

The codes that were sold strongly were HPG 199 billion VND, VHM 158 billion VND, VND 118 billion VND, VIC 95 billion VND, VNM 95 billion VND,... On the contrary, the codes that were mainly bought were FTS 138 billion VND, DIG 99 billion VND, EIB 68 billion VND, DGW 44 billion VND, EVF 44 billion VND,... .

Source

Comment (0)