The US reciprocal tariffs have shown a strong impact on the global economy in general and financial markets in particular in recent weeks. Although receiving positive signals about the 90-day postponement of tariffs by Mr. Trump to 75 countries (including Vietnam) has helped the Vietnamese stock market recover positively.

But the fear of market risks from this tax policy has not disappeared as doubts after 90 days have been raised that Mr. Trump's move is still a mystery, especially for industries that are strongly and directly affected by this policy: industrial zones, seafood, exports, etc.

However, in the long term, the stock market is still considered to have a lot of room, positive growth signals this year with many supports, this could be the right time for investors to accumulate potential stocks with attractive prices, because in reality, there are still many industry groups that are not/less directly affected by this policy.

Based on the above, Mr. Bui Ngoc Trung, consultant, Mirae Asset Securities , commented that the banking and securities sectors will be the main driving force for the VN-Index. Because banks will still maintain their supporting role thanks to credit demand and monetary policy being kept in a supportive state.

By the end of the first quarter of 2025, credit growth reached 3.93%, 2.5 times higher than the 1.42% in the same period in 2024. Lending interest rates continued to decrease by 0.4% compared to the end of 2024, demonstrating the banking system's efforts to promote capital flows to the economy.

In the report of SSI Research , experts assessed that the potential impact of US reciprocal tax on the banking industry is relatively complicated. Although not directly affected, this is an industry that is related to the directly affected industries: textiles, seafood, wood products and FDI, in addition to consumption and real estate.

Specifically, credit growth is likely to slow down among SMEs (small and medium enterprises) in the export sector, but is expected to be offset by increased outstanding loans to sectors such as infrastructure, construction, real estate, and consumption.

At the same time, this industry group will face risks from bad debt and increased credit costs, along with reduced income from trade finance and foreign exchange transactions, and reduced lending rates to support customers in difficulty.

On the bright side, however, the 90-day suspension of reciprocal tariffs with most countries is a short-term positive for Vietnam. As a result, exports to the US market will improve in the short term, as importers accelerate orders not only for the back-to-school season but also for the holiday season, except for orders that take more than 90 days to complete.

In addition, the Government will introduce support measures to stimulate the economy such as accelerating public investment and supporting interest rates. The weakening USD can reduce some pressure on capital costs, easing financial pressure on banks.

Therefore, in the current context, banks with high levels of exposure to exports and FDI, specifically the group of state-owned commercial banks, can benefit somewhat in the short term, and have more time to develop a medium-term strategy.

In the long term, the outlook remains uncertain and the impact is not expected to begin until late 2025 or early 2026.

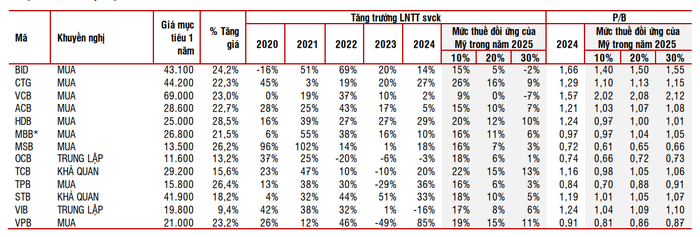

Summary of valuation of banking stocks (Source: SSI Research)

Based on the above analysis, SSI Research estimates that the banking industry's profits in 2025 will not be significantly affected. Uncertainties surrounding the US's reciprocal tax policy still exist, but current valuations are attractive, with potential upside ranging from 10% to 30%.

However, to take advantage of this accumulation opportunity, investors need to be selective based on: Assessing the level of influence of banks on industries related to import-export and FDI; Considering the proportion of foreign currency loans in total outstanding debt and foreign currency mobilization compared to total mobilization.

Accordingly, SSI Research makes recommendations for a number of banking stocks. Specifically, banks with competitive capital sources and operating results that closely follow the recovery of the Vietnamese economy, including: VCB (Vietcombank, HOSE), CTG (Vietinbank, HOSE), TCB (Techcombank, HOSE) and MBB (MBBank, HOSE).

In addition, despite not having a capital advantage, HDB (HDBank, HOSE) is expected to still benefit from a higher credit limit after participating in restructuring weak banks in the context of a recovering real estate market.

Meanwhile, VPB (VPBank, HOSE) and TPB (TPBank, HOSE) have adjusted their prices deeply and are likely to provide attractive short-term trading opportunities.

The market's upward momentum has temporarily slowed down after a nearly 150-point gain over three consecutive sessions. Closing the session on April 15, the VN-Index closed at 1,227.79 points, down 13.65 points (equivalent to 1.1%) with 145 stocks increasing and 334 stocks decreasing.

Total trading volume reached nearly 1.07 billion units, worth VND24,216.2 billion, equivalent to yesterday's session. A series of stocks in the VN30 group reversed sharply, but the "Vin family" stocks maintained their growth, VIC (Vingroup, HOSE) increased by 1.3%, VHM (Vinhomes, HOSE) increased by 0.5%.

Source: https://phunuvietnam.vn/bank-stocks-go-backward-to-the-world-2025041518235851.htm

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)