In the world, in an effort to improve the business environment to motivate the development of the private economic sector, the World Bank (WB) has introduced a method called "Business Ready" (B-Ready), piloted from 2024 - 2026, replacing the "Doing Business" report that has been discontinued since September 2021. Vietnam is among 50 economies assessed in the first edition of "Business Ready 2024", based on 3 main pillars, including legal framework, public services, and operational efficiency. According to B-Ready 2024, Singapore leads the rankings in terms of market entry of enterprises with an impressive score of 93.57 points, Vietnam recorded a score of 65.47. In this indicator, in the ASEAN region, besides Singapore and Vietnam, there are the Philippines with 48.49 points, Indonesia with 63.72 points and Cambodia with 43.8 points. Regarding the legal framework, the WB recorded Vietnam at 66.81 points, ranking it in group 3. This score shows that Vietnam has made significant progress in creating a healthy business environment. However, in the public sector, our country only achieved 53.41 points and was ranked in group 3, reflecting significant gaps in the quality of public services that businesses can access, especially in the field of digitalization of government services. In this category, Singapore is in the highest position with 87.33 points.

Tan Vu Port (Hai Phong)

NGOC THANG

Dr. Nguyen Minh Thao, Head of the Department of Business Environment and Competitiveness Research (Central Institute for Economic Management - CIEM), said that according to the old assessment method of the WB, Vietnam ranked 5th in ASEAN in terms of business environment. With this new assessment method, Vietnam moved up 1 place, to 4th in ASEAN, after Singapore, Malaysia and Thailand. To be in the top 3 in terms of good business environment reform, Vietnam must at least surpass Thailand, based on international practices. The reform needs to "rely" on 10 criteria in the life cycle of enterprises according to international practices, from establishment, meeting business conditions, tax obligations, customs, social insurance, etc.

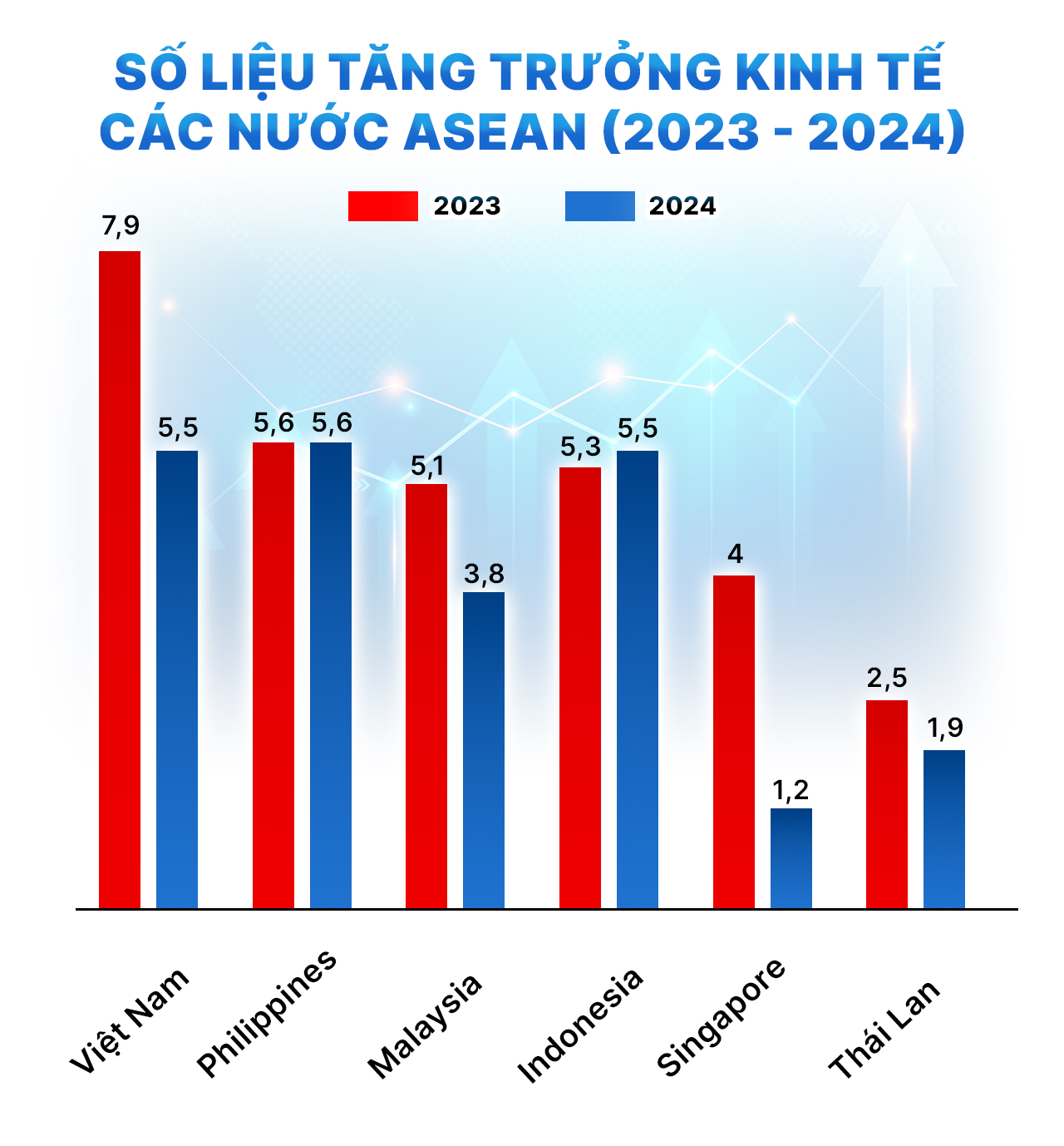

According to Dr. Nguyen Minh Thao, in 2024, the International Monetary Fund (IMF) estimates that Vietnam's GDP could reach about 448.4 billion USD, ranking 5th in the region. Meanwhile, Indonesia leads the region with about 1,400 billion USD, followed by Singapore with an estimated 530.7 billion USD. Next are Thailand and the Philippines, with estimated GDPs of 528.9 billion USD and 470 billion USD, respectively. "Thus, to surpass Thailand in terms of business environment, we must by all means increase the size of the economy and narrow the gap. It is worth noting that the IMF also forecasts that by 2028, Vietnam's GDP could reach about 628 billion USD, surpassing Thailand (624 billion USD) to become the 3rd largest economy in Southeast Asia, and the 32nd largest in the world. It can be seen that the General Secretary's suggestive goal is completely grounded if ministries and branches immediately start reviewing and cutting procedures," emphasized Dr. Nguyen Minh Thao.

Channel Well Technology Vietnam Co., Ltd. (Quang Minh Industrial Park, Hanoi) - electronic components

PHAM HUNG

Putting Vietnam in relation to the top 4 countries, economist Tran Anh Tung (Head of Business Administration, Faculty of Business Administration, University of Economics and Finance, Ho Chi Minh City) analyzed: Based on the Global Competitiveness Index (GCI) 5.0 in 2021/22 of the World Economic Forum (WEF), Vietnam ranked 50th, in the group of lower middle-income countries, with Indonesia at 53rd (WEF GCI 5.0). Meanwhile, Thailand, an upper middle-income country, ranked around 40th based on the 2019 ranking (40/140), showing a better position than Vietnam. Singapore, often in the top 10, even ranked first in the World Competitiveness Ranking 2024 of the Institute for Development Management, at position 1, while Thailand was at position 25 (IMD Ranking 2024).

"In general, the gap between Vietnam and the countries above is not too far. To enter the top 3 international investment destinations in the region, Vietnam needs to implement specific measures such as fighting corruption and reducing administrative procedures. Accordingly, strengthening the enforcement of anti-corruption laws, simplifying the licensing process, and improving transparency. For example, it is possible to reduce the number of steps and time to obtain a construction permit from 110 days to the level equivalent to Thailand. Improve regulations by ensuring consistent, transparent and predictable policies, reducing risks for investors. This includes reforming investment laws and public-private partnerships (PPP) to attract foreign capital," Mr. Tran Anh Tung suggested.

Dr. Hoang Minh Hieu, Standing Member of the National Assembly's Law Committee, acknowledged that since the implementation of the open-door policy, Vietnam's business environment has continuously improved. However, there are still many shortcomings such as lengthy business registration procedures, investment procedures that go through many unnecessary steps, and complicated bankruptcy procedures...

To be in the top 3 of ASEAN in terms of business environment, Vietnam must continue to cut down on administrative procedures, in which priority should be given to areas with many shortcomings that have been clearly identified as hindering businesses from doing business. "For example, business registration procedures in Vietnam still take about 15 days, while in Singapore it only takes about 1.5 days, in Thailand it only takes about 4.5 days; tax declaration and payment procedures have been improved but tax records are still complicated, the electronic tax system is not synchronized between localities, tax refund time is still long; the time to carry out property registration procedures still requires many different documents and procedures; electricity access procedures are time-consuming and costly, especially in rural areas; bankruptcy procedures are very complicated, in some cases lasting for years...", Dr. Hoang Minh Hieu cited.

Construction workers at Terminal T3, Tan Son Nhat Airport

DNT

Data from the National Legal Information Portal shows that Vietnam has about 6,200 business conditions and more than 5,000 administrative procedures in key areas such as investment, land, construction, tax, trade, and logistics. Mr. Tran Anh Tung commented that the 30% reduction requested by the General Secretary is the minimum level to help Vietnam catch up with countries with competitive business environments in the region. According to the reform experience of Malaysia and Thailand, these two countries have reduced an average of 25-35% of administrative procedures to improve the investment environment.

Specifically, in the investment sector, the current process of appraising and granting investment registration certificates requires too many intermediate steps at the Department of Planning and Investment, the Ministry of Planning and Investment, as well as the provincial People's Committee. In particular, Clause 1, Article 33 of the 2020 Investment Law requires an assessment of the socio-economic impact of foreign investment (FDI) projects, but the assessment criteria are unclear, creating conditions for arbitrariness in implementation. Removing this requirement or simplifying the assessment criteria will help reduce the appraisal time from an average of 45 days to 20 days. In addition, the procedure for approving investment policies under Articles 30 and 31 of the Investment Law needs to be streamlined, especially for projects with a total investment capital of less than VND 500 billion that are not in conditional sectors.

In the construction sector, Decree 15/2021 on construction investment project management requires too many overlapping inspection steps from the Departments of Construction, Natural Resources and Environment, and Planning and Investment. Article 43 of this Decree stipulates that an environmental impact assessment (EIA) report is required before granting a construction permit, even for projects with insignificant environmental impacts. If this regulation is reduced or only applied to large-scale projects, it will help shorten the licensing process from 6 months to less than 3 months. In addition, Circular 06/2021 guiding construction licensing stipulates that enterprises must submit many types of duplicate documents such as land use right certificates, appraised design drawings, and investment licenses. Data interconnection between agencies can help reduce licensing time by at least 30%.

Manufactured at Tinh Loi Garment Company Limited (Lai Vu Industrial Park, Kim Thanh District, Hai Duong)

NGOC THANG

Regarding land access, Mr. Tran Anh Tung pointed out: The 2013 Land Law and Decree 43/2014 stipulate many unnecessary procedures that make enterprises take 1-2 years to complete legal land use rights. Specifically, Article 194 of the Land Law requires investors to have "financial capacity" confirmed by competent authorities before being able to transfer projects. However, the criteria for assessing financial capacity are unclear, enterprises must prepare many different financial reports to meet the requirements of the Provincial People's Committee, Department of Natural Resources and Environment and Department of Planning and Investment. Removing this condition or replacing it with simpler criteria such as registered capital confirmed by the bank will help enterprises shorten the time to complete procedures from 12 months to 6 months.

Regarding taxes and customs, Decree 126/2020 guiding the Law on Tax Administration requires enterprises to declare provisional corporate income tax quarterly (Article 8), while many countries such as Singapore and Thailand only require annual declaration. Eliminating the quarterly declaration requirement will help enterprises reduce 50% of the time spent on tax procedures. In addition, Circular 39/2018 stipulates post-clearance inspections, which take a lot of time for enterprises due to unclear procedures. Simplifying inspection criteria and applying a priority mechanism for enterprises with a good compliance history will help shorten the time for customs clearance of goods from 48 hours to less than 24 hours.

"Cut 30% equivalent to about 1,500 procedures, focusing on investment, construction, land, tax and trade," said Mr. Tran Anh Tung.

Dr. Hoang Minh Hieu admitted that the goal of reducing administrative procedures and the burden of compliance costs for enterprises has been mentioned many times in our country, including successful and unsuccessful lessons. However, this time, there is a very high determination of the State, people and enterprises, especially the very strong direction of the Party and State leaders. Besides, at present, there are also many favorable conditions such as the development of information technology which has greatly supported the implementation and supervision of the settlement of administrative procedures; Vietnam's state governance capacity has increased; international integration also poses high requirements for improving publicity and transparency in the implementation of administrative procedures. In particular, the process of streamlining the state apparatus is being vigorously implemented, contributing to reducing focal points and intermediate levels of work processing, which will have a strong impact on shortening the process of handling administrative procedures. Not to mention, the strong implementation of digital transformation also contributes to simplifying administrative procedures for people and businesses.

"Currently, there are still many public services that have not been deployed in the digital environment. Meanwhile, referring to the experience of some countries in the world, it shows that once all administrative procedures are conducted in the digital environment, the cost of complying with administrative procedures will be reduced to below 0.5% of GDP. Implementing processes and procedures in a public and transparent manner in the online environment will also contribute to reducing informal costs, enhancing supervision and evaluation of the results of handling administrative procedures of public agencies. Finally, the very important factor is people. The process of arranging and streamlining the apparatus with the policy of Streamlining - Lean - Strong will contribute to creating a team of cadres and civil servants with high capacity and technicality, which will promote the simplification of administrative procedures in a practical direction. The above basic factors help us believe that this revolution of streamlining administrative procedures will achieve success", Dr. Hoang Minh Hieu expected.

People apply for real estate online at the one-stop shop of the People's Committee Office of Binh Tan District, Ho Chi Minh City.

SY DONG

From another perspective, Dr. Nguyen Minh Thao noted that the logic of reform is more complicated than what we say. Administrative procedures are just the final derivative factor. Because when there are conditions, procedures still exist. Cutting means eliminating them completely, but cutting down and simplifying only removes a few factors and words in a condition, which will not solve any problem.

"Countries like Thailand and Malaysia have agencies called national monitoring committees, which are responsible for monitoring and inspecting administrative reforms at ministries, independently assessing and reporting to the government. In the immediate future, the government must establish and nominate a unit with the role of monitoring the reduction of procedures at ministries and branches independently. This unit must have expertise, be the focal point to monitor and supervise how ministries and branches reform, even urge and advise. If the government starts such an approach, it must set targets for ministries and branches on how to cut, assign them to the monitoring unit, and the method must go to the bottom of the problem, step by step but clearly, transparently and decisively. If this can be done, the goal of entering the top 3 ASEAN can certainly be achieved before 2028," Dr. Nguyen Minh Thao suggested.

Thanhnien.vn

Source: https://thanhnien.vn/dot-pha-cai-cach-dua-viet-nam-vao-top-3-asean-185250301211608654.htm

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)