Analysts say that the economic situation is still quite quiet and unpredictable, especially for the real estate market and export market (because the world economy is growing slowly, so there are not many orders).

However, the fact that interest rates are trending down and stable helps the cash flow in the stock market become more stable.

Early market reaction

Experts from Saigon Securities Inc. (SHS) commented that investor sentiment is gradually stabilizing as they believe the economy will stabilize again. The stock market usually reacts early, so SHS believes that it is understandable that the market is moving positively.

The short-term market continues to break out continuously, but with the increase without adjustment, the market will face stronger fluctuations, so short-term investors need to be cautious, SHS recommends.

In the medium and long term, the market has formed an uptrend (overall upward trend of the stock market) and the target that VN-Index can aim for will be the 1,300 point area.

According to SHS, the market received information last week, such as China's GDP in the second quarter of 2023 increased by 6.3% compared to the same period last year, higher than 4.5% in the first quarter of 2023 but lower than forecast; China's unemployment rate hit a new peak, at 21.3% in June 2023; Ho Chi Minh City Stock Exchange (HoSE) announced changes to the composition of VN30, VNFinLead for the July 2023 period. Hanoi Stock Exchange (HNX) officially launched the individual corporate bond trading system on July 19, 2023.

Putting the individual corporate bond trading system into operation will contribute to increasing transparency, limiting risks for investors, promoting liquidity for the corporate bond market, and creating conditions for the primary market for individual corporate bonds to develop more sustainably.

Thereby, the real estate stock group, which has a high bond issuance rate, has had quite positive developments, standing out in the market, many codes have increased well with strong liquidity such as NDN increased by 21.57%, HDC increased by 16.49%, CEO increased by 13.21%, DIG increased by 10.71% and PDR increased by 10.05%... On the contrary, some codes were under slight adjustment pressure such as DRH decreased by 0.83%, ITC decreased by 0.38%.

Most banking stocks also had positive developments last week, such as VBP up 7.54%, SHB up 5.11%, HDB up 4.66%, MSB up 4.33%... However, there were still stocks under pressure to decrease in price such as STB down 0.86% and EIB down 0.99%...

The market is in the process of receiving information about the business results of the second quarter of 2023, so the level of differentiation is quite strong, many codes in each industry group with positive business results all had quite positive sudden transactions last week such as the industrial park group, with SZC increasing by 13.33%, SNZ increasing by 9.6%)...; the securities group with VIX increasing by 12%, BSI increasing by 3.55%, BVS increasing by 3.08%..., construction materials with DHA increasing by 6.86%, BMP increasing by 6.11%, NNC increasing by 4.23%...

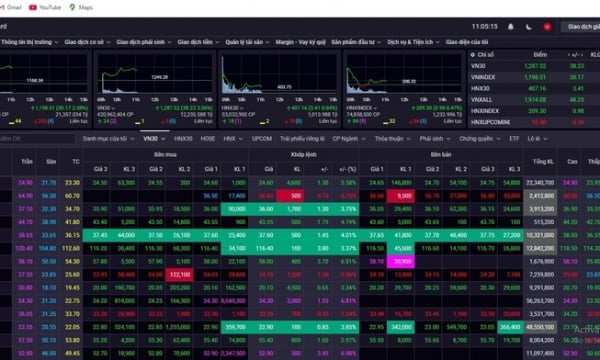

VN-Index has maintained a strong upward trend for the third consecutive week with market liquidity remaining above average. In the past trading week, VN-Index had 4 sessions of tug-of-war, fluctuating within a narrow range around 1,165 - 1,180 points and increased sharply in the last session of the week, under the positive influence of the VN30 group.

At the end of the trading week from July 17 to 21, VN-Index increased by 1.5% compared to the previous week to 1,185.90 points. VN30 increased by 2.24% to 1,186.60 points and HNX-Index increased by 2.08% compared to the previous week to 234.98 points.

During the week, liquidity on HOSE reached VND89,670.63 billion, down slightly by 2.1%, but trading volume increased slightly by 0.2% compared to the previous week, remaining above average, showing that cash flow remained strong in the market. Liquidity on HNX increased by 8.4%, with VND9,866.62 billion traded.

After many consecutive weeks of net selling, foreign investors returned to net buying with a value of VND 1,176.36 billion, net buying well on HNX with a value of VND 195.14 billion.

Analyst Nguyen Huy Phuong, Rong Viet Securities Joint Stock Company (VDSC), commented that, with the supply not being too large, the cash flow has increased its efforts to support and help the market have a strong increase at the end of the week, accompanied by large liquidity.

With the ongoing price increase, it is likely that the market will continue to be supported and move towards the resistance zone of 1,200 - 1,220 points in the near future. This zone can temporarily put great supply pressure on the market.

Mr. Pham Binh Phuong, an expert from Mirae Asset Securities Joint Stock Company (Vietnam), said that VN-Index surpassed the resistance of 1,180 after 4 sessions of struggling, investors' short-term profit-taking psychology could be relieved and create a boost for VN-Index to continue to be positive in the first sessions of next week.

However, Mirae Asset Securities (Vietnam) assessed the 1,200 - 1,210 mark as a strong resistance zone. This will be a very important challenge for the short-term and medium-term growth of the VN-Index. In addition, July 25 and 26 are also the days when the US Federal Reserve (Fed) will make a decision on the operating interest rate and there is a high possibility that the Fed will increase the interest rate by 0.25%.

Markets could be surprised if the Fed is more aggressive than expected

The Vietnamese stock market had a strong week of growth, in the context of major stock markets around the world "anxiously" preparing to receive important decisions from leading central banks.

Global stock markets were mixed on July 21, a day after shares of major US technology companies fell and as investors braced for a week of key interest rate decisions from the world's top central banks.

After a mixed session on European and Asian stock markets, Wall Street ended the week on a negative note.

The Dow Jones Industrial Average edged up less than 0.1% to 35,227.69, its 10th straight gain since 2017. The S&P 500 gained less than 0.1% to 4,536.34. The Nasdaq Composite, however, fell 0.2% to 14,032.81.

Earlier, in the July 20 session, the Nasdaq index fell more than 2% due to disappointing profit reports from Tesla and Netflix, two of the biggest names in the index, spreading to other "giants" including Amazon, Apple and Google's parent company, Alphabet.

Analysts warn that the market could be poised for a pullback after a strong second quarter and into the third quarter. News of Netflix and Tesla helped spur profit-taking in the tech sector this session, according to Jack Ablin of investment advisory firm Cresset Capital.

In Europe, the FTSE 100 index in London rose 0.2% to 7,663.73 points. The CAC 40 index in Paris rose 0.7% to 7,432.77 points, while the DAX 30 index on the Frankfurt Stock Exchange fell 0.2% to 16,177.22 points. The EURO STOXX 50 composite index rose 0.4% to 4,391.41 points.

In addition to earnings, the market is also looking ahead to next week's Fed policy meeting. While the Fed is widely expected to raise interest rates, Art Hogan of B. Riley Financial said the market could be surprised if the Fed acts "more aggressively" than expected. Hogan also noted that investors do not expect the Fed to raise rates again until September 2023.

Meanwhile, the European Central Bank and the Bank of Japan (BoJ) will also hold monetary policy meetings next week.

In currency markets, the yen rose sharply against the dollar after data showed Japan's inflation accelerated in June, which some saw as increasing pressure on the BoJ to tighten policy.

However, the yen later fell more than 1% as observers said the figures were unlikely to prompt monetary policymakers to change their stance on ultra-loose monetary policy.

The BoJ is expected to keep its monetary policy stance unchanged at its meeting next week, following recent “dovish” comments by BoJ Governor Kazuo Ueda.

Asian stock markets were mixed on the afternoon of July 21, as new US employment data led the market to predict that the Fed would raise interest rates two more times, in addition to current concerns about the Chinese economy.

At the end of this session, on the Hong Kong stock market (China), the Hang Seng index increased by 0.8% to 19,075.26 points. Green was also recorded in the markets of Seoul, Manila, Singapore, Bangkok and Wellington.

Meanwhile, in Tokyo, the Nikkei 225 index fell 0.6% to 32,304.25 points, while the Shanghai Composite index in Shanghai (China) lost 0.1% to 3,167.75 points. The Sydney and Mumbai markets also fell.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)