Lam Dong Tax Department has just proposed the Provincial People's Committee to transfer the Provincial Inspectorate to conduct a comprehensive inspection of the "Sao Da Lat Luxury Resort" project of Sao Da Lat Joint Stock Company.

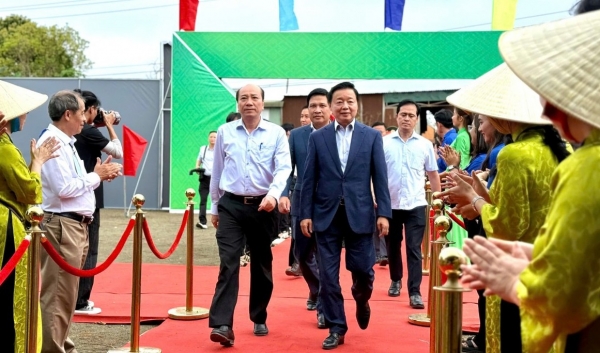

This project is located in Tuyen Lam Lake National Tourist Area and is famous for the name "Sculpture Tunnel" or "Clay Village" (phase 1) tourist area, attracting hundreds of thousands of domestic and foreign tourists to visit every year, creating jobs for 80 regular workers, contributing tens of billions of VND to the budget each year, so the above information has caused a stir in public opinion.

Sculpture Tunnel Tourist Area

Suddenly "in debt" of more than 12.3 billion VND?

Sao Da Lat high-end resort project was granted Investment Certificate (IRC) No. 42121000240 by the Provincial People's Committee on May 8, 2008 (area 12.97 ha; total investment capital 100 billion VND). According to Conclusion No. 929/KL-TTCP dated June 12, 2020 of the Government Inspectorate, this project is in Appendix 12: implementation is behind schedule compared to the IRC...

Lam Dong Tax Department said that, after reviewing, the amount of corporate income tax (CIT) that the company must collect due to not meeting the conditions for enjoying CIT incentives according to Clause 1, Article 35 of Decree No. 24/2007/ND-CP dated February 14, 2007 of the Government is more than 12.3 billion VND for the years 2015, 2016, 2017, 2018.

However, Mr. Trinh Ba Dung, General Director of Sao Da Lat Joint Stock Company, affirmed that the company has not owed any tax money so far. "We are very upset with the above recommendation of the Tax Department," Mr. Dung said.

According to Mr. Dung, the delay in progress is due to objective reasons such as: the area's infrastructure system is almost non-existent and has not yet been supplied with clean water, and there is no wastewater collection and treatment system. At the same time, Lam Dong province added regulations requiring the adjustment of planning, construction, and architectural targets in the area; followed by the prolonged activities of the Government Inspectorate (from the time of inspection to the issuance of conclusions and remediation of consequences); the impact of the Forestry Law...

Sculptures in the Sculpture Tunnel

"After conclusion No. 929/KL-TTCP, Lam Dong Provincial People's Committee agreed in principle to allow the company to continue extending the project implementation (according to document No. 1076/UBND-VX2 dated February 23, 2021). Since then, the company has carried out the procedures according to this document," Mr. Dung added.

Talking to Thanh Nien , Mr. Chung Thanh Tien, Chairman of the Accounting Association Understand Correctly - Do Correctly (Ho Chi Minh City Accounting Association), commented: "The document of the Tax Department has very strange content, they made recommendations on the situation of project implementation and planning, construction which are not within the functions and powers prescribed by the Law on Tax Administration and were not assigned by the People's Committee of Lam Dong province".

Have "grudge"?

According to Mr. Trinh Ba Dung, the request for a comprehensive inspection of the company makes him feel like the Tax Department is "trying to hold back" the business. "It is possible that this stems from the fact that we sued the Director of the Tax Department last year," he questioned.

Every year this tourist area welcomes hundreds of thousands of visitors.

"On August 12, 2019, the Tax Department issued Decision No. 1799/QD-CT to fine VPHC more than VND 11.1 billion (including corporate income tax arrears and late payment penalties). Meanwhile, the Investment Registration Certificate No. 42121000240 clearly states: enterprises are exempt from corporate income tax for 2 years from the time of taxable income and a 50% reduction in tax payable for the next 2 years. We filed a lawsuit and on December 30, 2020, the Tax Department issued a decision to cancel all content in the VPHC penalty decision No. 1799/QD-CT", Mr. Dung informed.

Mr. Dung said that since 2008, "because the province has incentives, we have come here to invest. Suddenly, a dozen years later, the tax department said we are not eligible for incentives, how can that be? Moreover, the Investment Certificate issued by the Provincial People's Committee to the company is still valid, and has not been adjusted in any way. The proposal to conduct a comprehensive inspection of the project as well as the debt that "fell from the sky" has had a significant impact on the image and reputation of our company."

A corner of the Sculpture Tunnel

Mr. Tran Phuong, Director of Lam Dong Tax Department, said that the enterprise did not owe taxes, the tax amount mentioned was corporate income tax arising from 2015 - 2018, the enterprise declared that it was entitled to incentives, but according to regulations, it was not entitled to them, so the tax authority requested a re-declaration to pay. The tax exemption and reduction content on the Investment Registration Certificate issued by the Provincial People's Committee was not consistent with tax regulations.

"The tax authority has proposed to adjust the Investment Registration Certificate granted to this enterprise. The Provincial People's Committee believes that it is not necessary to adjust it and assigns the Tax Department to base on current regulations to implement. After reviewing, the tax authority found that this enterprise's project has some issues that show signs of violating the law, so it is responsible for recommending the Provincial People's Committee to conduct a comprehensive inspection," said Mr. Phuong.

Source link

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

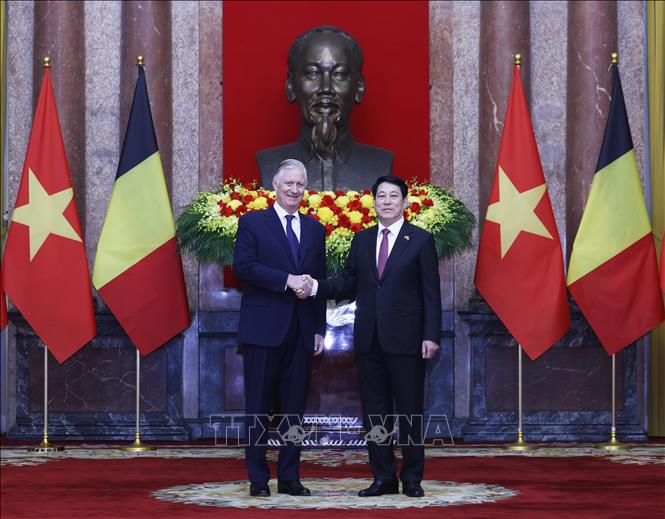

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

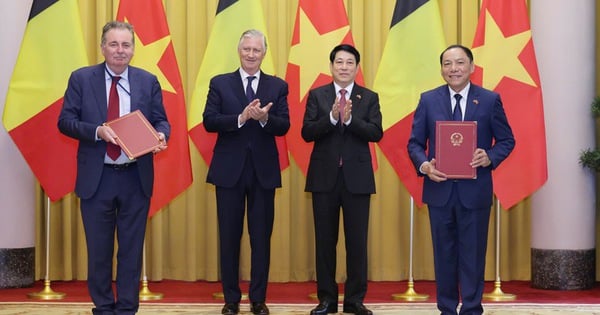

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

Comment (0)