Domestic gold price today April 5, 2025

At the time of survey at 04:30 on April 5, 2025, the domestic gold price decreased by nearly 1 million VND, down to nearly 101 million. Specifically:

The price of SJC gold bars was listed by Saigon Jewelry Company at 98.8-101.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

DOJI Group listed the price of SJC at 98.8-101.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 900,000 VND/tael for selling. The difference between buying and selling prices is 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 98.8-101.3 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 900,000 VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.5-101.3 million VND/tael (buy - sell); down 200,000 VND for buying and down 900,000 VND/tael for selling. The difference between buying and selling is listed at 2.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 98.8-101.3 million VND/tael (buy - sell); down 300,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling is 2.5 million VND/tael.

The latest gold price list today, April 5, 2025 is as follows:

| Gold price today | April 5, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 98.8 | 101.3 | -700 | -900 |

| DOJI Group | 98.8 | 101.3 | -700 | -900 |

| Red Eyelashes | 99.6 | 101.5 | +200 | -200 |

| PNJ | 98.8 | 101.3 | -700 | -900 |

| Vietinbank Gold | 101.3 | -900 | ||

| Bao Tin Minh Chau | 98.8 | 101.3 | -200 | -900 |

| Phu Quy | 98.6 | 101.3 | -400 | -900 |

| 1. DOJI - Updated: April 5, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 98,800 ▼700K | 101,300 ▼900K |

| AVPL/SJC HCM | 98,800 ▼700K | 101,300 ▼900K |

| AVPL/SJC DN | 98,800 ▼700K | 101,300 ▼900K |

| Raw material 9999 - HN | 98,300 ▼200K | 100,400 ▼900K |

| Raw material 999 - HN | 98,200 ▼200K | 100,300 ▼900K |

| 2. PNJ - Updated: April 5, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 9,880 | 10,130 |

| PNJ 999.9 Plain Ring | 9,870 | 10,130 |

| Kim Bao Gold 999.9 | 9,870 | 10,130 |

| Gold Phuc Loc Tai 999.9 | 9,870 | 10,130 |

| 999.9 gold jewelry | 9,870 | 10,120 |

| 999 gold jewelry | 9,860 | 10,110 |

| 9920 jewelry gold | 9,799 | 10,049 |

| 99 gold jewelry | 9,779 | 10,029 |

| 750 Gold (18K) | 7,355 | 7,605 |

| 585 Gold (14K) | 5,685 | 5,935 |

| 416 Gold (10K) | 3,975 | 4,225 |

| PNJ Gold - Phoenix | 9,870 | 10,130 |

| 916 Gold (22K) | 9,030 | 9,280 |

| 610 Gold (14.6K) | 5,938 | 6,188 |

| 650 Gold (15.6K) | 6,343 | 6,593 |

| 680 Gold (16.3K) | 6,647 | 6,897 |

| 375 Gold (9K) | 3,560 | 3,810 |

| 333 Gold (8K) | 3,105 | 3,355 |

| 3. SJC - Updated: 4/5/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,800 ▼700K | 101,300 ▼900K |

| SJC gold 5 chi | 98,800 ▼700K | 101,320 ▼900K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,800 ▼700K | 101,330 ▼900K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,700 ▼700K | 101,200 ▼800K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,700 ▼700K | 101,300 ▼800K |

| Jewelry 99.99% | 98,700 ▼700K | 100,900 ▼800K |

| Jewelry 99% | 96,901 ▼792K | 99,901 ▼792K |

| Jewelry 68% | 65,769 ▼544K | 68,769 ▼544K |

| Jewelry 41.7% | 39,229 ▼344K | 42,229 ▼344K |

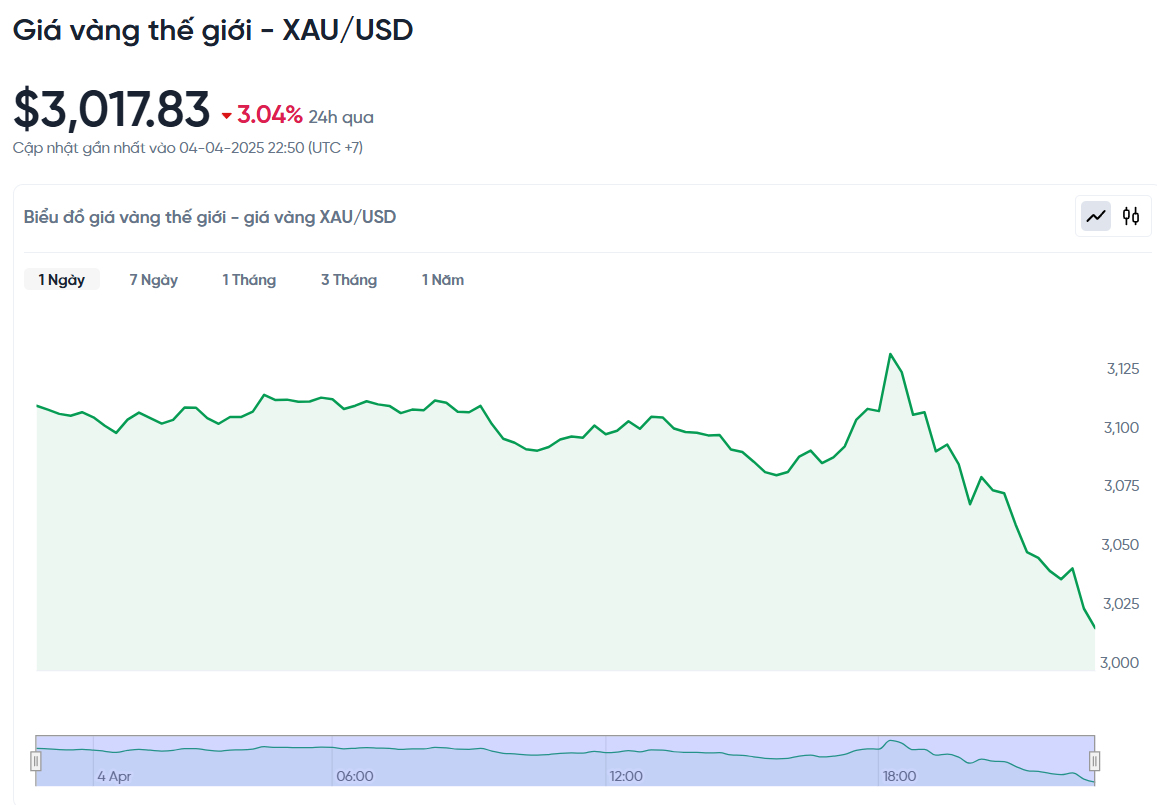

World gold price today April 5, 2025 and world gold price fluctuation chart in the past 24 hours

In the international market, the spot gold price was recorded at 3,017.83 USD/ounce, down 94.61 USD/ounce compared to the previous session. Converted at the current exchange rate, the world gold price is equivalent to about 94.4 million VND/tael (excluding taxes and fees), nearly 6.9 million VND/tael lower than domestic gold bars.

World gold prices have fallen sharply due to risk aversion. Following news of US tariffs, along with trade retaliation measures from US partners, the precious metal remains under selling pressure due to profit taking and contract liquidation from short-term traders.

Many investors are unable to sell the assets they want, so they sell what they can. This is why gold, which is considered a safe haven, is also being sold off despite the general market sentiment being more defensive.

Amid the turmoil in global markets, the US March jobs report was largely overshadowed. According to the US Labor Department, nonfarm payrolls increased by 228,000, far exceeding the forecast of 140,000 and higher than the downwardly revised 117,000 in February.

Asian and European stocks have both fallen sharply in the past two sessions. Markets are still reeling from the US announcing new tariffs on Wednesday, which prompted retaliatory measures from other countries. China has just announced a 34% tariff on all US imports, adding to global trade tensions.

The futures market is now predicting that the US Federal Reserve will cut interest rates five times this year, a total of 1.25% reduction, indicating that investors are concerned about the possibility of the US economy falling into recession.

Against this backdrop, safe havens such as the Japanese yen and Swiss franc are seeing increased buying. The dollar index edged up slightly but remained near a six-month low. Nymex crude oil fell sharply to nearly $62 a barrel – its lowest in nearly four years. The yield on the 10-year US government bond also retreated to 3.9%, indicating that money is seeking safe havens amid market volatility.

Not only gold, silver prices also fell sharply by 4.9% to $30.32/ounce, recording the worst weekly decline since September 2020. Platinum and palladium fell 2.8% and 1.4%, respectively, to $925.55 and $915.21, and were also under selling pressure during the week.

Gold Price Forecast

Technically, the uptrend in gold prices in June futures contracts remains dominant. The next target for bulls is to push prices above the resistance level of $3,201.60 per ounce. On the contrary, bears are trying to push prices below the support zone of $3,031 per ounce.

Important levels to watch are the immediate resistance levels at $3,150 and $3,160.2, along with support levels at $3,089.3 and $3,073.5. The Wyckoff Index is currently at 8.5 out of 10, suggesting that the uptrend remains strong.

The gold market is being strongly affected by the import tax policies announced by President Donald Trump. Although gold prices may adjust slightly in the short term, many financial institutions believe that the risk of a deep decline is not high.

Ahead of the tax announcement, RBC Capital Markets raised its 2025 average gold price forecast to $3,039 an ounce and expects it to hit $3,195 an ounce next year. However, they also warned that the recent rally has been too rapid, and if there is a correction, prices could fall back to support around $2,821 an ounce.

TD Securities experts also believe that the gold market can still be volatile. Although gold prices are high, the actual amount of gold held by large investors is still low, showing that there is still potential for growth if money flows return.

TD also said that if there is a correction, the possibility of a deep decline is not high. Many investors have made profits after a series of increases lasting more than a year, so they will not sell off just because of a few short-term declines.

Some experts expect gold prices to hit $3,500 an ounce by the end of the year if the current trend continues. However, if the supporting factors change suddenly, the possibility of a stronger correction is still possible.

Source: https://baoquangnam.vn/gia-vang-hom-nay-5-4-2025-gia-vang-trong-nuoc-va-the-gioi-giam-manh-do-tam-ly-e-ngai-rui-ro-3152160.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)