VN-Index broke through the 1,200-point mark this morning (November 20). However, bottom-fishing demand appeared, helping the index recover, at times surpassing the reference level, creating a fierce tug-of-war in the first half of the morning session.

VN-Index broke through the 1,200-point mark this morning (November 20). However, bottom-fishing demand appeared, helping the index recover, at times surpassing the reference level, creating a fierce tug-of-war in the first half of the morning session.

|

| VN-Index development from the beginning of 2024. |

VN-Index closed the session on November 19 at 1,205.15 points, down 0.98% compared to the previous session with trading volume down 21.3% compared to the previous session. Trading was gloomy, liquidity dropped sharply, the market was in a short-term "paralysis" state with pressure to stop losses and reduce the proportion of stocks, leading to a strong expansion of selling pressure when investor sentiment continued to be pessimistic.

Pessimism and discouragement were evident right at the beginning of the trading session on November 20. Selling pressure increased right from the opening of the session and pushed the indices down below the reference level. The focus of the market was still on foreign selling pressure as this capital flow continued to increase selling in stocks such as FPT or MWG. FPT at one point fell by 2.5%, MWG also fell by 2.6%. FPT shares were also the "culprit" that dragged down the general index the most during the session.

VN-Index was under great pressure and officially “broke” the 1,200-point mark at 9:40 a.m. This was the first time since the trading session on August 24 that VN-Index returned to this important psychological threshold. Similar to the last time, VN-Index did not fall further but bounced back quickly.

Immediately after the VN-Index reached 1,198 points, the market activated bottom-fishing demand. Many stock groups recovered, helping the VN-Index reverse. At 10:10, the VN-Index increased by 1.01 points (0.08%) to 1,206.16 points. The HNX-Index decreased slightly by 0.02 points (-0.01%) to 219.66 points. The UPCoM-Index increased by 0.38 points to 90.68 points.

The real estate group is the most active in the market when NVL increased by more than 4%. NVL increased thanks to the information that on November 19, Chairman of Dong Nai Provincial People's Committee Vo Tan Duc signed Decision No. 3479 officially approving the local adjustment of the 1/10,000 master plan, marking a decisive step in resolving the legal issues for Novaland Group's Aqua City project, which has been stuck for more than 2 years.

The newly announced adjustment focuses on the population size and land use quota in subdivision C4, part of the urban area west of Bien Hoa - Vung Tau highway. This is an important legal step to remove obstacles for many projects of many enterprises; ensure the synchronization of the next planning levels, paving the way for the completion of the adjustment of subdivision C4 planning and detailed planning 1/500 of the Aqua City project, expected to be completed in early 2025.

Besides, other real estate codes such as DXG, DIG, CEO, PDR, HDG... also increased in price. Some securities stocks also had good recovery such as VDS increased by 1.14%, VCI increased by 1.24%, CTS increased by 0.8%...

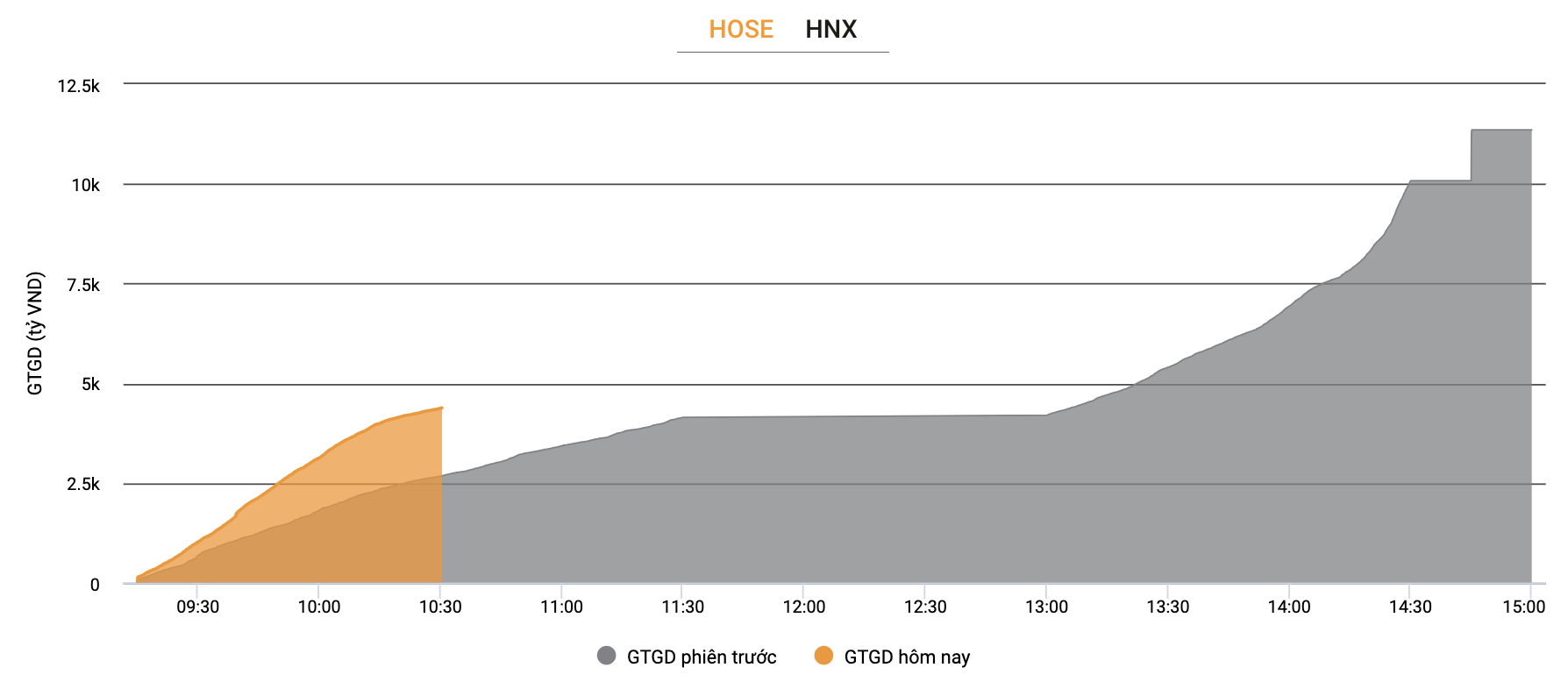

However, it is worth noting that trading has become more active. The trading value as of 10:30 am was VND4,380 billion, much higher than yesterday's VND2,670 billion.

|

| Trading value increased sharply when VN-Index broke the 1,200 point mark. |

Before the trading session, with the market falling sharply and sentiment being suppressed in a gloomy state, most securities companies expressed a cautious view and believed that the main index would continue to adjust.

Yuanta Securities Vietnam Co., Ltd.'s analysis department believes that the market may continue to decline and the VN-Index will retest the 1,200-point level in the next session. At the same time, the market may soon see a recovery and investors should limit sell-offs in the next session. On the positive side, the Real Estate and Retail indexes also formed a bullish reversal pattern, indicating that the market may soon form a bottom.

KB Securities Vietnam Joint Stock Company also assessed that the VN-Index's lowest closing price yesterday showed that the sellers completely controlled the trading status. Accordingly, the main index is at risk of losing the near support level and retreating to other support zones further away. Investors are advised to avoid chasing in early recovery sessions, take advantage of reducing the proportion of short-term positions or restructuring the portfolio in recovery sessions.

According to Agriseco analysts, VN-Index will retest this support level in these sessions before determining a clearer trend. Agriseco experts recommend investors maintain a high cash ratio, patiently wait for the market to confirm a bottom, and limit early disbursement to avoid the risk of T+ losses.

Source: https://baodautu.vn/chung-khoan-hoi-phuc-manh-tu-moc-1200-diem-d230475.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)