DNVN - According to the Vice President of the Vietnam Gold Trading Association, if the State monopoly on gold bar production is not abolished, there will be no solution to stabilize the market. State management must be separated. The State Bank only regulates foreign exchange reserves in gold or foreign currency instead of intervening in the production of gold bars for sale on the market.

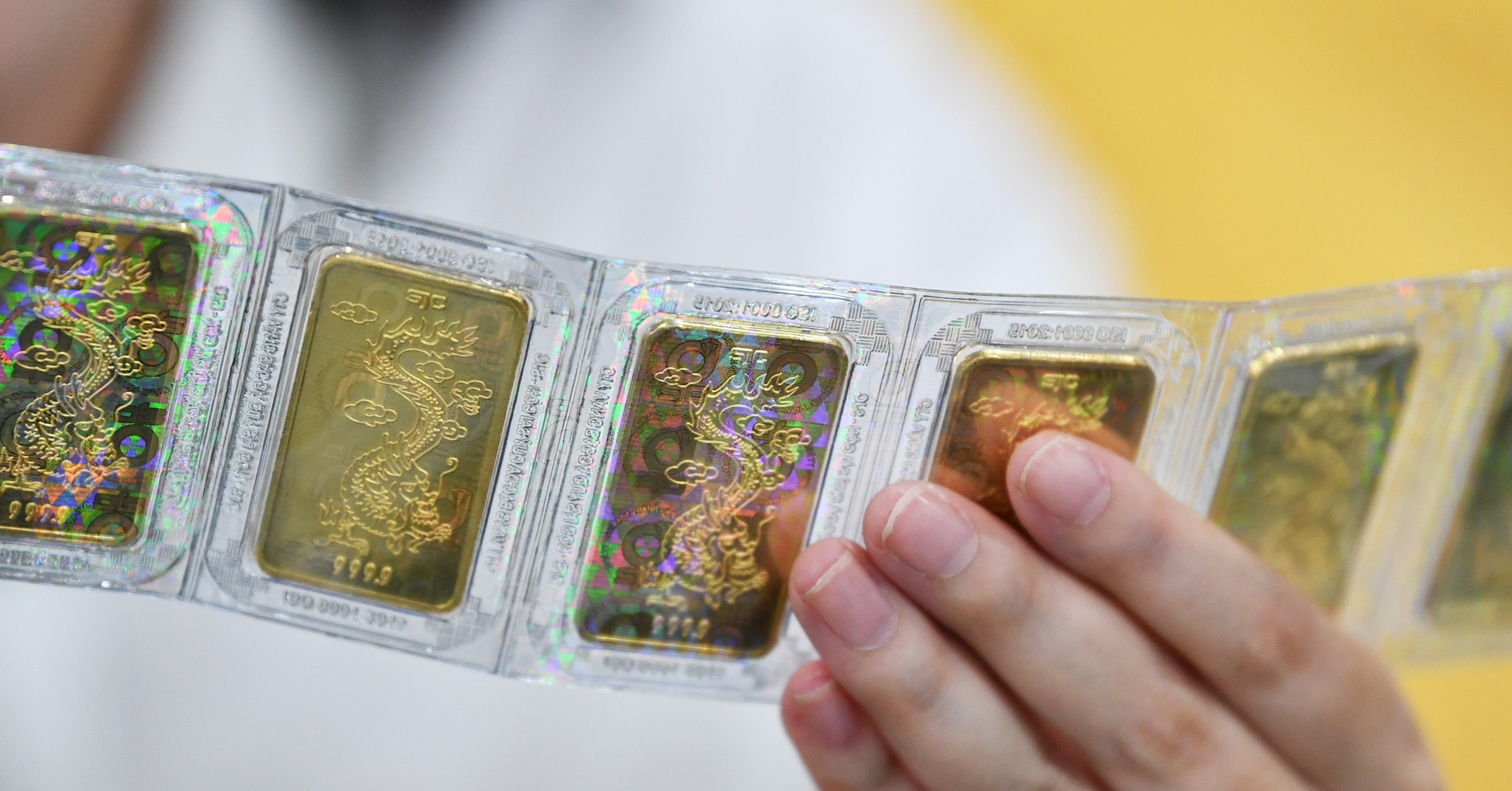

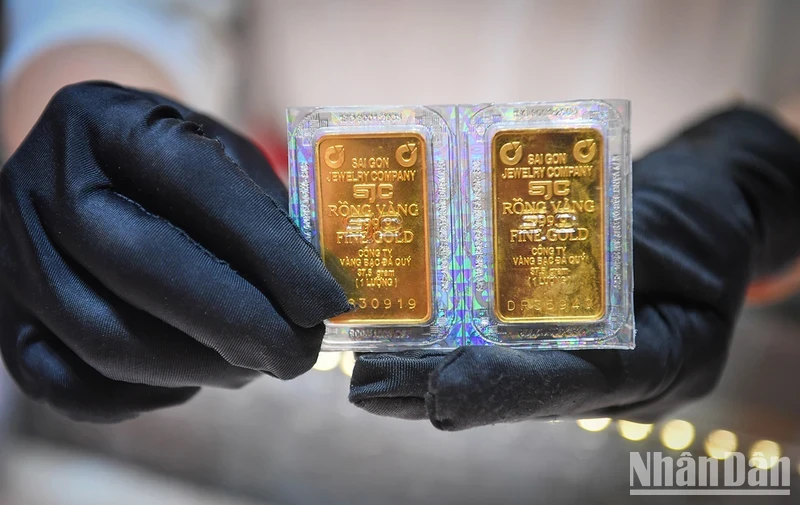

As of the morning of March 25, the price of SJC gold bars was listed by large enterprises at 78-80.3 million VND/tael (buy - sell). The difference between the two directions is 2.3 million VND/tael.

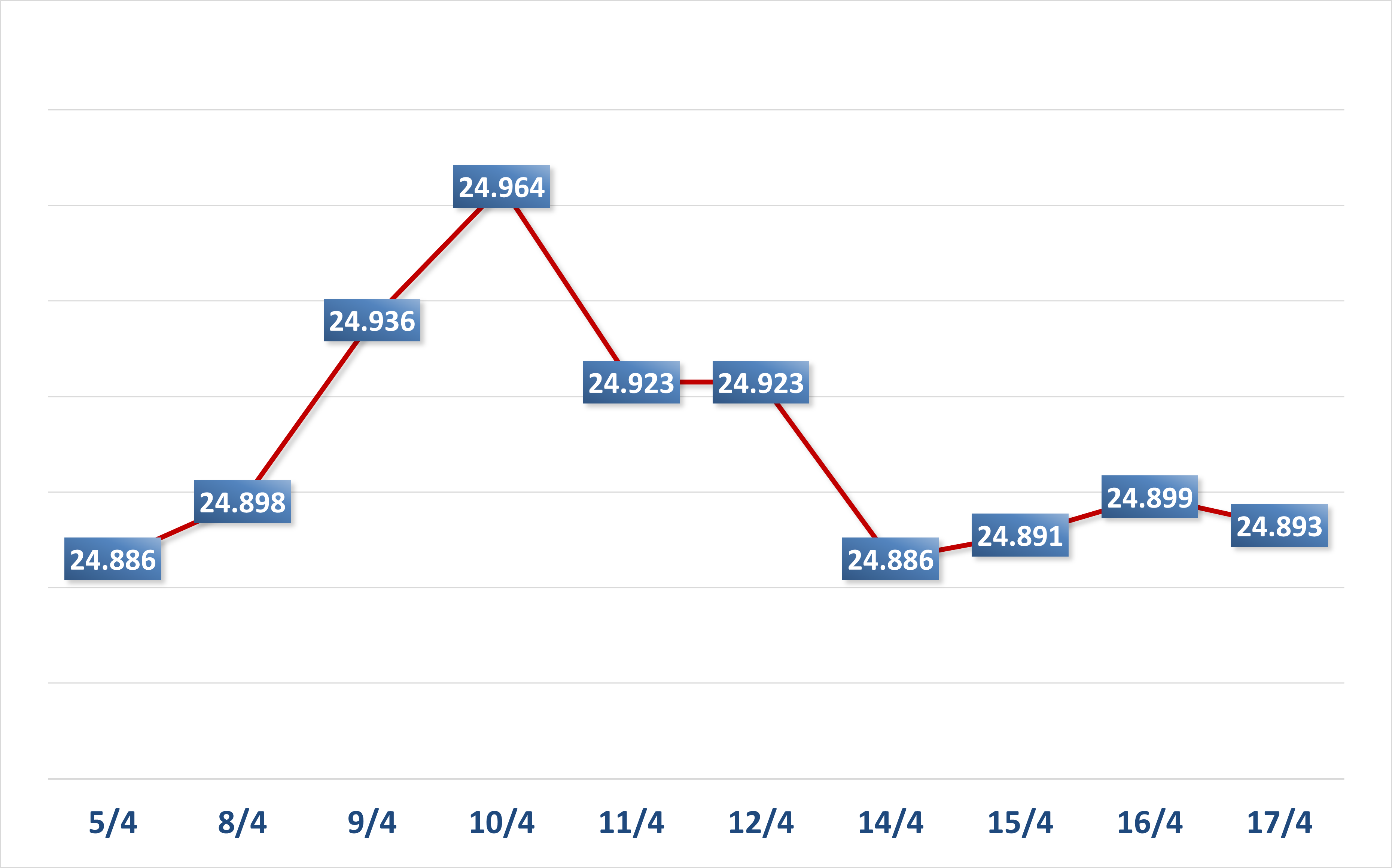

Last week, the highest price of gold bars ever recorded was 82 million VND/tael for sale and the lowest price was 79.9 million VND/tael, after the State Bank proposed to remove the monopoly on gold bars. The price of SJC gold has been continuously "erratic" in the past week, causing experts to advise caution.

According to finance and banking expert Nguyen Tri Hieu, the reason why the price of SJC gold and gold rings plummeted last week could be due to psychological issues. When people and gold traders received signals from the State management agency about amending the monopoly mechanism of SJC gold, the market immediately cooled down and the buying and selling prices were adjusted.

However, if there are no important decisions on amending Decree 24/2012/ND-CP on gold trading management dated April 3, 2012, the market will only cool down at this time and then "explode" again because the world gold price is still on an upward trend.

Experts say world and domestic gold prices are still on an upward trend.

Mr. Hieu advised investors to consider buying gold at this time, when the world and domestic gold prices are still on an upward trend. The gold price has only decreased temporarily due to psychological issues due to the Government's directives. The temporary price decrease is an opportunity for investors to buy.

Mr. Nguyen The Hung - Vice President of the Vietnam Gold Business Association said that if the State Bank abolishes the monopoly, regardless of whether it allows gold imports or not, the gold price will immediately drop by 5 million VND per tael, not just the current level. Therefore, a specific solution is needed to stabilize the gold market.

"Currently, the world gold market is in an upward cycle. When banks cut interest rates, the USD will lose value. Those who speculate on USD will sell and buy back other collateral assets, mainly gold. Large investment funds as well as countries like Russia and China are increasing their gold reserves. This purchasing power will push the gold price up.

If the State monopoly on gold bar production is not abolished, there will be no solution to stabilize the market. State management must be separated. How can the State Bank regulate foreign exchange reserves in gold or foreign currency instead of intervening in the matter of how much gold bar is produced and sold on the market?" Mr. Hung analyzed.

According to Mr. Hung, the monopoly must be abolished to reduce the difference in gold prices with the world. Gold bars should not be overemphasized. Gold bars should be considered as other gold products of equivalent quality, gold bars are the same as 9999 gold rings. At the same time, people's habit of buying gold bars for storage needs to change.

Experts recommend that, in the immediate future, it is necessary to import gold to produce gold jewelry because this type of gold can be exported. The State Bank should assign the import of gold to reputable and capable gold traders. It is possible to assign import-export quotas for those units to import gold under the direction of the State Bank.

Establishing a gold exchange is also the best method of gold management that many countries have done, and has been proposed by financial and monetary experts for a long time. The success of the Shanghai Gold Exchange (China, established in 2014) is a lesson that can be applied in our country. The products allowed to trade on this exchange are gold bars that meet international standards, always close to the world gold price.

Ha Anh

Source

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] General Secretary To Lam attends conference to meet voters in Hanoi city](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/889ce3da77e04ccdb753878da71ded24)

![[Photo] North-South Expressway construction component project, Bung - Van Ninh section before opening day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/ad7c27119f3445cd8dce5907647419d1)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)