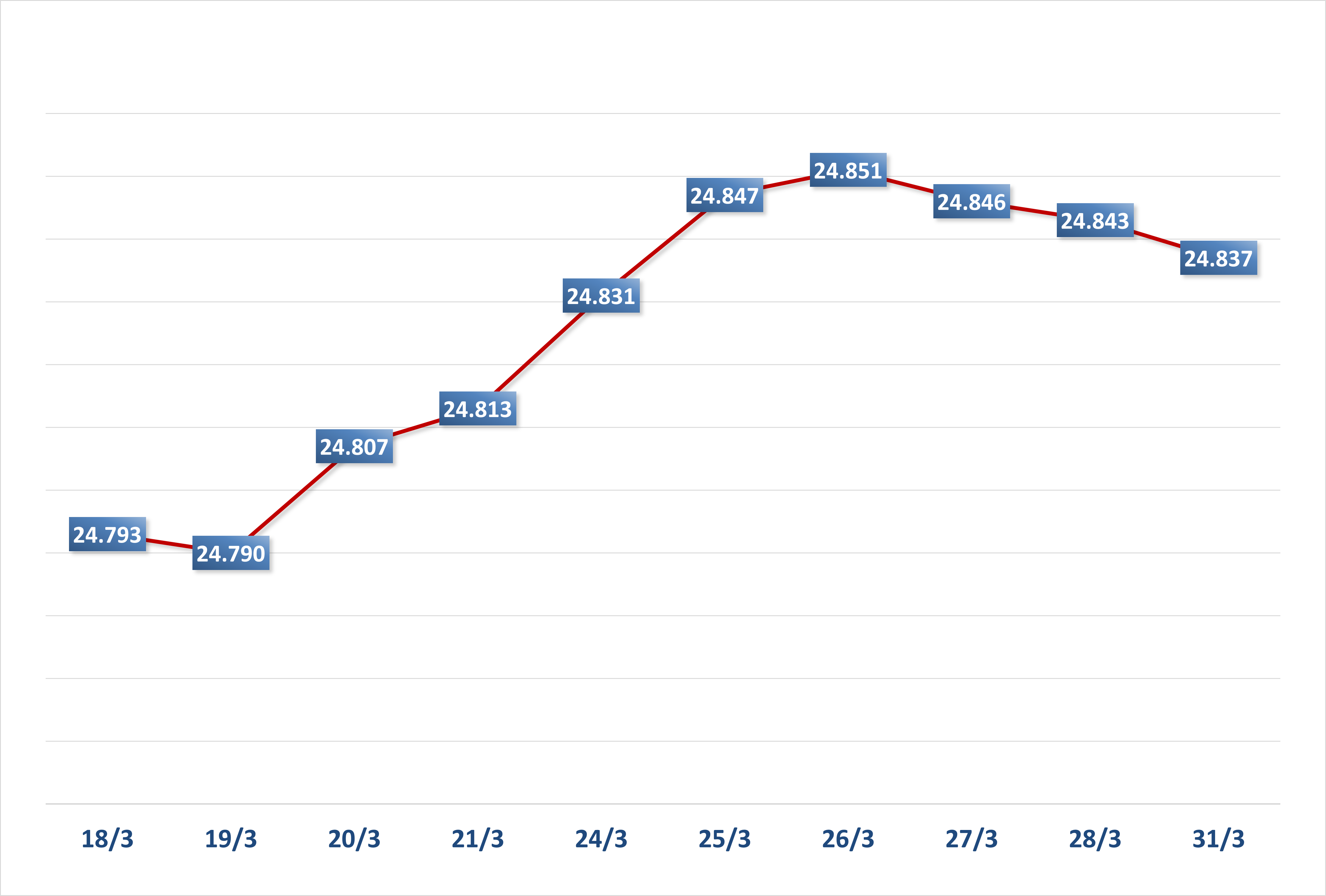

Three consecutive floor-price sessions caused shares of Pomina Steel Joint Stock Company (stock code: POM) to drop to VND 4,050, marking the lowest price since the end of November 2022.

The decline in the price of Pomina Steel Joint Stock Company (stock code: POM) shares began on the morning of April 3, after the Ho Chi Minh City Stock Exchange announced that it would delist the company's shares due to late submission of financial reports for three consecutive years. From the price of VND5,020, POM plummeted to VND4,670 with liquidity double that of the previous session.

The decline continued into the sessions of April 4 and April 5 when this stock lost its entire 7% amplitude each session and closed with no sellers, while a large number of shares were left for sale at the floor price. Typically, at the end of the session of April 5, POM matched orders of nearly 900,000 shares, equivalent to VND 3.6 billion, while the demand to sell at the floor price of VND 4,050 was up to 6.2 million shares.

Overall this week, POM shares experienced 4 sessions of decline and 1 session of increase, losing 20% compared to the end of last week and causing the market price to hit a 17-month low. With more than 279 million shares listed on the PT HCM Stock Exchange, Pomina Steel's market capitalization is currently at VND1,128 billion.

|

| POM stock price and liquidity chart from the end of 2022 to present. |

Before Pomina Steel was delisted, a series of people related to the company's board of directors divested their capital. The most recent was the sale of more than 5.3 million shares by Ms. Nguyen Thi Tuyet - wife of a member of the company's Board of Directors - to reduce her ownership ratio at Pomina Steel to zero.

According to the independent financial report, in 2023, the company recorded net revenue of VND 3,281 billion, a sharp decrease compared to VND 12,936 billion of the previous year and far below the revenue target of VND 9,000 set by the company's management. The company reported a loss after tax for the whole year of VND 960 billion, far exceeding the expected loss of VND 150 billion. The company currently has VND 8,809 billion in liabilities, an increase of nearly VND 400 billion compared to the beginning of the year. Most of this is short-term and long-term financial debt. Owner's equity at the end of the year was VND 1,594 billion. Undistributed loss after tax increased to VND 1,270 billion.

Explaining the delay in submitting the audited financial statements, the company's board of directors said that they are actively working with investment partners on a restructuring plan to provide auditors with a review and assessment of the going concern assumption, along with solid evidence for this assumption to overcome the negative equity situation.

“Because the investor is still considering making a cooperation agreement, it will take a certain amount of time,” Pomina Steel added.

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)