Interest rates at commercial banks became less volatile in September as the rate hike showed signs of slowing down.

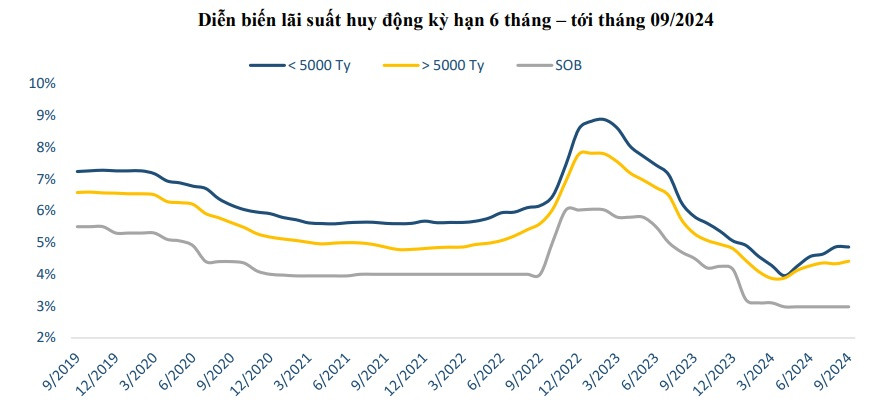

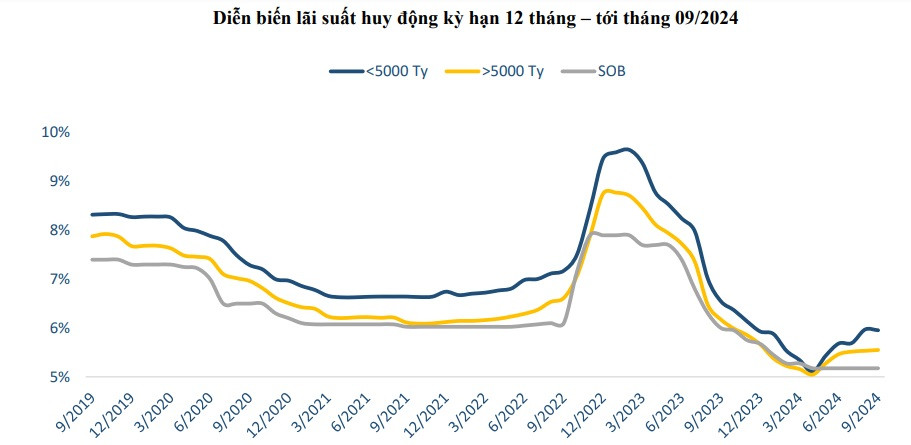

Deposit interest rates only really increased from April 2024 when for the first time in a year, 15 banks increased interest rates in a month. Since then, the market has experienced 6 consecutive months of deposit interest rates continuously increasing.

However, interest rates at commercial banks became less volatile in September as the increase showed signs of slowing down.

Up to now, only 12 banks have increased their deposit interest rates since the beginning of September, of which only 2 banks have adjusted their interest rates twice in the month, namely OceanBank and Dong A Bank.

The remaining 10 banks that increased interest rates this month include: VietBank, GPBank, Agribank, Bac A Bank, NCB, OCB, BVBank, ACB, PGBank, and Nam A Bank.

On the contrary, ABBank is the only bank to reduce deposit interest rates this month, with a reduction of 0.1-0.4%/year for terms of 1-12 months.

The above statistics show that the increase in deposit interest rates is showing signs of slowing down when compared to previous months. Specifically, in August 2024, 15 commercial banks increased deposit interest rates, of which 6 banks adjusted their interest rates twice in the month.

In July 2024, bank interest rates increased at 19 commercial banks, including VietBank, which increased interest rates 3 times in a month.

Even in June 2024, 23 commercial banks increased deposit interest rates, of which 12 banks increased interest rates twice that month.

Previously, according to VietNamNet statistics, 20 banks increased deposit interest rates in May 2024, with two banks, VIB and ABBank, adjusting deposit interest rates 4 times in just one month, and 8 other banks increasing interest rates twice.

Returning to the interest rate developments in September , OceanBank was the bank with the strongest increase of up to 0.6%/year for 1-11 month terms and an increase of 0.3%/year for 12-15 month terms. The interest rate for 18-36 month term deposits was also increased by 0.1%/year to 6.1%/year.

After OceanBank, the banks that increased deposit interest rates the most for 1-3 month terms were Dong A Bank (0.4%/year), Agribank (0.3%/year), while the increase of 0.2%/year was also implemented at the banks: BaoViet Bank, BVBank, GPBank, VietBank and OCB.

Regarding 6-month savings interest rates, Dong A Bank was behind OceanBank in terms of interest rate increase in September with an increase of 0.3%/year; savings interest rates at GPBank and OCB increased by 0.2%/year, while at Bac A Bank, it increased by 0.15%/year.

The highest increase in 9-month term deposit interest rates in September was 0.6%/year at OceanBank and Dong A Bank, while the increase was 0.2%/year at GPBank and 0.15%/year at Bac A Bank. The lowest increase was 0.1%/year at NCB, OCB, Agribank, and ACB.

The highest increase in 12-month deposit interest rates in September was 0.5%/year at Dong A Bank. Only 5 banks increased interest rates for this term, including OceanBank increasing 0.3%/year; Bac A Bank, ACB and NCB all increased 0.1%/year.

| INTEREST RATES FOR MAIN TERMS ON SEPTEMBER 28 AND INTEREST RATE FLUCTUATIONS IN SEPTEMBER (%/YEAR) | ||||||||

| BANK | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | ||||

| Interest rate | +/- | Interest rate | +/- | Interest rate | +/- | Interest rate | +/- | |

| AGRIBANK | 2.5 | 0.3 | 3.3 | 0.1 | 3.3 | 0.1 | 4.7 | 0 |

| BIDV | 2.3 | 0 | 3.3 | 0 | 3.3 | 0 | 4.7 | 0 |

| VIETINBANK | 2.3 | 0 | 3.3 | 0 | 3.3 | 0 | 4.7 | 0 |

| VIETCOMBANK | 1.9 | 0 | 2.9 | 0 | 2.9 | 0 | 4.7 | 0 |

| ABBANK | 3.7 | -0.3 | 5 | 0 | 5.2 | -0.3 | 5.6 | -0.4 |

| ACB | 3.5 | 0.1 | 4.2 | 0.05 | 4.3 | 0.1 | 4.9 | 0.1 |

| BAC A BANK | 3.95 | 0.15 | 5.15 | 0.15 | 5.25 | 0.15 | 5.7 | 0.1 |

| BAOVIETBANK | 4 | 0.2 | 5.2 | 0 | 5.4 | 0 | 5.8 | 0 |

| BVBANK | 4 | 0.4 | 5.2 | 0.1 | 5.5 | 0 | 5.8 | 0 |

| CBBANK | 4 | 0 | 5.55 | 0 | 5.5 | 0 | 5.7 | 0 |

| DONG A BANK | 4 | 0.2 | 5.2 | 0.3 | 5.5 | 0.6 | 5.8 | 0.5 |

| EXIMBANK | 4.3 | 0 | 5.2 | 0 | 4.5 | 0 | 5.2 | 0 |

| GPBANK | 3.72 | 0 | 5.05 | 0.2 | 5.4 | 0.2 | 5.75 | 0 |

| HDBANK | 3.95 | 0 | 5.1 | 0 | 4.7 | 0 | 5.5 | 0 |

| KIENLONGBANK | 3.7 | 0 | 5.2 | 0 | 5.3 | 0 | 5.6 | 0 |

| LPBANK | 3.5 | 0 | 4.7 | 0 | 4.8 | 0 | 5.1 | 0 |

| MB | 3.7 | 0 | 4.4 | 0 | 4.4 | 0 | 5.1 | 0 |

| MSB | 3.7 | 0 | 4.6 | 0 | 4.6 | 0 | 5.4 | 0 |

| NAM A BANK | 4.1 | 0 | 5 | 0 | 5.2 | 0 | 5.6 | 0 |

| NCB | 4.1 | 0.1 | 5.45 | 0.1 | 5.65 | 0.1 | 5.8 | 0.1 |

| OCB | 4.1 | 0.2 | 5.1 | 0.2 | 5.1 | 0.1 | 5.2 | 0 |

| OCEANBANK | 4.4 | 0.6 | 5.4 | 0.6 | 5.5 | 0.6 | 5.8 | 0.3 |

| PGBANK | 3.8 | 0.1 | 5 | 0 | 5 | 0 | 5.5 | 0 |

| PVCOMBANK | 3.6 | 0 | 4.5 | 0 | 4.7 | 0 | 5.1 | 0 |

| SACOMBANK | 3.6 | 0 | 4.9 | 0 | 4.9 | 0 | 5.4 | 0 |

| SAIGONBANK | 3.6 | 0 | 4.8 | 0 | 4.9 | 0 | 5.8 | 0 |

| SCB | 1.9 | 0 | 2.9 | 0 | 2.9 | 0 | 3.7 | 0 |

| SEABANK | 3.45 | 0 | 3.75 | 0 | 3.95 | 0 | 4.5 | 0 |

| SHB | 3.8 | 0 | 5 | 0 | 5.1 | 0 | 5.5 | 0 |

| TECHCOMBANK | 3.45 | 0 | 4.55 | 0 | 4.55 | 0 | 4.95 | 0 |

| TPBANK | 3.8 | 0 | 4.7 | 0 | 0 | 5.2 | 0 | |

| VIB | 3.6 | 0.1 | 4.6 | 0 | 4.6 | 0 | 0 | |

| VIET A BANK | 3.7 | 0.1 | 4.8 | 0 | 4.8 | 0 | 5.4 | 0 |

| VIETBANK | 4 | 0.2 | 5.2 | 0 | 5 | 0 | 5.6 | 0 |

| VPBANK | 3.8 | 0 | 5 | 0 | 5 | 0 | 5.5 | 0 |

Source: https://baodaknong.vn/da-tang-lai-suat-huy-dong-chung-lai-trong-thang-9-230419.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)