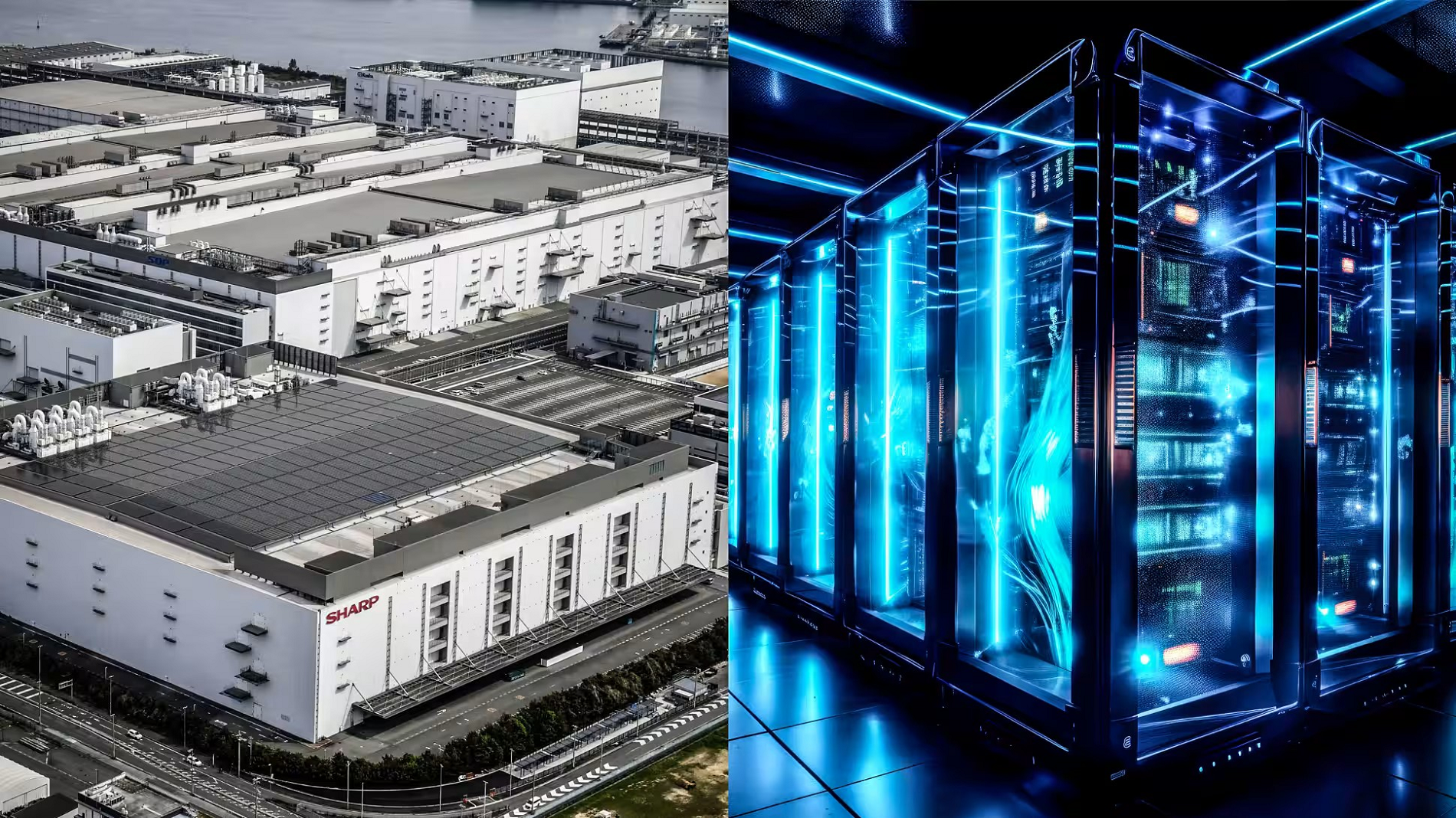

In early June, Japanese carrier KDDI said it would work with Sharp to turn its LCD panel factory in Sakai City into an artificial intelligence (AI) data center. Four days later, SoftBank, the telecommunications arm of Masayoshi Son’s SoftBank Group, said it had entered into “exclusive negotiations” to buy a majority of the facility from Sharp.

SoftBank and KDDI are just two of the companies racing to turn the Sharp plant into a giant AI data center. A third company is also in talks, Nikkei reported.

The Sakai plant, located in an industrial park of about 700,000 square meters built on reclaimed land in Osaka Bay, is Sharp's main factory for large-size TV screens. However, the company will stop production in September under pressure from Chinese rivals.

The decision has opened a scramble to repurpose the plant.

SoftBank said it is in talks to buy up to 60% of the Sakai facility, which includes the main TV panel factory as well as gas and power plants. SoftBank said it would convert the factory into a data center as it seeks to boost its AI businesses.

In May, Nikkei reported that SoftBank Group plans to spend 10 trillion yen ($63 billion) to transform itself into an AI powerhouse. In a previous meeting, SoftBank President and CEO Junichi Miyakawa said his ambition was to become “a market leader in generative AI” and that the new technology would be “a pillar of the company’s long-term vision,” shifting its focus to AI in the future.

SoftBank is also developing its own large language AI model tailored to Japanese.

For its part, KDDI said in a press release that it had entered into talks with Sharp, along with companies including U.S. server builder Super Micro Computer, to build “one of the largest AI data centers in Asia,” using 1,000 units of Nvidia’s advanced AI system. However, this will be more difficult with SoftBank stepping in. KDDI could negotiate to buy the rest of the Sakai facility that SoftBank did not buy.

According to a KDDI spokesperson, the company is still pursuing its original goal and what is important is the computing power, not the area of land on which the data center will be built.

Still, the Nikkei sources said the talks appeared to be tense. An executive at another Japanese company that had recently negotiated with Sharp said the discussions stalled because Sharp changed its offer midway through and suggested he use other LCD plants instead of the Sakai facility for data centers. He had heard that SoftBank had initially wanted to buy all the available space at the Sakai plant.

The scramble to convert Sharp’s LCD factory into an AI data center highlights Japan’s urgent need for AI computing power, as building data centers from scratch can take years. In addition, the data center market here is undersupplied and is unlikely to improve in the short term due to strong demand and power constraints. The power consumption per square meter of these facilities is at least 10 times that of a typical office, making it difficult to find ideal locations.

SoftBank hopes to begin operations at Sakai in 2025. What makes the Sakai facility particularly suitable for conversion to an AI data center is that its electrical utilities and water resources can be used for cooling purposes.

The Sakai facility, which opened in 2009, was considered Sharp’s crown jewel. However, Sakai has fallen short of expectations as Korean and Chinese rivals have stepped in and new technologies like OLED have emerged. While production is coming to an end, the capacity to handle the high power demands of LCD production remains.

Sakai also holds promise because of its location, a SoftBank spokesperson said. With many data centers located near Tokyo, it would be useful to disperse computing power to prevent disruption in the event of a disaster. That’s why the company is also planning to build an AI data center in Hokkaido.

(According to Nikkei)

Source: https://vietnamnet.vn/cuoc-chien-gianh-giat-nha-may-lcd-cua-sharp-2294527.html

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

Comment (0)