(NLDO) - Immediately after the news that Dat Xanh Group was approved to issue an additional 150 million shares, investors rushed to sell off DXG.

In the trading session this morning, December 24, the DXG code of Dat Xanh Group Joint Stock Company (Dat Xanh Group) dropped to the floor price, down to 16,450 VND after the information that the group was granted a certificate by the State Securities Commission to offer more than 150 million shares to existing shareholders.

Accordingly, Dat Xanh Group will offer shares to existing shareholders at VND12,000/share. The exercise ratio is 24:5, meaning that shareholders who own 24 DXG shares will have the right to buy 5 new shares at VND12,000. In the previous few sessions, DXG shares exceeded VND18,000 but this morning's session dropped to VND16,450.

According to the announcement, after the issuance, Dat Xanh Group is expected to collect more than 1,800 billion VND. The amount raised will be allocated 1,559 billion VND to contribute to Ha An Real Estate Investment and Trading Joint Stock Company, the rest will be used to pay off bonds and partners. Ha An Real Estate is currently a subsidiary of Dat Xanh Group with a controlling ratio of 99.99% of charter capital.

In this morning's trading session, in some stock groups (rooms), many investors commented: "DXG announced the news of the stock split and immediately fell sharply... Risks for investors if they do not carefully evaluate the business".

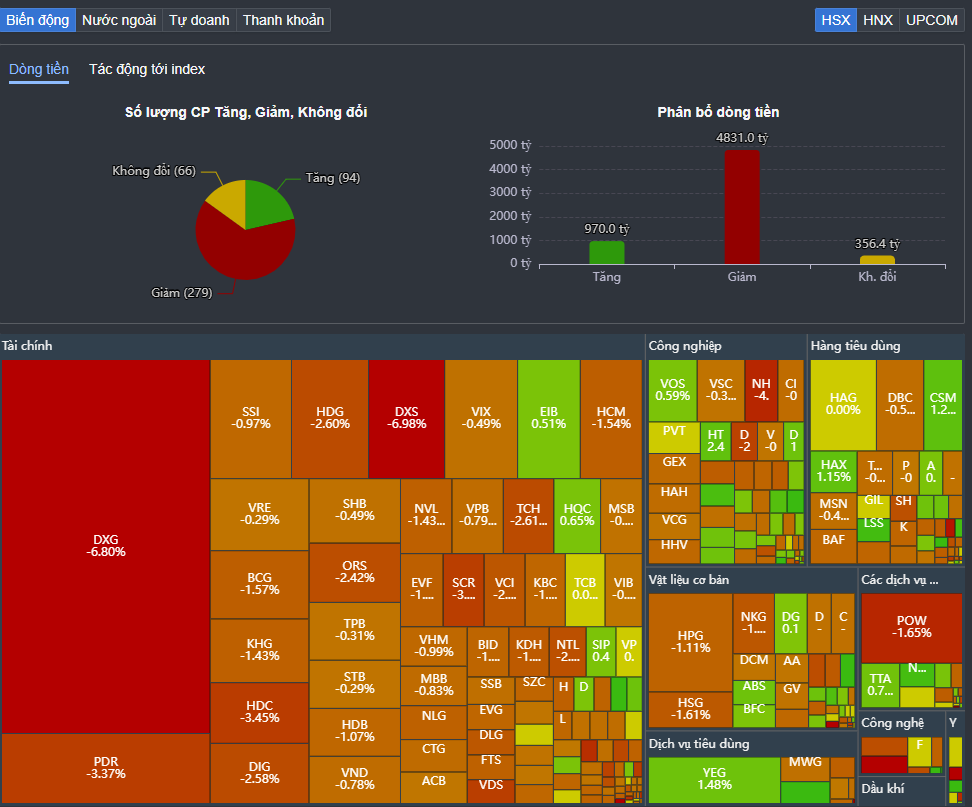

DXG stock hit the floor, greatly affecting the general market.

Previously, the shares of some securities companies also fell to rock bottom when issuing more shares. Recently, DIG (Construction Development Investment Corporation) also postponed issuing shares so the share price is still temporarily stable.

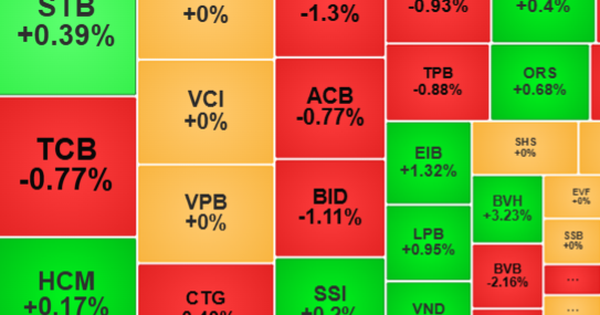

According to the investment director of a securities company, the sharp decline in DXG shares affected and spread to real estate stocks in the early morning session of December 24, causing the VN-Index to drop 5 points, filling the "GAP" (price gap) created yesterday. Filling the "GAP" is a necessary movement of the market. After that, the market began to balance out and recover, but there was a clear differentiation.

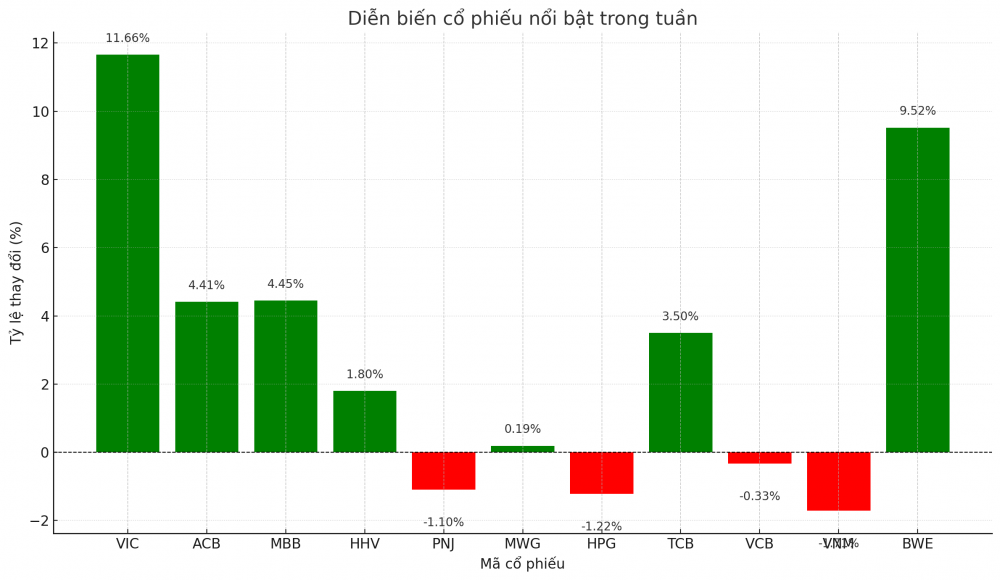

Only businesses with good fundamentals, reputation, health, and effective business operations will be targeted by cash flow. On the contrary, businesses with poor reputation and continuous paper distribution will increasingly have difficulty and break the "bottom". The stocks with good fundamentals in the current group are still performing well, recovering and diversifying according to the market. Investors can continue to hold these stocks.

Source: https://nld.com.vn/co-phieu-dat-xanh-bi-ban-thao-sau-tin-phat-hanh-them-196241224115134215.htm

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)