Choosing the right investment channel is the key to optimizing investment profits. With a capital of 500 million VND, how can individual investors allocate it effectively and in line with their financial goals for 2025?

Choosing the right investment channel is the key to optimizing investment profits. With a capital of 500 million VND, how can individual investors allocate it effectively and in line with their financial goals for 2025?

|

Choose investment channel

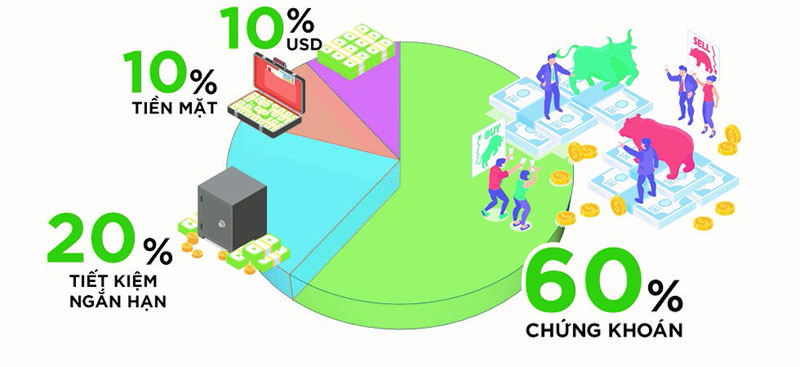

Experts from Thien Viet Fund Management Company (TVAM) believe that domestic gold is often higher than the world price and difficult to predict; real estate requires large capital and long investment time, both of these investment channels are not suitable for individual investors at this time. Instead, experts recommend an investment strategy for 9-12 months with expected profit of about 12%, allocating capital across 4 channels: stocks, short-term savings, cash and US dollars.

According to the strategy, 20% of the portfolio is allocated to short-term deposits (1-3 months) because the capital is not yet eligible to participate in corporate bonds, 10% is kept in cash to take advantage of deep market corrections (if any) to increase stocks, and 10% is held in USD expecting to benefit from the US fiscal policy of the Trump administration. 60% of the portfolio is for stocks thanks to the potential in 2025 with corporate profits expected to increase by 16-18% and PE and PB valuations at attractive levels (14.8x and 1.6x).

|

Securities – the focus of investment portfolio in 2025

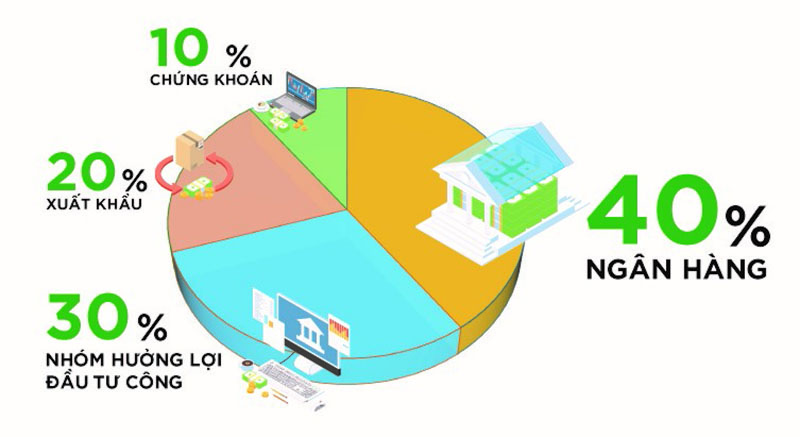

Regarding the stock investment channel, TVAM experts believe that this is an effective investment channel for individual customers and continue to provide portfolio strategies by industry group.

The banking group's profit is expected to increase by 20%, thanks to a 16% increase in credit and a recovery in net interest margin (NIM). The group's valuation is currently attractive for investment with PB of 1.3 - 1.4 times. In addition, the industry group benefits from public investment, as the Government sets a disbursement target of VND 790 trillion, an increase of 18% compared to the 2024 plan. The export industry group has potential thanks to recovering global demand and supportive exchange rates, while the securities industry is expected to benefit from FTSE upgrading Vietnam's market to Emerging in September 2025, attracting foreign capital flows of 3-4 billion USD.

|

TVAM experts believe that choosing the above strategy and portfolio will be suitable for investing VND500 million with an expected return of 12%. If individual investors have a higher risk appetite, they can increase the investment proportion in the stock channel to match their investment goals.

Source: https://baodautu.vn/500-trieu-dong-nen-dau-tu-the-nao-de-toi-uu-loi-nhuan-d241950.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)