According to Mr. Nguyen Van Than, Chairman of the Vietnam Association of Small and Medium Enterprises (National Assembly delegate of Thai Binh province), the Draft Law on Corporate Income Tax submitted to the National Assembly for comments at the 8th Session, imposing corporate income tax (CIT) of 15% on micro-enterprises and 17% on small enterprises is not really attractive.

According to Mr. Nguyen Van Than, Chairman of the Vietnam Association of Small and Medium Enterprises (National Assembly delegate of Thai Binh province), the Draft Law on Corporate Income Tax submitted to the National Assembly for comments at the 8th Session, imposing corporate income tax (CIT) of 15% on micro-enterprises and 17% on small enterprises is not really attractive.

|

| Mr. Nguyen Van Than, Chairman of Vietnam Association of Small and Medium Enterprises (National Assembly delegate of Thai Binh province) |

What do you think about the current preferential tax rates for small and micro enterprises?

From July 1, 2013, small businesses enjoyed a corporate income tax rate of 20%, instead of the general tax rate of 22%. However, from January 1, 2016, the general tax rate was reduced to 20%, meaning that small businesses must pay taxes equal to corporations and general companies with capital of tens of thousands of billions of VND. In fact, Vietnam's general corporate income tax rate is not high compared to other countries in the region.

This is not about whether the general corporate income tax rate is high or low, but only about preferential policies for small and micro enterprises. Since 2016, when the general tax rate was reduced to 20%, small, medium and micro enterprises no longer receive tax incentives.

Meanwhile, the Law on Support for Small and Medium Enterprises (effective from January 1, 2018) stipulates that small and medium enterprises are entitled to a corporate income tax rate lower than the normal tax rate for a limited period of time. Thus, the preferential and supportive policies of the Law on Support for Small and Medium Enterprises have not been implemented, while most countries in the world have tax incentives for this group.

The eighth session of the National Assembly will comment on the Draft Law on Corporate Income Tax, which will allow small and micro enterprises to enjoy a lower corporate income tax rate than the general tax rate. Do you think the proposed tax rate is attractive?

The draft Law on Corporate Income Tax submitted to the National Assembly this time proposes two preferential tax rates: 15% applies to enterprises with total revenue of no more than VND 3 billion/year; and 17% applies to enterprises with total revenue from over VND 3 billion to no more than VND 50 billion/year (not applicable to enterprises that are subsidiaries or affiliated companies whose parent companies and affiliated companies are not eligible for this tax incentive policy).

To be convincing, the Drafting Committee (Ministry of Finance) must have a specific assessment, if applying this tax rate or another tax rate, how many businesses will benefit, how much will they benefit (based on the estimated annual reduction in state budget revenue). With each preferential tax rate, it is expected that each year how many new businesses will be established, how many jobs will be created...

On that basis, the National Assembly will have data to compare and decide which preferential tax rate is appropriate. Currently, the dossier for drafting the Law on Corporate Income Tax only proposes two tax rates for small and micro enterprises, so whether it is attractive or not is just a matter of opinion.

So how do you feel?

Of the over 900,000 operating enterprises, about 94% are small and micro-sized, mostly micro-sized, with registered capital of less than VND10 billion. Of these enterprises, only about 20% are profitable and have to pay corporate income tax. Therefore, the tax rate proposed by the Ministry of Finance is only meant to encourage, not really support enterprises, not a push, creating conditions for organizations, households, and individuals to invest capital in business.

Compared to other countries, Vietnam's preferential tax rates are not attractive. Specifically, China's general corporate income tax rate is currently 25%, but small businesses enjoy a tax rate of 20%, which is 5 percentage points lower. In Vietnam, small businesses enjoy a tax rate of 17%, which is only 3 percentage points lower than the general tax rate of 20%.

Do you mean that more incentives are needed for small and micro enterprises?

This is the expectation of the entire small, micro and medium-sized enterprise community. In fact, this sector's direct contribution to the state budget is not as large as other revenues, but it is a sector that creates jobs, especially for very large informal workers; creates income for workers, especially untrained workers, without degrees or certificates; and makes an important contribution to solving social security. Therefore, it is necessary to boldly support and provide incentives with many different tools, of which tax reduction is just one way.

One of the goals of the Law on Support for Small and Medium Enterprises is to encourage households and individuals to establish businesses, but after nearly 7 years of implementation, it can be said that this goal has failed. The reason why tens of thousands of households and individuals with very large revenues, even more than medium-sized enterprises, still do not want to establish businesses is that household businesses pay a lump-sum tax calculated on revenue more attractively.

Specifically, goods distribution and supply activities pay tax equivalent to 1.5% of revenue; services and construction without contracted materials pay 7%; production, transportation, services associated with goods, construction with contracted materials pay 4.5%; other service activities pay 3%.

I think that if we offer a truly attractive preferential tax rate, there will be a series of households and individuals doing business to establish enterprises because the preferential tax rate is lower than the lump-sum tax.

In your opinion, is it reasonable to calculate tax incentives based on revenue?

High revenue does not mean that the business has high profits. In the context of "hundreds of buyers and ten thousand sellers", to sell products and provide services, it is necessary to reduce prices, give incentives, after-sales service, promote, advertise, market... to customers, so revenue does not reflect the business's operating efficiency.

Therefore, in my opinion, instead of taxing based on revenue, it should be based on taxable income (revenue minus reasonable and valid expenses). Many countries also provide tax incentives based on taxable income, which can be applied at a single tax rate or progressive tax.

Source: https://baodautu.vn/muc-uu-dai-thue-cho-doanh-nghiep-nho-sieu-nho-chua-hap-dan-d228428.html

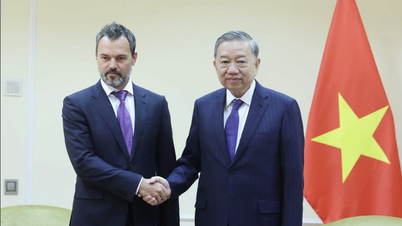

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)