In the trading session on April 1, the stock market recovered impressively, regaining almost all the points lost in yesterday's decline. VN-Index closed at 1,317.33 points, up 10.47 points; HNX Index increased 1.36 points to 236.42 points compared to the previous session.

The increase in VN-Index's points mainly focused on large-cap stocks (belonging to VN30 basket) such as Vingroup stocks (VIC, VHM, VRE), banking stocks (TCB, MBB, STB)...

However, liquidity hit a 2-month low when the transaction value on HOSE was just over 15,000 billion VND.

Many investors worried about the risk of losing money in today's session after buying stocks at the bottom of the previous session were relieved when the securities and banking groups recovered strongly at the end of the session.

Stock market surged at the end of the session, helping VN-Index close at the highest level of the day.

Commenting on tomorrow's trading session, Vietnam Construction Securities Company (CSI) said that there are not enough signals to confirm a reversal. CSI continues to maintain a cautious stance and is not in a hurry to enter a new stock buying position. Investors need to patiently wait for the VN-Index to retest the support level of 1,286 - 1,290 points before taking a strong net stock buying position.

DSC Securities Company also commented that VN-Index had a very good session to fill the gap of yesterday's decline, but to confirm the return to the uptrend, it is necessary to observe leading stocks such as FPT, LPB, DGC breaking the downward trend, creating a bottom. Investors should still limit the fomo of chasing green prices, focus on management and wait for more suitable opportunities in the near future.

Tomorrow, April 2, the market is waiting for US President Donald Trump to make an official decision on reciprocal taxes with other countries, which could have a strong impact on Vietnam.

On the contrary, according to SHS Securities Company, in the short term, the price range around 1,280 points - 1,300 points is a reasonable price range to consider disbursing. Because many codes and groups of stocks that have been under pressure to decrease in price over the past time have returned to a relatively reasonable price range, considering the internal factors of the enterprise and business prospects.

Medium-weight investors should limit selling at this price range. Carefully consider new buying positions, focusing on stocks with good fundamentals and expected growth in business results.

Source: https://nld.com.vn/chung-khoan-ngay-mai-2-4-vn-index-thoat-hiem-gio-chot-nhip-chinh-da-ket-thuc-196250401183934823.htm

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

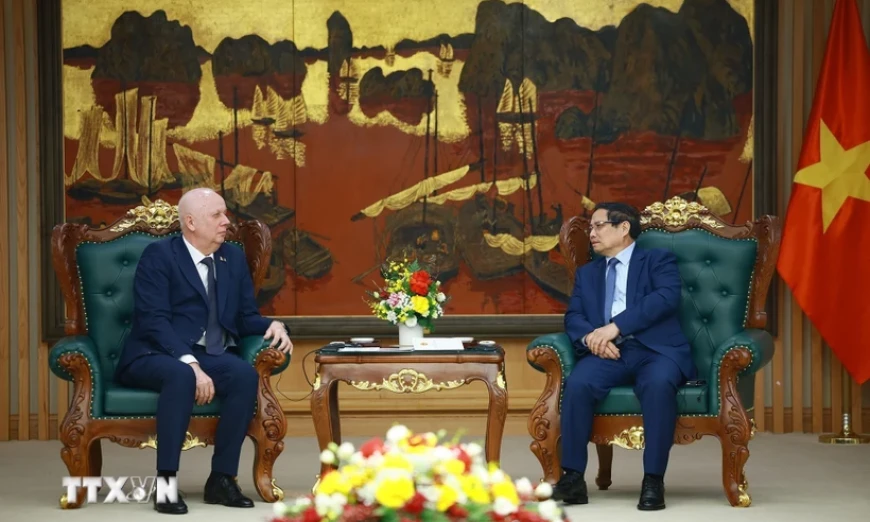

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

Comment (0)