According to the Resolution of the 8th Session of the 15th National Assembly, which was just passed, the National Assembly agreed to continue to reduce the value-added tax (VAT) rate by 2% for groups of goods and services specified in Resolution No. 43/2022/QH15 of the National Assembly on fiscal and monetary policies to support the Socio-Economic Recovery and Development Program.

Request for early taxing of small value goods

On the afternoon of November 30, the 15th National Assembly held its closing session, voted to pass the Resolution on questions and answers of the 15th National Assembly; and passed the Resolution of the 8th Session of the 15th National Assembly.

Before voting to pass the Resolution of the 8th Session, Member of the National Assembly Standing Committee, Secretary General of the National Assembly, and Head of the National Assembly Office Le Quang Tung presented the draft resolution.

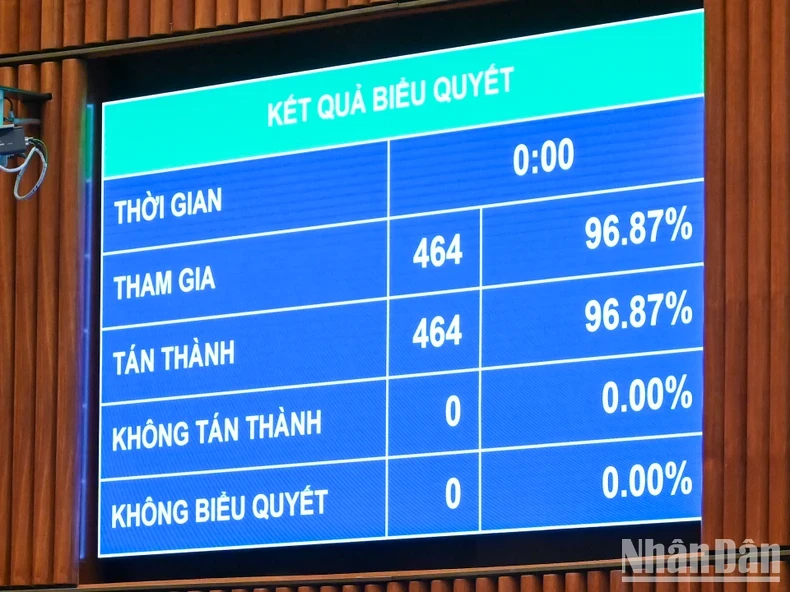

The electronic voting results showed that 464/464 National Assembly deputies participated in the vote in favor, accounting for 96.87% of the total number of National Assembly deputies. Thus, with 100% of the deputies present participating in the vote in favor, the National Assembly officially passed the Resolution of the 8th Session, 15th National Assembly.

According to the resolution, the National Assembly agreed to continue reducing by 2%. VAT for groups of goods and services specified in Resolution No. 43/2022/QH15 of the National Assembly on fiscal and monetary policies to support the Socio-Economic Recovery and Development Program.

Specifically, the 2% VAT reduction will apply to groups of goods and services currently subject to a 10% tax rate (to 8%).

This regulation does not apply to a number of groups of goods and services including: Telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, metals, prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products, goods and services subject to special consumption tax.

According to the resolution, the 2% VAT reduction period will be extended from January 1, 2025 to June 30, 2025. Currently, according to Decree 72 of the Government, the regulation of 2% VAT reduction for some groups of goods will expire on December 31, 2024.

Thus, with the newly passed resolution, the 2% VAT reduction will be extended by 6 months.

The National Assembly assigned the Government to organize implementation and take responsibility for ensuring the collection task and the ability to balance the state budget in 2025 as decided by the National Assembly.

Also according to the resolution, the National Assembly assigned the Government to urgently issue a Decree on customs management of exported and imported goods traded via e-commerce channels.

Accordingly, it is guaranteed that import tax exemptions for small-value goods are not allowed, providing a basis for tax authorities to have a legal basis and sanctions to manage collection of foreign e-commerce platforms selling goods into Vietnam.

Agree to add more than 20 trillion VND in capital to Vietcombank

In the Resolution of the 8th Session, the National Assembly also approved the policy of investing additional state capital to maintain the state capital contribution ratio at the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) with an amount of more than VND 20,695 billion.

The above amount is from stock dividends distributed to state shareholders from the remaining accumulated profits up to the end of 2018 and the remaining profits in 2021 of this bank.

The National Assembly assigned the Government and the Prime Minister to direct the investment and supplement of state capital at Vietcombank in accordance with the provisions of law; and to be responsible before the National Assembly for the accuracy of data and the scale of state capital supplementation for this bank.

In addition to Vietcombank, the National Assembly also approved solutions to continue to remove difficulties caused by the impact of the Covid-19 pandemic so that Vietnam Airlines Corporation can soon recover and develop sustainably.

Specifically, Vietnam Airlines Corporation is allowed to offer additional shares to existing shareholders to increase charter capital with a maximum scale of VND22 trillion.

In particular, in phase 1, the Government is allowed to assign the State Capital Investment Corporation to represent the Government in investing in purchasing shares at Vietnam Airlines Corporation under the State shareholder's right to purchase shares (the State Capital Management Committee at enterprises is the agency representing the State shareholder's capital) by transferring the right to purchase when Vietnam Airlines Corporation implements the plan to increase charter capital in phase 1 with an issuance scale of 9,000 billion VND.

In phase 2, the National Assembly approved the policy and assigned the Government to direct the implementation of the plan (including the plan for the State to transfer the right to purchase shares to enterprises) with a maximum issuance scale of 13 trillion VND. In case of any problems, continue to report to the competent authority.

In addition, the National Assembly also allows Pacific Airlines Joint Stock Company to erase late payment fines and late payment fees calculated on tax debts arising according to decisions of competent tax authorities, outstanding until December 31, 2024.

Source

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)