Japanese or German cars is a familiar question for car enthusiasts. One side bows to the power and speed of German engines, while the other admires the reliability and value for money of a Japanese car.

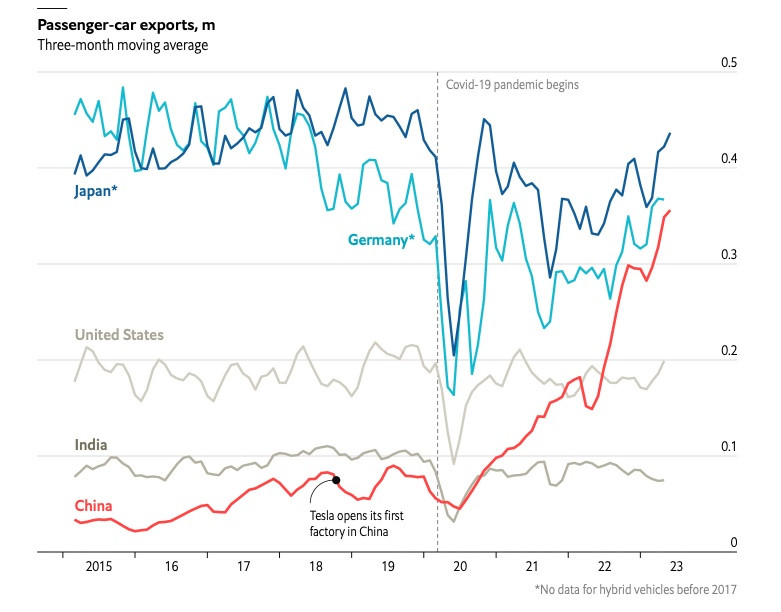

For decades, the two countries have taken turns as the world’s top auto exporters. But the dominance of Germany and Japan is coming to an end as China, the world’s largest automaker, is on track to surpass a host of other big names in exports.

Just a few years ago, China’s efforts to expand overseas were stalled. In 2015, China exported fewer than 375,000 cars a year, fewer than India and about as much as Germany and Japan export in a month. But since 2020, things have changed.

China exported nearly 1.6 million cars in 2021. By 2022, the figure was 2.7 million. International sales are expected to rise further in 2023. Customs data shows the country shipped nearly 2 million cars in the first six months of the year, or more than 10,000 a day.

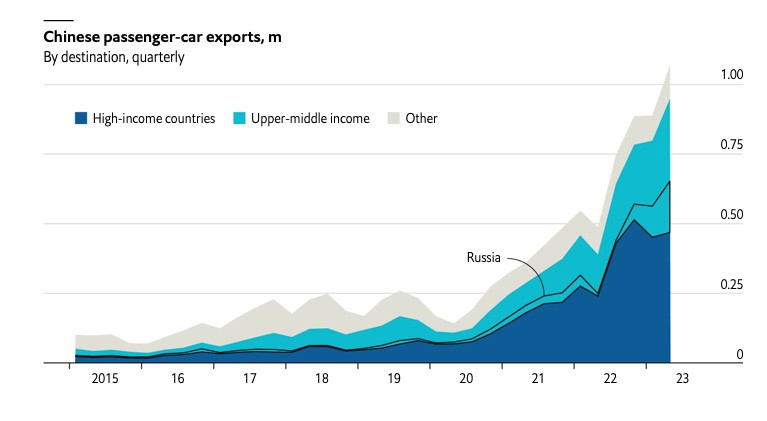

The country's fledgling auto industry is largely exported to poorer countries, but now many Western consumers are buying Chinese-made cars for the first time.

Exports to Australia tripled year-on-year in the first half of 2023 to more than 100,000 cars; sales to Spain increased 17-fold to nearly 70,000 cars.

But many of these vehicles are Western brands. For example, 10% of all exports in 2022 were from Tesla, an American electric car company. In addition, cars branded with MG, originally a British brand, and Volvo, a Swedish carmaker now owned by Chinese companies, also account for a large share of vehicles exported abroad.

Electric vehicles have played a major role in China’s surge in auto exports. Despite its enormous manufacturing prowess, the world’s second-largest economy has never mastered the internal combustion engine, a complex engine with hundreds of moving parts that is difficult to assemble.

Simple mechanics, easy manufacturing

The advent of battery-powered vehicles, which are mechanically simpler and easier to manufacture, has helped China catch up with traditional car giants.

Over the 10 years from 2009 to 2019, Beijing invested about 676 billion yuan ($100 billion) in electric vehicle technology and rose to become the world leader.

Battery-powered vehicles now account for a fifth of car sales in China and a third of exports. In Japan and Germany, only 4% and 20% of exports are electric vehicles, respectively.

The war has also boosted Chinese exports to Russia. As soon as the Russia-Ukraine conflict broke out in February 2022, most Western automakers halted operations in Russia. Their departure allowed Chinese companies to gain market share.

According to the analysis firm Autostat, in the first half of 2023, Russia imported nearly 300,000 Chinese cars worth $4.5 billion, a six-fold increase compared to 2022. In July 2023, Chinese cars accounted for nearly 80% of imported cars in this market.

AlixPartners, a consulting firm, estimates overseas sales of Chinese-branded cars could reach 9 million units by 2030, double Japan's exports by 2022.

While these domestic brands are still relatively unknown in the West, these cars are often relatively cheap—on average, a “Made in China” car is about 40% cheaper than a German-made one—so they are easily becoming popular in emerging markets like Brazil.

But while China’s electric carmakers are generating huge revenues, few are actually making money, experts say, because the industry is heavily subsidized by the state and this cannot last forever.

(According to TheEconomist)

Source

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

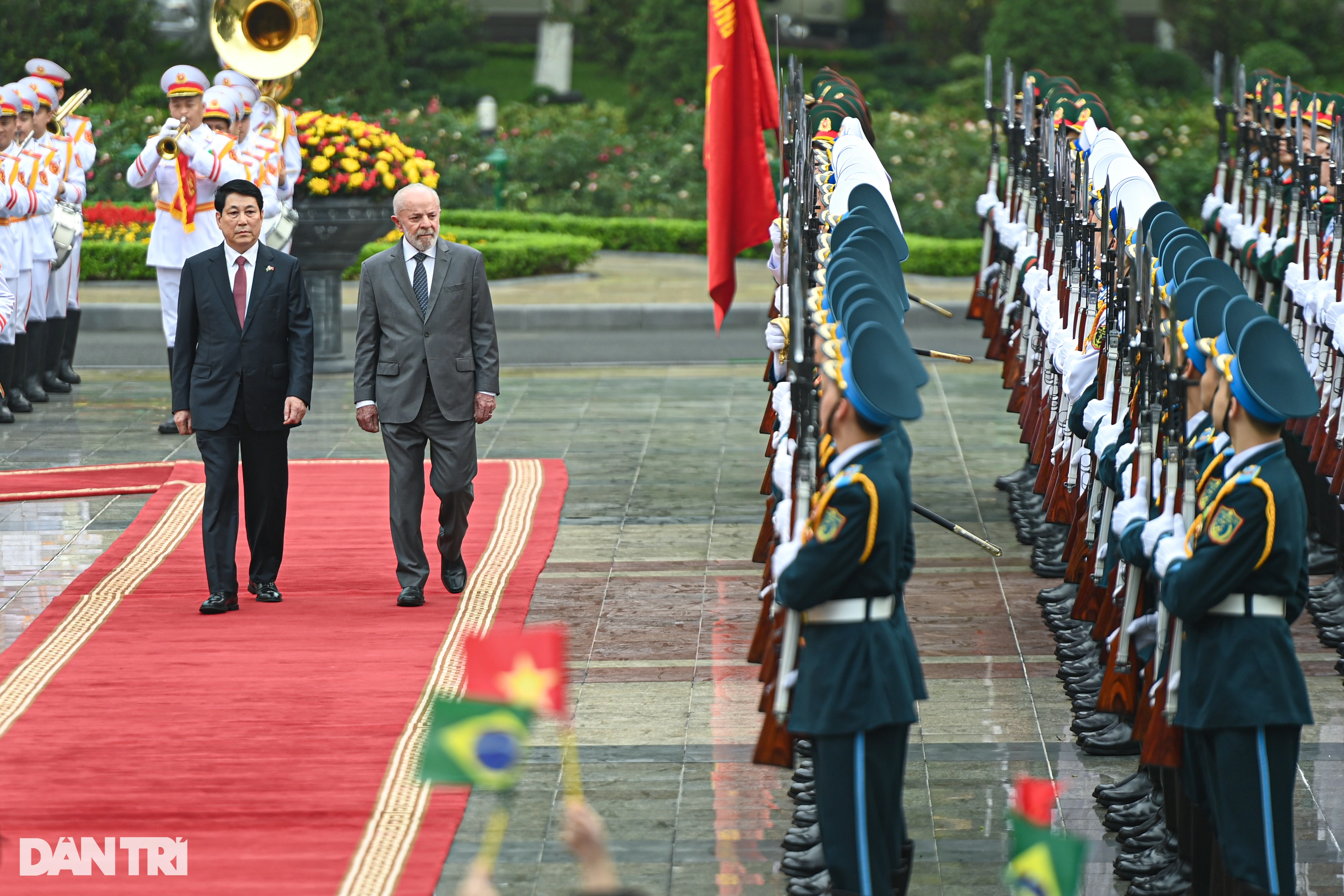

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

Comment (0)