China has emerged as the world's top auto exporter by volume over the past three years, thanks to electric vehicles and a boom in the Russian market.

Car enthusiasts tend to fall into one of two camps: those who admire the power and speed of German engineering; or those who think Japanese cars are superior, reliable and worth the money.

For decades, the two countries have vied for the top spot as the world’s auto exporter. But their dominance is coming to an end. Now, as the world’s largest automaker, China is on track to surpass its rivals in exports.

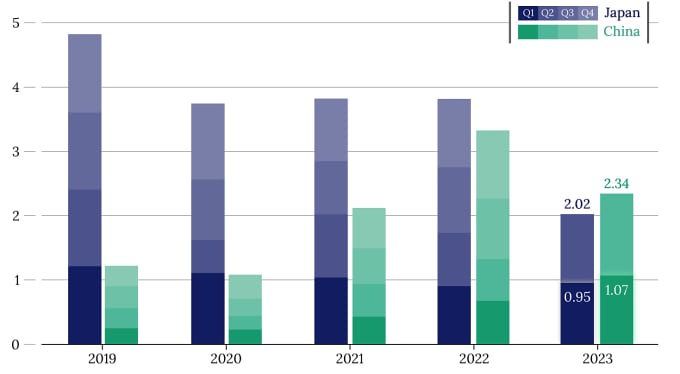

Auto export output of Japan (blue) and China (green) over the years. Unit; million units. Source: Caixin

China is the world's largest auto exporter in the first half of 2023. Its exports from January to June rose 77.1% year-on-year to 2.34 million vehicles, according to data released by China's General Administration of Customs. By comparison, Japan exported 2.02 million vehicles in the same period, up 16.8%, according to data from the Japan Automobile Manufacturers Association.

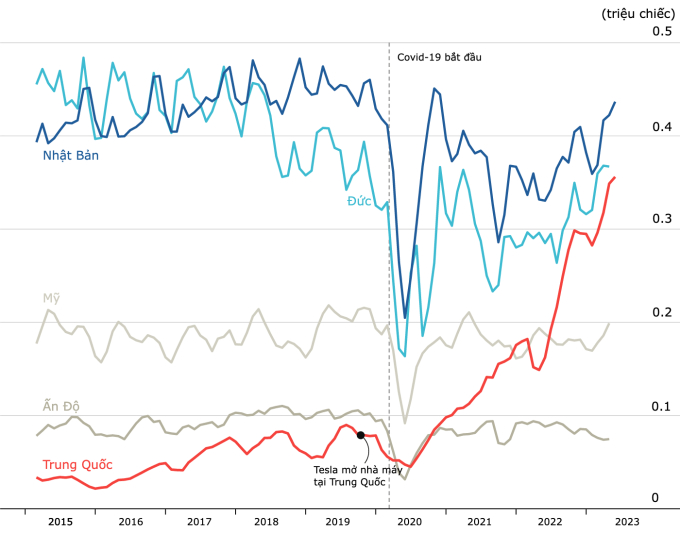

Just a few years ago, China’s efforts to expand abroad were modest. In 2015, China exported fewer than 375,000 cars a year, less than India and as much as Germany and Japan exported in a month. But around 2020, that changed.

China exported nearly 1.6 million cars in 2021. It sold 2.7 million overseas in 2022. International sales are expected to rise further this year. Customs data shows the country sold more than 10,000 foreign cars a day in the first half of 2023.

Car exports by country from 2015 to present. Source: Economist

China’s fledgling auto industry has largely been exported to poorer countries. But now many Western consumers are buying Chinese-made cars for the first time. Exports to Australia tripled in the first half of 2023 from the same period in 2022, to more than 100,000 vehicles. Sales to Spain increased 17-fold, to nearly 70,000 vehicles.

Some of these are Western brands. About 10% of exports in 2022 will come from Tesla (USA). Also from MG, an Anglo-Swedish brand bought by a Chinese company. But the vast majority of exports are Chinese brands.

The country’s rapid export growth is largely due to electric vehicles. For all its manufacturing prowess, China has never mastered the internal combustion engine, which has hundreds of moving parts and is difficult to assemble. But the advent of battery-powered vehicles, which are mechanically simpler and easier to manufacture, has helped it catch up, according to the Economist .

Government investment in electric vehicle technology, estimated at 676 billion yuan ($100 billion) between 2009 and 2019, has propelled the country to the top. Today, battery-powered vehicles account for a fifth of China’s auto sales and a third of its exports. In Japan and Germany, only 4% and 20% of exports are electric vehicles, respectively.

Pure electric vehicles had the highest output and growth rate among overseas shipments, according to a report by the China Association of Automobile Manufacturers (CAAM) in late July. Cui Dongshu, secretary general of the China Passenger Car Association (CPCA), predicted that the “explosive” growth rate of electric vehicle exports could continue in the second half of the year as demand remains strong in Europe.

The conflict in Ukraine was a second catalyst for increased exports, especially to Russia. With most Western automakers shutting down operations in Russia, their Chinese rivals quickly moved in to grab market share. In the first half of 2023, Russia imported nearly 300,000 Chinese cars worth $4.5 billion, a sixfold increase from 2022. In July, Chinese cars accounted for nearly 80% of the country’s car imports, according to analytics firm Autostat.

Previously, the CAAM report also confirmed that Russia was the largest destination for Chinese cars in the first five months of 2023, followed by Mexico, Belgium, Australia and the UK. However, Belgium was the largest recipient of Chinese-made electric cars in the five-month period, followed by the UK, Thailand and Spain, according to CAAM.

An export shipment of electric vehicle company Hozon New Energy Automobile. Photo: Neta

China’s auto exports will continue to grow. Caixin forecasts that China will remain the world’s largest auto exporter for the entire year. Some analysts say output will exceed 4 million units, with electric vehicles accounting for about 35 percent of the total. Cui Dongshu is optimistic that exports could reach 5 million units.

In the long term, consulting firm AlixPartners estimates that overseas sales of Chinese-branded vehicles could reach 9 million by 2030, doubling Japan’s exports by 2022. While these domestic brands are still relatively unknown in the West, they tend to be cheap—on average, Chinese-made cars cost about 40% of those made in Germany. As a result, Chinese cars have become popular in emerging markets like Brazil.

But there are challenges for China’s cars. The country’s electric carmakers may be generating big sales, but they are rarely profitable. The industry is sustained by government subsidies, which have recently been extended after sales growth slowed. But the subsidies may not last forever.

That’s not to mention some regulatory hurdles. For example, the French government announced in May a plan to subsidize buyers of new electric cars made in Europe, a move analysts say is aimed at helping the region’s auto industry counter the threat of cheaper Chinese electric car imports.

Another big challenge comes from the US, where the Biden administration signed into law in August 2022 the Inflation Reduction Act, which includes a provision allowing buyers to get tax credits of up to $7,500 on electric vehicles assembled in North America.

While the global competition for electric vehicles is still in its early stages, Chinese automakers should avoid being overly optimistic about the future, said Takaki Nakanishi, CEO of Japan-based research firm Nakanishi. He recommended that they focus on building a stable after-sales service network in overseas markets.

Phien An ( according to Economist, Caixin )

Source link

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

Comment (0)