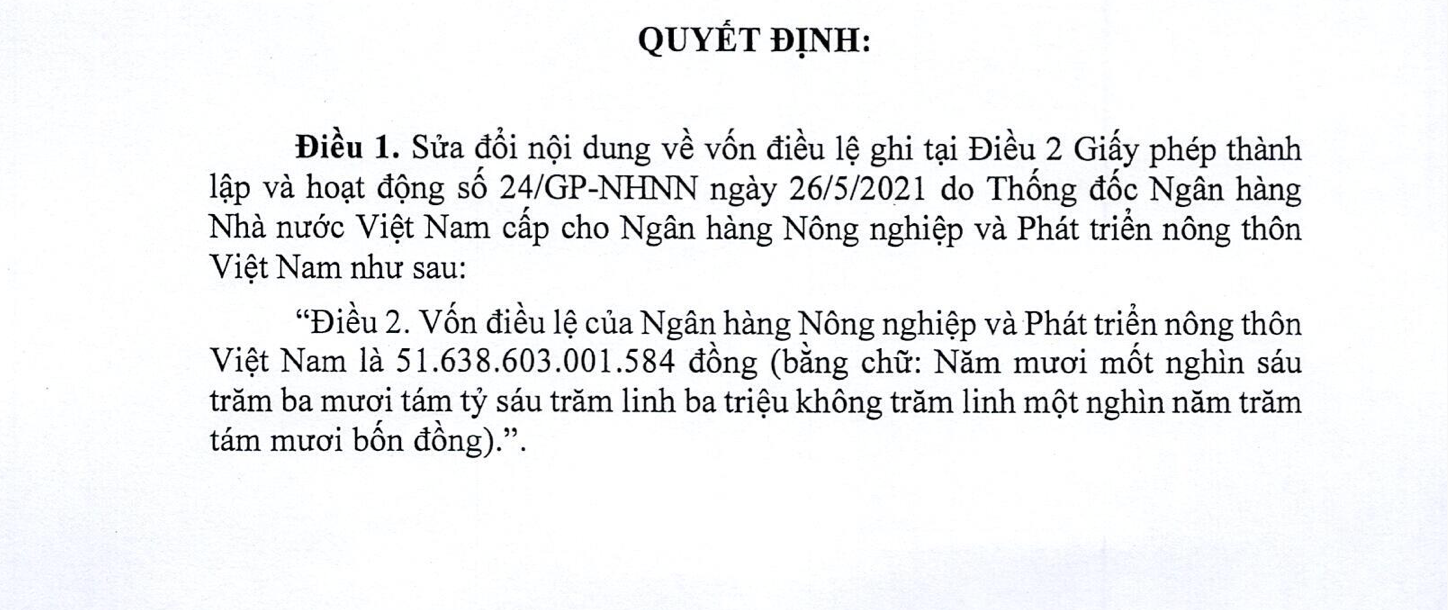

The banking inspection and supervision agency, the State Bank of Vietnam (SBV), has just issued a decision to amend the contents of the License for establishment and operation of the Bank for Agriculture and Rural Development of Vietnam (Agribank).

Specifically, from October 4, 2024, Agribank's charter capital will officially be VND51,639 billion. Earlier this year, the bank also announced an increase in its charter capital from VND34,210 billion to VND40,963 billion.

Previously, in the Resolution of the 5th session, the 15th National Assembly approved the policy of investing additional charter capital for Agribank in the period of 2021 - 2030 corresponding to the remaining profit actually paid to the state budget in the period of 2021 - 2023 of the Bank for Agriculture and Rural Development of Vietnam, up to a maximum of VND 17,100 billion.

Agribank amended its charter capital to VND 51,539 billion in the Establishment and Operation License.

The additional source from the central budget expenditure estimate for 2023 is 6,753 billion VND approved by the National Assembly in Resolution 70/2022/QH15 and the remaining 10,347 billion VND is allocated in 2024 from the state budget (NSNN) according to the provisions of the Law on State Budget.

At that time, according to Deputy Governor of the State Bank Doan Thai Son, the charter capital of Agribank as of December 31, 2022 was the lowest among the group of state-owned commercial banks and there was no difference, even much smaller than some other joint stock commercial banks.

Thus, with the plan to increase capital scale of joint stock commercial banks, if Agribank is not allowed to increase capital, it will not be able to ensure its leading role and orientation in the banking market, especially for banks operating mainly in the agricultural and rural sectors like Agribank.

However, despite having increased charter capital, Agribank still has the lowest charter capital among the group of 4 state-owned banks and the 7th highest charter capital in the entire system, after Big4 and 3 other joint stock commercial banks: VPBank (over 79,300 billion VND), Techcombank (70,450 billion VND) and MB (over 52,100 billion VND).

Regarding business performance, in the first half of 2024, Agribank reported a profit after tax of nearly VND 10,615 billion, down slightly by 1.8% over the same period.

As of June 30, 2024, Agribank's total assets were recorded at VND 2.08 million billion, up 1.8% compared to the end of 2023. Of which, customer loans were VND 1.59 million billion, up 2.6%. Customer deposits also increased slightly by 0.9% to VND 1.83 million billion.

Regarding loan quality, Agribank's total bad debt at the end of June 2024 was VND29,276 billion, up 1.9% compared to VND28,721 at the end of last year. Due to the increase in customer loans, the bad debt ratio decreased from 1.85% to 1.84%.

Source: https://www.nguoiduatin.vn/agribank-chinh-thuc-tang-von-dieu-le-len-gan-52000-ty-dong-204241008191116883.htm

Comment (0)