SGGPO

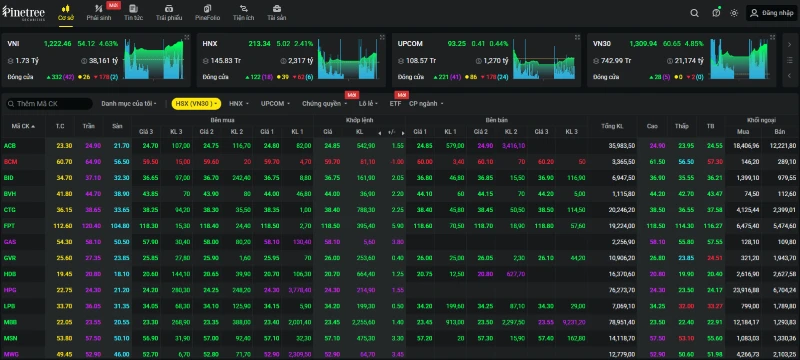

The US Federal Reserve (Fed) kept interest rates unchanged at 5.25%-5.5% after its November meeting ended last night. Along with the upward trend of world stocks, the Vietnamese stock market also increased strongly, despite foreign investors still net selling nearly 330 billion VND on the HOSE floor.

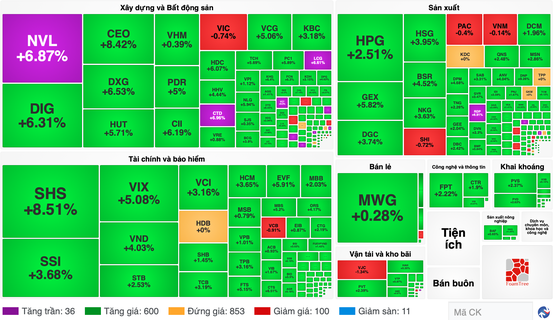

At the opening of the trading session on November 2, VN-Index opened a price gap of nearly 10 points. After that, the market fell to fill the gap at the beginning of the session and then quickly increased strongly. Green covered the entire market. Even stocks that had fallen deeply in previous sessions such as the trio of Vingroup stocks, only VIC decreased by nearly 1%, VRE and VHM regained green, both increasing by nearly 1%. Even MWG shares, after hitting the floor for the previous two consecutive sessions, regained green.

The market's "pilot" stocks opened the morning session with stronger signals than the general market with MBS increasing by 5.2%, FTS increasing by 5.55%, VIX increasing by 5.08%, VND increasing by 4.03%, HCM increasing by 3.65%, VCI increasing by 3.16%...

Real estate and construction stocks soared with CTD, LCG, NVL hitting the ceiling, PDR up 5%, DXG up 6.53%, DIG up 6.31%, CII up 6.19, HDC up 6.07%, TCH up 5.69%, VCG up 5.06%, NLG up 5.94%...

Banking stocks also turned green with large-cap stocks increasing strongly: TCB increased by 3.16%, TPB increased by 3.16%, BID increased by 3.5%, CTG increased by 2.19%, MBB increased by 2.03%... contributing to the strong increase of VN-Index.

In addition, the manufacturing and retail groups also recovered well with GEX increasing by 5.82%, DGC increasing by 3.74%, HPG increasing by 2.21%, HSG increasing by 3.95%, BSR increasing by 4.52%, NKG increasing by 3.63%...

|

Vietnam's stock market recovers in line with world stock market trend |

Temporarily closing the morning session, VN-Index increased by 15.74 points (1.51%) with 442 stocks increasing, 68 stocks decreasing and 46 stocks remaining unchanged.

At the end of the morning session, the HNX-Index also increased by 5.89 points (2.81%) with 145 stocks increasing, 31 stocks decreasing and 30 stocks remaining unchanged. Liquidity improved with the total trading value in the morning session of the entire market reaching nearly VND8,200 billion.

* Ho Chi Minh City Stock Exchange (HOSE) has just announced that NVL (Novaland) shares will be removed from the warning list from November 3 because the company has resolved the cause that led to the stock being warned.

Previously, Novaland also submitted a proposal to remove NVL shares from the warning list after overcoming the reasons why the securities were put on the warning list; at the same time, it explained the reason for the delay in disclosing the 2022 audited financial statements and announced that the company had completed the disclosure of the 2022 audited financial statements. In addition, Novaland has also complied with regulations on information disclosure on the stock market over the past 6 months.

After being removed from the warning list, NVL shares closed the morning session with a sharp increase in amplitude to 14,000 VND/share with a buy surplus of nearly 4.7 million shares.

Source

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)