Results of the implementation of the tax exemption and reduction policy, the report of the National Assembly's Supervisory Delegation on the implementation of Resolution No. 43 dated January 11, 2022 of the National Assembly on fiscal and monetary policies to support the Socio-Economic Recovery and Development Program and the National Assembly's resolutions on a number of important national projects until the end of 2023", the expected reduction in VAT (value added tax) when developing the program is 49,400 billion VND. The actual amount reached 44,458 billion VND, of which the reduction in the State budget revenue in 2022 was 41,498 billion VND, the reduction in the State budget revenue in January 2023 was 2,960 billion VND, equal to 90% of the expected amount. Of which, the reduction in domestic production and business value added tax is about 25,200 billion VND, the reduction in value added tax in import and export activities is about 19,258 billion VND.

The Government submitted to the National Assembly at the 5th and 6th sessions of the 15th National Assembly permission to continue applying the policy of reducing VAT rates by 2% similar to the provisions of Resolution No. 43 from July 1, 2023 to December 31, 2023 and from January 1, 2024 to June 30, 2024.

Thus, the implementation period of the 2% VAT reduction policy is about to end. The question is whether to continue to extend the implementation period or stop it?

Last weekend, when the National Assembly discussed this issue, some National Assembly deputies proposed that the National Assembly consider allowing the extension of the policy of reducing VAT by 2% for all goods until the end of 2024.

Mr. Ha Sy Dong - Standing Vice Chairman of the People's Committee of Quang Tri province said that many opinions suggested reducing the period by a few more months to 2025 because this is the lean season for businesses. As before, when the social distancing period just ended and flights were restored, it was necessary to consider reducing aviation VAT to 0 or reducing other fees and taxes, which could help the aviation industry and other industries recover and develop the economy faster. In addition, Deputy Mai Van Hai (Thanh Hoa National Assembly Delegation) also proposed that the National Assembly consider allowing the policy to be extended for a suitable period of time.

According to Deputy Tran Anh Tuan (Ho Chi Minh City National Assembly Delegation), the group of successful policies that brought positive effects to the economy is the 2% VAT reduction policy. In addition to the comments that we clearly see that the policy has contributed to stimulating the economy, effectively supporting the production and business activities of enterprises, the 2% VAT reduction policy also contributes to increasing income tax for enterprises. Therefore, Mr. Tuan proposed that the 2% VAT reduction policy continue to be extended in the coming time.

The support for a 2% VAT reduction took place in the context of the Covid-19 pandemic, and now everything has returned to normal. So is it appropriate to continue reducing VAT now? Because in 2 years, nearly 44,500 billion VND has been supported from a 2% VAT reduction, which means a large budget deficit. Not to mention that from July 1, 2024, the new salary policy will begin to be implemented, and resources are needed to implement the new salary regime.

During the monitoring process, the monitoring team also pointed out many shortcomings in the implementation of tax exemption and reduction. Specifically, regarding the identification of some goods and services that are not eligible for VAT reduction and some goods and services that are eligible for VAT reduction and the lookup of business codes and HS codes when importing goods and raw materials, some enterprises do not clearly understand the business items in the list of goods and services that are not eligible for VAT reduction.

In particular, businesses that calculate VAT using the percentage method on revenue are entitled to a 20% reduction in the percentage rate for calculating VAT when issuing invoices for goods and services eligible for VAT reduction. The amount of VAT reduction in this case is low, and some businesses and buyers of goods and services do not want to comply with the regulations. A large number of households and individuals doing small and retail business do not issue or do not have the conditions to issue sales invoices, so they cannot manage the selling price of goods.

Deputy Nguyen Quang Huan (Binh Duong Delegation) also disagreed with the continued extension of the 2% VAT reduction. Mr. Huan said: Resolution 43 is applied during the Covid-19 pandemic. The support policy is valuable but only applies in the short term of 1-2 years. When socio-economic conditions return to normal, normal operations should be resumed.

Because according to Mr. Huan, when VAT is reduced by 2%, the budget will lose nearly 44.5 trillion VND, of which 25 trillion VND is domestic, and 19 trillion VND is import and export. When the poor need to enjoy social welfare, where will the State get money to subsidize when it loses more than 44 trillion VND?

“VAT is essentially an indirect tax, collected from consumers and paid to the State, while businesses are not affected. During the pandemic, when people do not spend, a 2% tax reduction is completely appropriate to help businesses. Now that society has returned to normal activities, it must be brought back to normal. Therefore, the 2% VAT reduction should be implemented until June 30, 2024, then stopped and no longer applied,” said Mr. Huan.

Source: https://daidoanket.vn/co-nen-tiep-tuc-giam-2-thue-vat-10280926.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

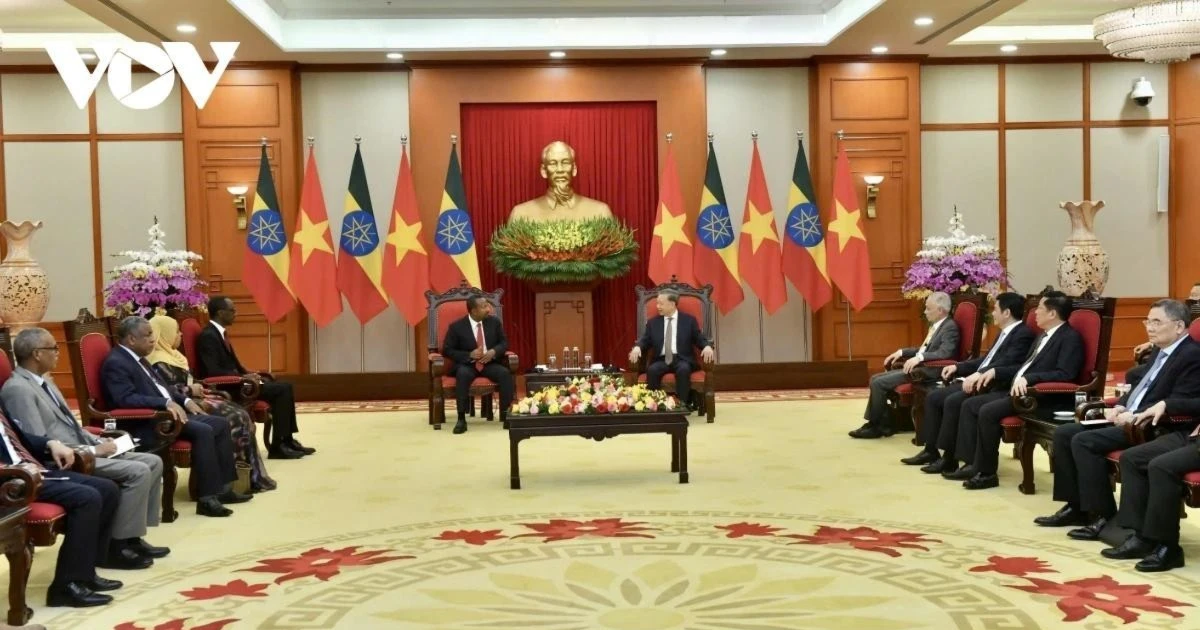

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

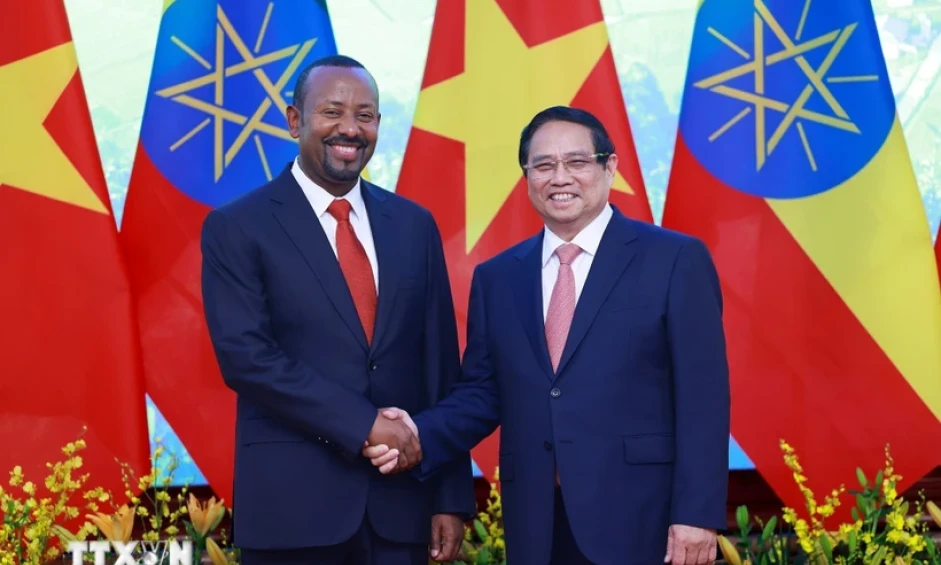

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)