According to MXV, at the end of the first trading session of the week, soybean prices recorded a slight increase, recovering after a plunge at the end of last week.

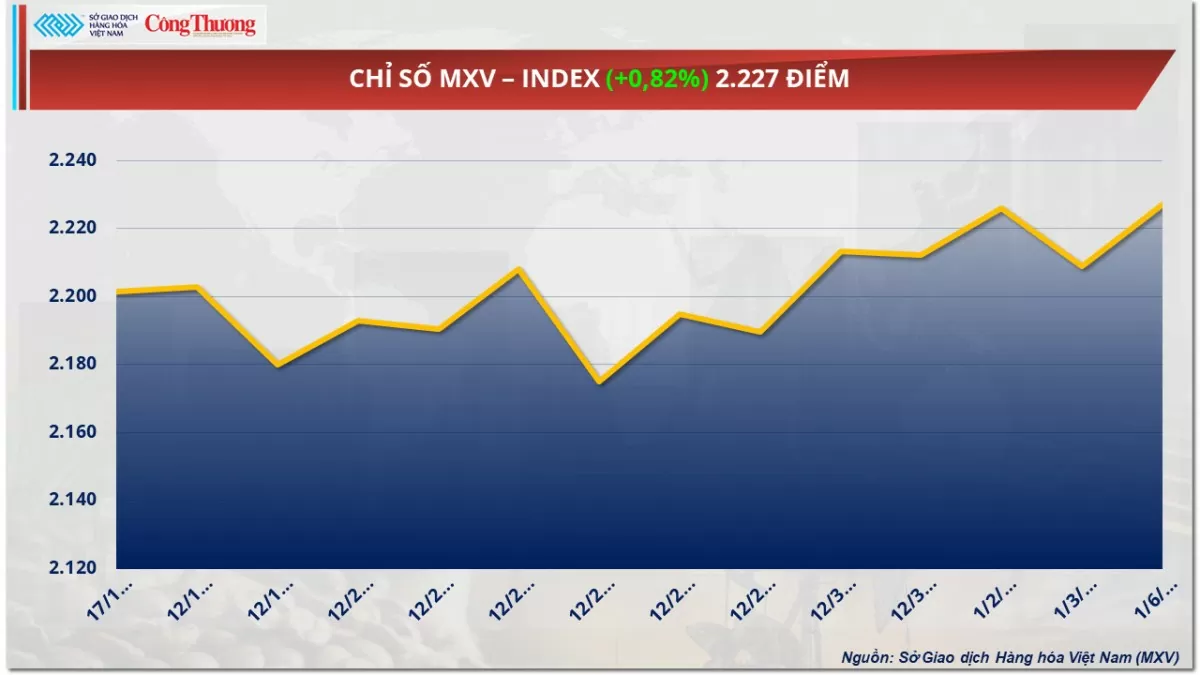

According to the Vietnam Commodity Exchange (MXV), investment cash flowed strongly into the world raw material market on the first trading day of the week (January 6). At the end of the session, the MXV-Index increased by 0.82% to 2,227 points, the highest level in nearly three months. Notably, the metal group led the increase with 7 out of 10 commodities increasing in price, in which silver prices continued to increase from the previous sessions; COMEX copper prices increased the most since mid-October. At the same time, in the agricultural market, commodities such as corn, soybeans and wheat also had positive developments.

|

| MXV-Index |

Weakening USD, Increasing Buying Power in Metal Market

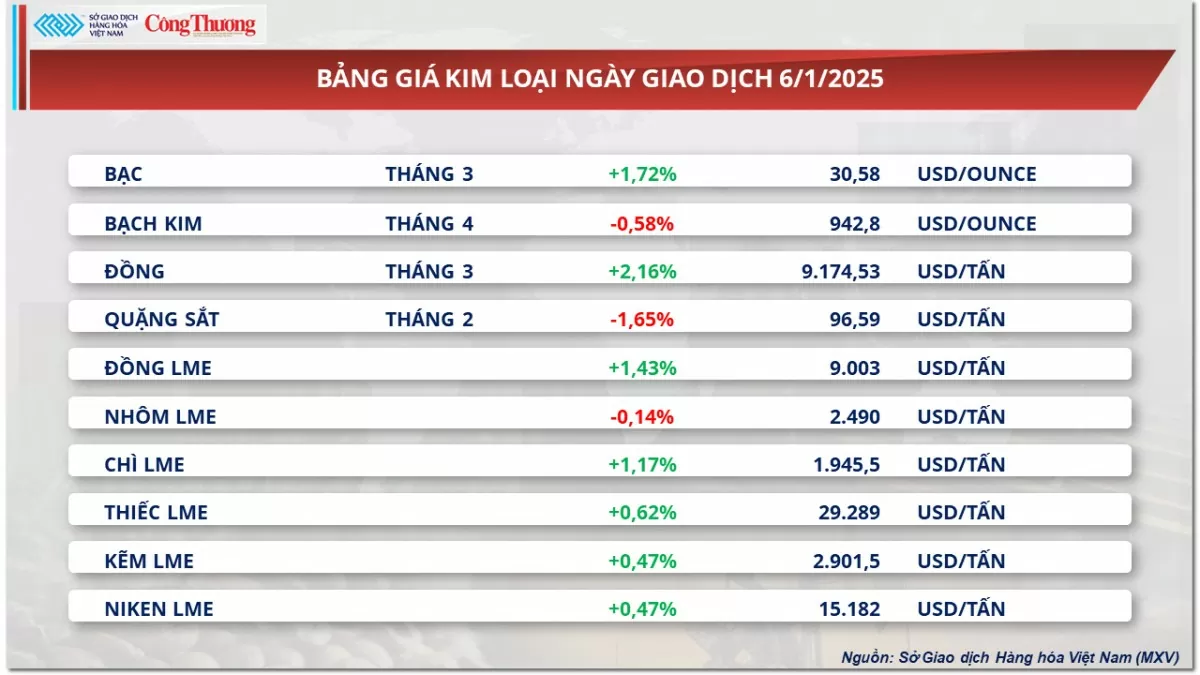

At the end of the first trading session of the week, the green color dominated the metal price chart. For precious metals, the price of silver continued to increase from the previous weekend sessions, increasing by 1.72% to 30.58 USD/ounce. On the contrary, the price of platinum turned to decrease by nearly 0.6%.

|

| Metal price list |

The precious metals group received positive buying pressure yesterday after the USD weakened sharply in the afternoon session. The Dollar Index reversed and fell 0.64% to 108.26 points after the Washington Post reported that President-elect Donald Trump's advisers are considering plans to impose tariffs on all countries, but only on sectors important to the US national security or economy. This eased concerns that the US would impose high tariffs as previously announced and reduced disruption to global trade flows.

The price of precious metals silver and platinum immediately rebounded sharply. However, platinum prices still ended the session in the red because the increase could not offset the sharp decline in prices earlier. Moreover, the USD gradually regained its strength towards the end of the session after President-elect Donald Trump denied that he would implement a less drastic tariff policy than previously announced.

For the base metals group, the weakening of the US dollar also supported the sharp increase in copper prices yesterday. At the end of the session, COMEX copper prices increased by 2.16% to 9,174 USD/ton, marking the strongest increase of this commodity in the past three months.

Copper prices also benefited from China’s signal of continued economic stimulus late last week, including both fiscal and monetary stimulus. Specifically, an official at the National Development and Reform Commission (NDRC) said China will increase funding from the sale of ultra-long-term treasury bonds in 2025 to boost business investment and consumer spending. In addition, the People’s Bank of China (PBOC) said the PBOC will increase financial support for technological development and stimulate consumption, while reaffirming that it will lower interest rates and reserve requirement ratios (RRR) at appropriate times to boost growth.

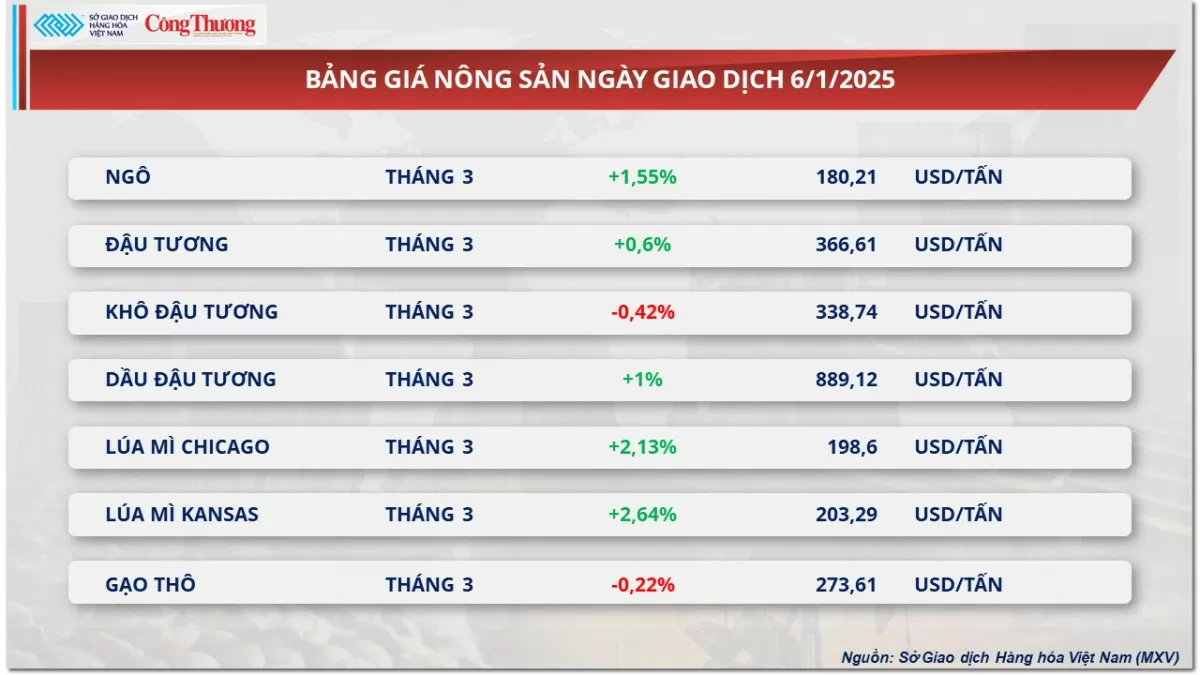

Soybean prices recorded a slight increase

According to MXV, soybean prices recorded a slight increase at the end of the first trading session of the week, recovering after a sharp decline at the end of last week. Weather conditions in Argentina and the weakening of the USD were the main factors supporting the market yesterday.

|

| Agricultural product price list |

Argentina's two major grain exchanges, Buenos Aires and Rosario, have recently warned that hot, dry summer weather conditions are starting to affect the 2024-2025 soybean crop. Abundant spring rains have previously provided favorable conditions for crops, but the situation is now changing. The Rosario Grain Exchange (BCR) said that northeastern Buenos Aires and southern Santa Fe received just 35 mm of rain in December, well below the historical monthly average of 110 mm. Meanwhile, the Buenos Aires exchange said that the area with adequate or optimal water has decreased by 7%, accounting for 81% of the total planted area. The worsening weather conditions in Argentina are raising concerns about the quality and yield of the current crop, which has been driving buying in the market.

In addition, the Export Inspections report showed that US soybean deliveries only reached 1.28 million tons, down from 1.64 million tons last week but still higher than market expectations. This decline is not too surprising because it coincides with the New Year holiday. In addition, the peak US export season is gradually coming to an end, but the delivery volume in the week ending January 2 was still quite impressive. This is a factor that also contributed to the dominance of buyers yesterday.

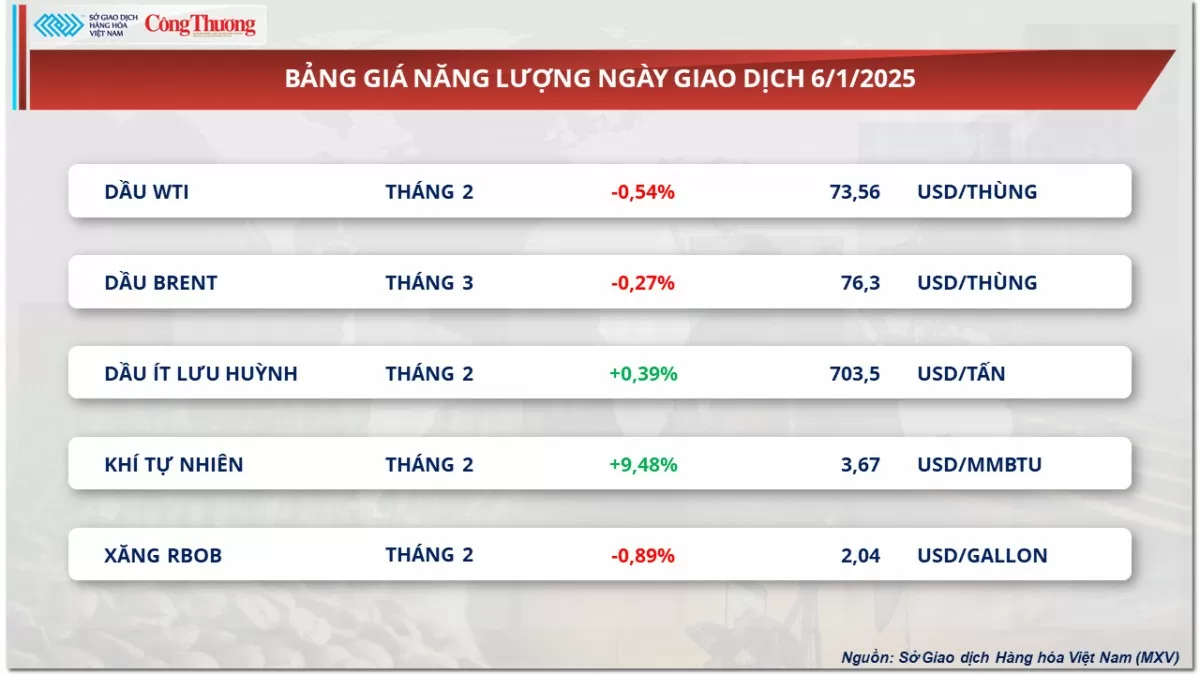

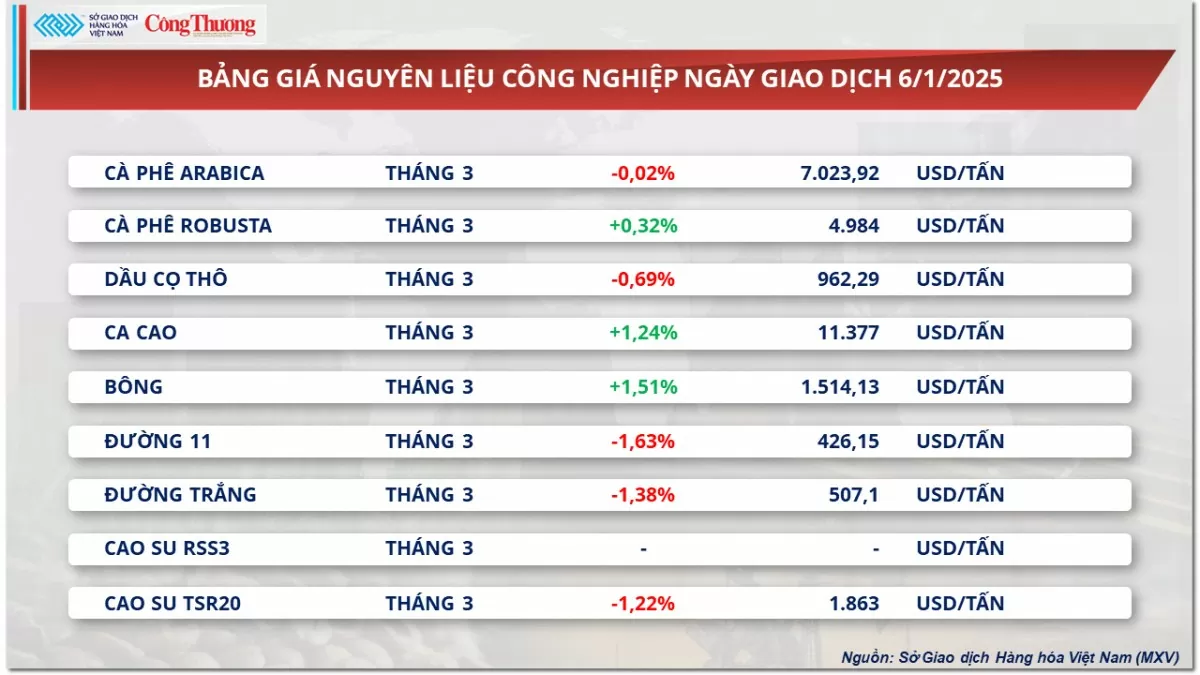

Prices of some other goods

|

| Energy price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-71-gia-dau-tuong-tang-nhe-368294.html

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Quang Binh: Bright yellow vermicelli flowers in Le Thuy village](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/80efad70a1d8452581981f8bdccabc9d)

Comment (0)