|

| The US economy is heading towards a 'soft landing' scenario. (Source: Getty Images) |

BofA's CEO said consumer spending at the bank slowed to 4% in October from 4.5%.

That's about half the pace recorded earlier this year, while commercial customers aren't borrowing much either.

Still, Mr. Moynihan sees the "healthy" financial situation and consumer spending over the past several months as a sign that the US economy can avoid a recession.

BofA economists predict the US economy will grow 2.7% this year and 0.7% in 2024, and predict the US Federal Reserve will raise interest rates once more in December to a range of 5.5-5.75%.

"The Fed could raise rates again, but that's not a given. There's also speculation that rates will fall in the second half of 2024. Getting inflation down to the 2% target may take until late 2025," Moynihan stressed.

Source

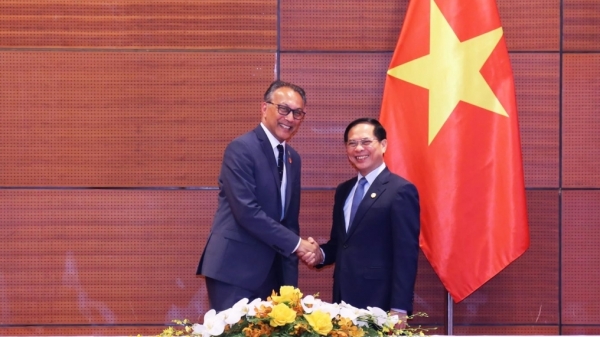

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)