Vietnam's stainless steel industry is facing huge challenges, similar to the story of 10 years ago, but on a larger, more complex scale...

At the 2023 Annual General Meeting of Shareholders of Hoa Phat Group, Mr. Tran Dinh Long, Chairman of Hoa Phat Group, announced to shareholders and the public about stopping research and production of stainless steel in Vietnam.

Previously, the research on stainless steel was a well-planned step by the largest steel manufacturing group in Vietnam and Southeast Asia when Hoa Phat cooperated with Danielli, the leading steel manufacturer in Italy. But why was a move that was in line with the Group's orientation of making high-grade steel canceled after a long period of research?

The main reason Mr. Long gave for stopping the research and production of stainless steel is that “Vietnam has no advantage in producing stainless steel, because Vietnam does not have a supply of nickel ore”, one of the most important raw materials for manufacturing and ensuring the quality of stainless steel. In Asia, the two countries with large supplies of nickel ore are China and Indonesia.

“If Hoa Phat does it, it will lose,” Mr. Long emphasized. When Hoa Phat “lets go”, can other remaining Vietnamese businesses in the industry develop?

Pressure from regional markets

According to statistics, the world's annual stainless steel output is about 55 million tons. Of which, China produces 36 million tons, accounting for 65%, Indonesia produces 5.5 million tons, accounting for about 10%, in line with its advantage in nickel ore resources. China and Indonesia also account for the majority of the world's stainless steel exports. In 2023, China exported 3.4 million tons, Indonesia exported 2.7 million tons, accounting for 20.7% and 16.4% of the world's total exports, respectively.

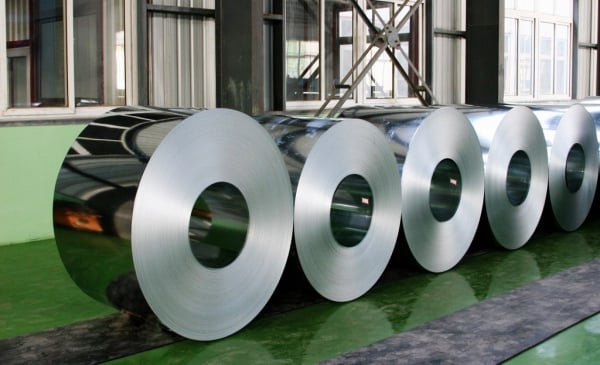

In Vietnam, the current annual output is about 1 million tons of steel (cold-rolled stainless steel), not including downstream products such as stainless steel pipes, stainless steel basins, etc. Of which, domestic consumption is about 120,000 tons (accounting for 12-15% of output), the rest is exported abroad. Vietnamese enterprises fully meet the demand for cold-rolled stainless steel in Vietnam and participate in export.

But that small demand for cold-rolled stainless steel is constantly being swallowed up by imports as Vietnam stands next to two stainless steel giants. With an annual cold-rolled stainless steel export capacity of 5.8 million tons, only 4.3% of that exceeds Vietnam's domestic demand.

Domestically produced goods almost only have competitive advantages because they understand the market better, and have shorter transportation and delivery times than imported goods. But that is when foreign goods compete fairly, and when they “play tricks” with unhealthy behaviors (such as dumping or cheating on quality), Vietnamese goods have almost no chance to compete with them. Difficulties are always present and persistent day after day, month after month, making businesses always in a state of “exhaustion” because of competition.

|

| Vietnam stainless steel is facing many difficulties and challenges. |

The difficult journey to adulthood

Looking back, we can see that the stainless steel industry in Vietnam has only had 15 years of development and maturity, with the first two names being Hoa Binh (Hung Yen) and Posco (Dong Nai).

In the South, in 2009, Posco acquired ASC's 30,000 tons/year stainless steel plant and increased its capacity to 75,000 tons/year. In 2011, Posco decided to continue increasing the plant's capacity to 250,000 tons/year and complete it in 2012 to anticipate the market following the development of the Vietnamese economy. Posco VST stainless steel plant in Nhon Trach Industrial Park is Posco's largest stainless steel cold rolling plant in Southeast Asia.

In the North, Hoa Binh, from a steel factory on the outskirts of Hanoi, made a bold decision to invest in a large-size cold-rolled stainless steel factory using European technology with a capital of more than 1,000 billion VND in 2010.

But in 2010-2013, Vietnam went through a difficult economic period with many macroeconomic instabilities. Inflation sometimes reached over 18% in 2011, the construction and real estate industries were almost paralyzed. The stainless steel industry, which is an input material for construction and real estate, has also been struggling for many years. Stainless steel enterprises therefore had to run around everywhere to find output, stabilize production, and use newly installed machinery and equipment.

Recently, the Covid-19 pandemic and the recession of the real estate industry have caused stainless steel businesses in the past 3 years to struggle with old problems, despite having much more experience than in the previous period.

After more than 15 years of development, up to now, with the entry of Yongjin Company, a Chinese investor, Vietnam's cold-rolled stainless steel production capacity has reached approximately 1 million tons, exported to many countries around the world.

Despite difficulties and disadvantages in relation to neighboring countries in the region, Vietnamese stainless steel enterprises, including both domestic and foreign invested enterprises (FDI), have made continuous efforts to maintain market share, compete fairly with foreign imports, contribute to stabilizing the market, and gradually develop this young industry.

Cool water irrigates the parched fields

Despite many difficulties, in addition to self-efforts, the development of the stainless steel industry today cannot be ignored without the attention and support of the State. The State, as a "midwife" of the market, has created an equal space for businesses to operate and grow.

Since 2014, the Ministry of Industry and Trade has applied and maintained anti-dumping tax on stainless steel imported from four countries: Malaysia, Taiwan, Indonesia and China.

In 2014, Vietnam had just emerged from the economic recession with many macroeconomic uncertainties. The real estate industry was almost paralyzed in the period of 2012 - 2014, causing the stainless steel industry to face many difficulties. The anti-dumping tax of the Ministry of Industry and Trade at that time was like a cool stream of water irrigating the dry fields.

Over the past 10 years, the industry has matured to a certain extent. In addition to meeting domestic demand, stainless steel enterprises have actively participated in export activities. Export volume accounts for the majority of the industry's output.

However, at present, the industry is also facing huge challenges, similar to the story of 10 years ago but on a larger scale.

Firstly, the industry is going through a difficult period due to the Covid-19 pandemic and the recession of the real estate industry in the domestic market.

Second, the industry's capacity has doubled in the 2020-2024 period (from about 400,000 tons/year to nearly 1 million tons/year).

Third, unfair competition of foreign export goods is currently very fierce because foreign supply is in huge surplus, always waiting to flood into Vietnam.

Fourth, the world economy is in difficult times, demand has not yet recovered.

Currently, after 10 years of tax application, businesses are working with the Ministry of Industry and Trade to re-evaluate whether this tax measure should continue or not. In that context, many people wonder whether it is necessary to continue imposing the tax or not, thinking that 10 years is a long enough period for businesses to restructure and grow.

Ten years is not a short period of time, but compared to the development of the world's stainless steel industry, it is nothing. The steel industry in general and the stainless steel industry in particular in Vietnam have only been developed for 15 years, still too young compared to the centuries-old history of development in the West, or half a century in China. With immature strength, limited resources, and little experience, how can we compete with the giants?!

Steel in general and stainless steel in particular is an industry with a high investment rate with super-sized and super-heavy equipment and machinery, and in-depth production technology, so it will not be easy for a new investor to pour money into the industry. The example of Hoa Phat's abandonment also shows how difficult this market is.

Over the past 15 years, Vietnam has had only 3 enterprises producing and selling cold-rolled stainless steel. The rest are enterprises trading in downstream products such as steel pipes, stainless steel basins, and other downstream products.

Meanwhile, trade defense measures, specifically anti-dumping measures, are a tool for the State to combat unfair trade practices of some markets in the domestic market of Vietnam, as prescribed by law and recognized by the WTO, to re-establish a healthy competitive environment in the domestic market. Countries have also maintained anti-dumping measures for decades (Vietnamese basa fish and shrimp have had to cope with anti-dumping taxes from the US since 2003 and have not stopped yet). Therefore, timely trade defense activities with legitimate tools, as prescribed by law, will be a useful support for businesses during this period.

Source: https://baodautu.vn/hanh-trinh-tim-su-cong-bang-o-san-nha-cua-thep-khong-gi-d220293.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)