Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank - HoSE: HDB) has just announced a report on the results of the second public bond offering in 2023.

Accordingly, HDBank successfully offered 10 million bonds with a total value of VND1,000 billion to a total of 69 investors.

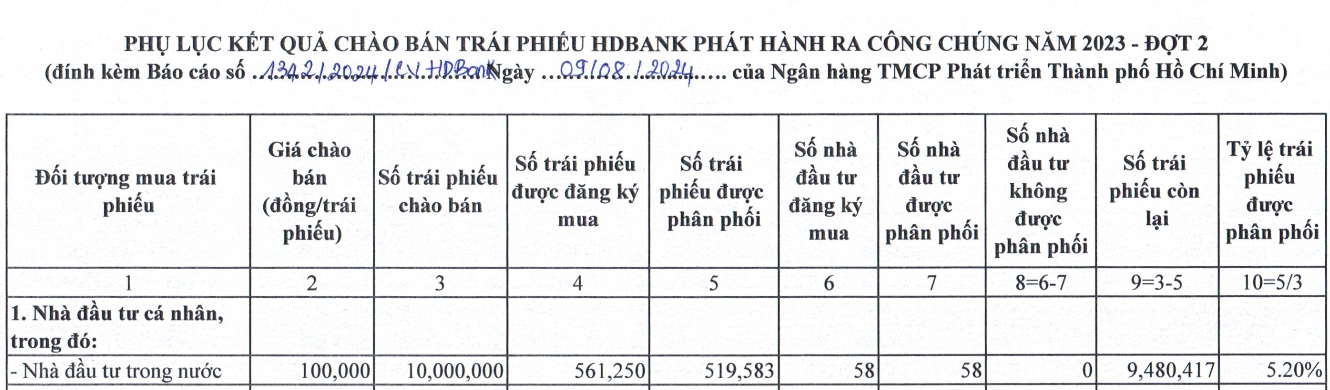

Of these, 58 individual investors, all domestic investors, registered to buy 561,250 bonds. However, the number of bonds distributed by the bank was 519,583, equivalent to a distribution rate of 5.2%.

In addition, 10 domestic institutional investors purchased 9.99 million bank bonds and were distributed nearly 9.25 million bonds, a ratio of 92.49%. Finally, 1 foreign institutional investor registered to purchase 250,000 bonds and received 231,454 bonds, corresponding to a distribution ratio of 2.31%.

Information on the results of HDBank's second bond offering in 2023.

Within 30 days from the closing date of the offering, investors will receive the original Certificate of Bond Ownership and/or the original extract of the Register (if requested by the bondholder), except in cases where the investor has authorized the issuer to carry out centralized deposit procedures.

Previously, HDBank also announced the second public offering of bonds. Accordingly, HDBank plans to issue to the public bond code HDBC7Y202302 with a face value of VND 100,000/bond, with a total issuance value of VND 1,000 billion.

The bond lot has a term of 7 years, the registration period is from July 17, 2024 to August 7, 2024. The bond has a floating interest rate, applied for the entire term of the bond. The interest rate is calculated by the reference interest rate plus a margin of 2.8%/year.

In 2023, HDBank plans to offer 3 bonds to the public with a total of 50 million bonds.

In the first phase, the bank offered 30 million bonds to the public, and in the second and third phases, each phase offered 10 million bonds.

HDBank's third bond offering is expected to take place in the second and fourth quarters of 2024. The purpose of raising bonds is to supplement Tier 2 capital, improve capital adequacy ratio, and serve HDBank's customer lending needs.

According to information from the Hanoi Stock Exchange, within 8 months of 2024, HDBank mobilized a total of 11 bond lots to the market with a total value of VND 11,700 billion.

Of which, the bond lot with the largest face value is 3,000 billion VND, code HDBL2427010, issued on July 31, 2024, term of 3 years, expected to mature in 2027. Issue interest rate is 5.7%/year.

Source: https://www.nguoiduatin.vn/69-nha-dau-tu-mua-10-trieu-trai-phieu-hdbank-204240816212450259.htm

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)