According to NAPAS, the number of money transfer transactions in January increased by 5% compared to December 2023 and increased by 58% compared to the same period last year. Meanwhile, cash withdrawal transactions via ATM decreased by 28% compared to the same period last year. This clearly affirms that people's demand for cash withdrawals is decreasing, not only during the year, but also during peak periods near Tet like now.

People are increasingly scanning QR codes

To meet the demand for non-cash payments during the days leading up to Tet, NAPAS will strengthen liquidity monitoring of member organizations, and arrange staff to be on duty 24/7 to be ready to support banks, payment intermediaries and businesses during the peak holiday season.

Notably, ATM cash withdrawals have continued to decline in recent years. In 2023, ATM cash withdrawals decreased by 16.9% in number of transactions and 19.5% in transaction value, with ATM transactions now accounting for only 3.6% of total transactions through the NAPAS system. The above figures clearly reflect the decreasing demand for cash withdrawals from people and being replaced by more convenient payment services such as NAPAS 247 fast money transfer and QR code scanning payment.

In 2023, NAPAS continued to record growth in non-cash payment transactions via the NAPAS system. Accordingly, the total number of transactions of the NAPAS system increased by more than 52% and the total transaction value increased by more than 12% compared to 2022.

Notably, ATM cash withdrawals have continued to decline in recent years. In 2023, ATM cash withdrawals decreased by 16.9% in number of transactions and 19.5% in transaction value, with ATM transactions now accounting for only 3.6% of total transactions through the NAPAS system. The above figures clearly reflect the decreasing demand for cash withdrawals from people and being replaced by more convenient payment services such as NAPAS 247 fast money transfer and QR code scanning payment.

Source link

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

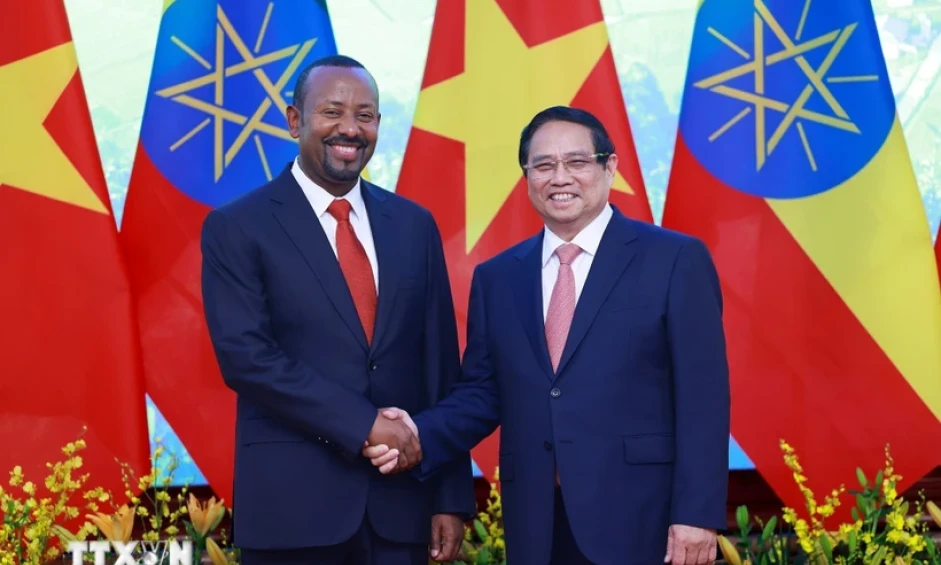

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)