(Dan Tri) - When the revised Law on Social Insurance (SI) comes into effect, the calculation of pensions and one-time benefits upon retirement will be adjusted.

Before July 1

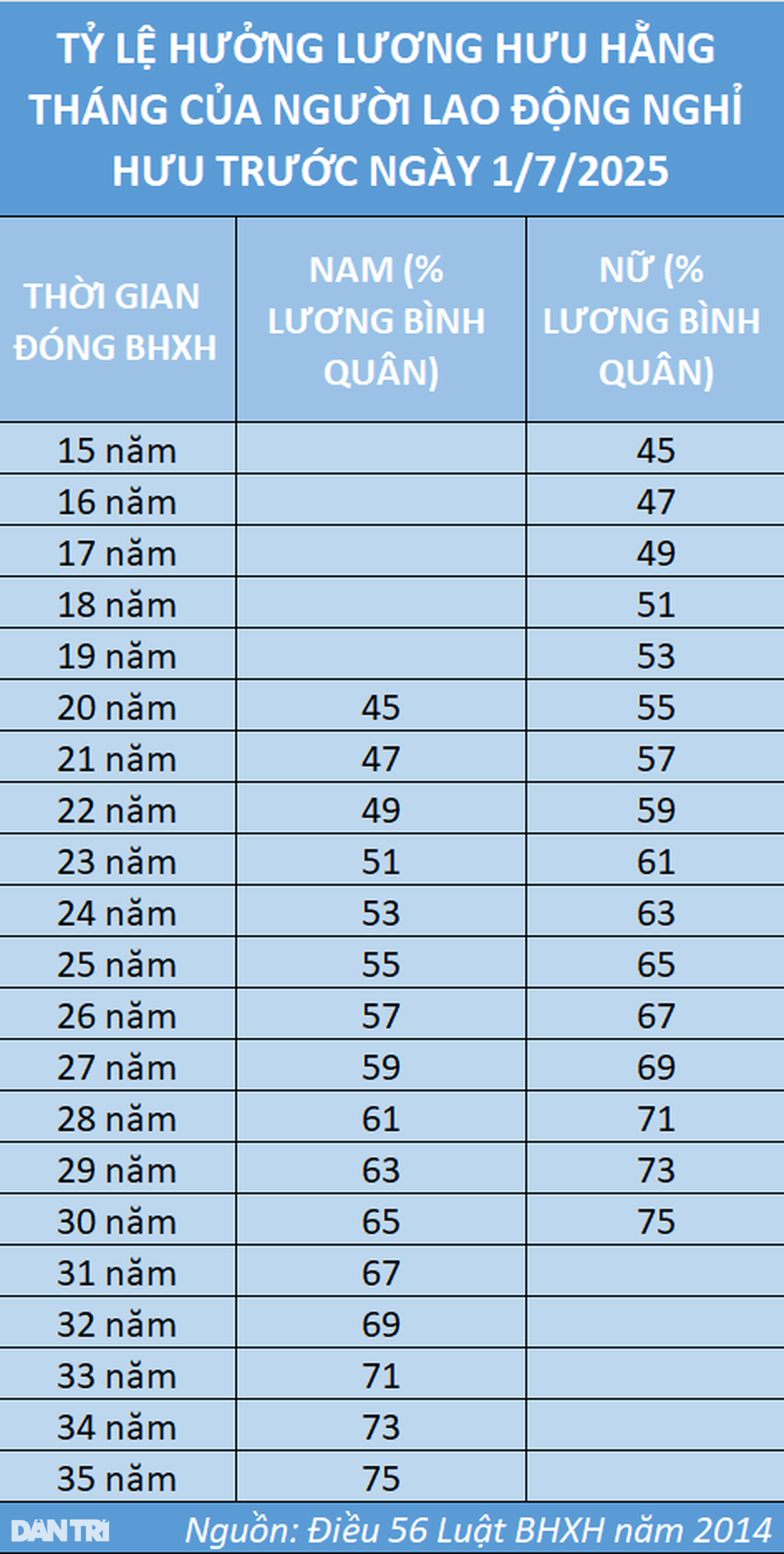

The method of calculating pensions before July 1 is stipulated in Article 56 of the 2014 Law on Social Insurance and detailed instructions in Article 7 of Decree No. 115/2015/ND-CP.

Accordingly, the monthly pension of employees is calculated by multiplying the monthly pension rate by the average monthly salary for social insurance contribution.

The pension rate for male workers is calculated at 45% of the average monthly salary for social insurance contributions corresponding to 20 years of social insurance contributions; then for each additional year of social insurance contributions, an additional 2% is calculated, up to a maximum of 75% of the average monthly salary for social insurance contributions (corresponding to 35 years of social insurance contributions).

The pension rate for female workers is calculated at 45% of the average monthly salary for social insurance contributions corresponding to 15 years of social insurance contributions; then for each additional year of social insurance contributions, an additional 2% is calculated, up to a maximum of 75% of the average monthly salary for social insurance contributions (corresponding to 30 years of social insurance contributions).

Pension rate before July 1, 2025 (Graphic: Tung Nguyen).

In case an employee retires early due to reduced working capacity, the salary will be reduced by 2% for each year of early retirement.

In case when retiring to receive pension, the employee has a period of social insurance contribution higher than the number of years corresponding to the pension rate of 75%, then when retiring, in addition to pension, he/she will also receive a one-time allowance.

The one-time pension level upon retirement is calculated based on the number of years of social insurance contributions higher than the number of years corresponding to the pension rate of 75%. For each year of social insurance contributions, it is calculated as 0.5 months of the average monthly salary for social insurance contributions.

From 1/7 onwards

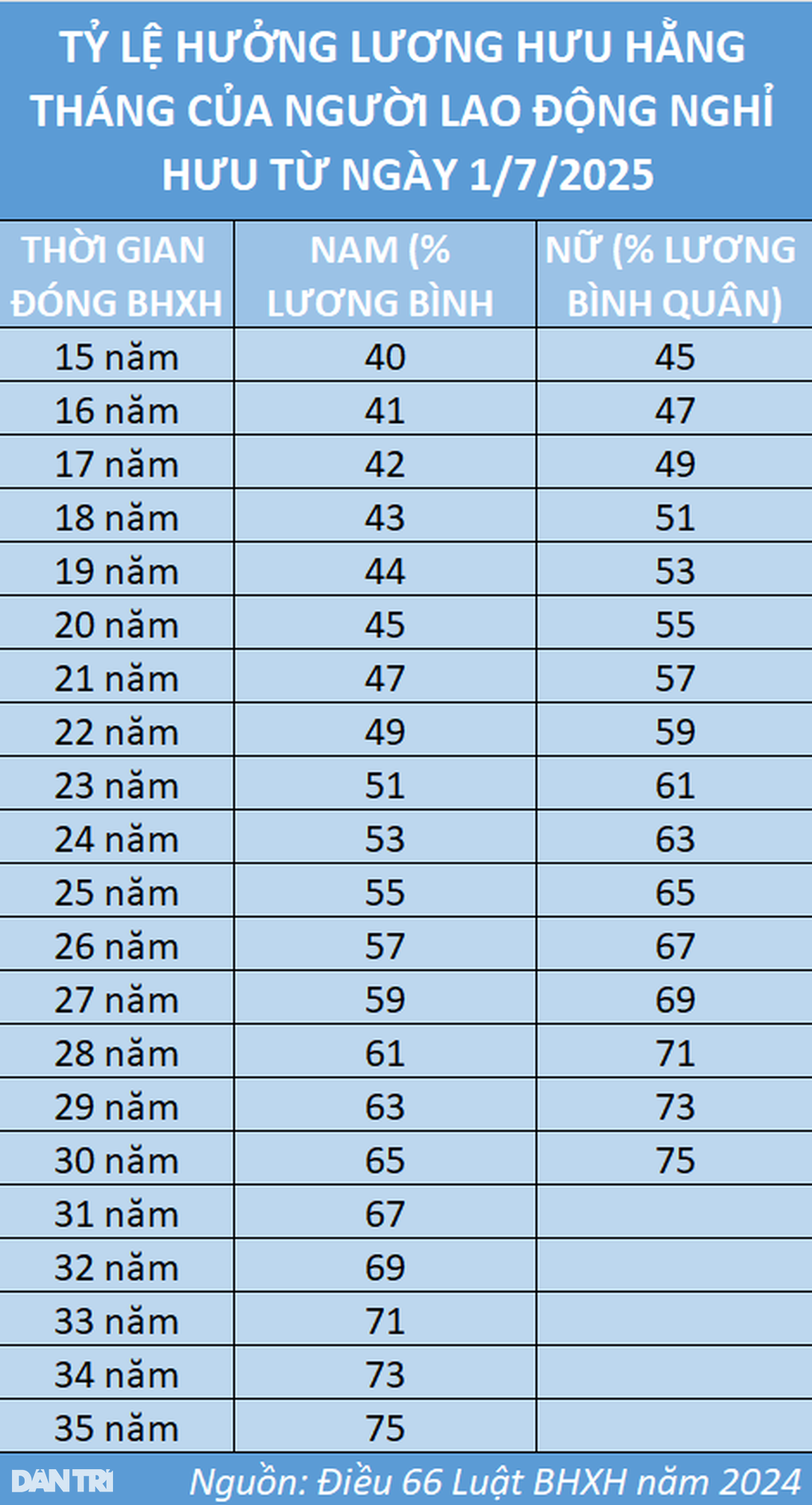

From July 1 onwards, the pension calculation method is applied according to Article 66 of the Social Insurance Law 2024. In which, the monthly pension level is stipulated at.

Accordingly, for female workers, the monthly pension is calculated at 45% of the average salary used as the basis for social insurance contributions corresponding to 15 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75% (corresponding to 30 years of social insurance contributions).

For male workers, the monthly pension is calculated at 45% of the average salary used as the basis for social insurance contributions corresponding to 20 years of social insurance contributions, then 2% is added for each additional year of contributions, up to a maximum of 75% (corresponding to 35 years of social insurance contributions).

In case male employees have paid social insurance for 15 years but less than 20 years, the monthly pension is equal to 40% of the average salary used as the basis for social insurance payment corresponding to 15 years of social insurance payment, then for each additional year of payment, 1% is added. This is a difference compared to the Social Insurance Law of 2014.

Monthly pension benefits from July 1, 2025 onwards (Graphic: Tung Nguyen).

According to the 2024 Social Insurance Law, in case an employee retires early due to reduced working capacity, the pension rate will also be deducted, with each year of early retirement being reduced by 2%.

In case when retiring to receive pension, the employee has a period of social insurance contribution higher than the number of years corresponding to the pension rate of 75%, then when retiring, in addition to pension, he/she will also receive a one-time allowance.

The lump sum benefit upon retirement is calculated for the period of social insurance contribution higher than the period of contribution to reach the maximum pension level (30 years for female workers, 35 years for male workers).

The one-time benefit level is calculated at 0.5 times the average salary used as the basis for social insurance contributions for each year of contribution above the retirement age as prescribed by law.

In the case of employees who are eligible for pension but continue to pay social insurance, the one-time subsidy is calculated as 2 times the average salary used as the basis for social insurance contributions for each higher year of contribution (from the time after reaching retirement age as prescribed by law until the time of retirement and pension benefits). This is a difference compared to the Social Insurance Law of 2014.

Source: https://dantri.com.vn/an-sinh/cach-tinh-luong-huu-va-tro-cap-mot-lan-nam-2025-20250214120827935.htm

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)