For the third time in 2024, the VN-Index reached the 1,300-point mark, but continued to fail to conquer it in the session on October 1. Selling pressure continued to appear strongly when the VN-Index approached this threshold, causing many stock groups to weaken.

Ending the third quarter of 2024 at 1,287.94 points, up 3.42% compared to the second quarter and up 13.98% compared to the end of 2023, the VN-Index remained in red for most of the last trading session of the quarter, however, low-price demand was still quite good and helped support the general market.

Entering the trading session on October 1, trading on the market took place somewhat positively when a series of stock groups increased in price and pulled the indices above the reference level. VN-Index continued to surpass the 1,300-point mark twice in today's session, but similar to previous times, the index still encountered strong selling pressure in this area and both times declined again. VN-Index even closed at the lowest level of the session when a series of stock groups weakened at the end of the session.

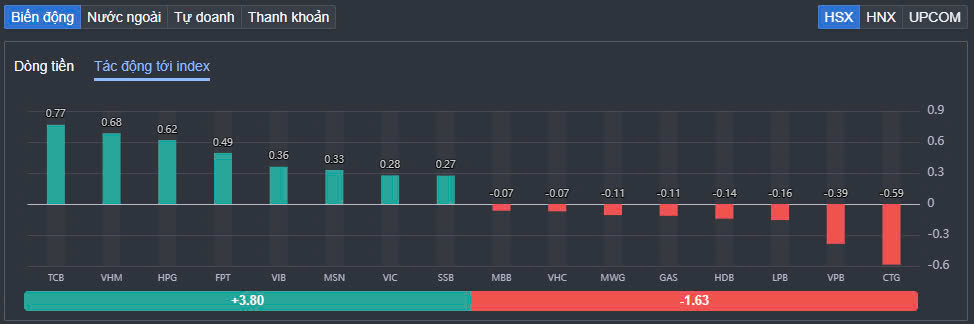

The focus of today's session belonged to the banking stocks group when names such as VIB, SSB, TCB... all increased sharply in price and maintained positivity throughout the session despite strong selling pressure in the final minutes. Of which, VIB closed the session up 2.6% with extraordinary liquidity when matching a record order of more than 33 million units. VIB ranked 5th in the list of stocks with the most positive impact on the VN-Index when contributing 0.36 points. TCB increased 1.86% and was the stock that contributed the most to the index with 0.77 points.

Besides, VHM, after being sold off heavily yesterday, was suddenly pulled up and increased by 1.5%. VHM contributed 0.68 points to the VN-Index. Two stocks also belonging to the "Vin" family, VIC and VRE, also increased in price. VIC increased by 0.7%, VRE increased by 1.6%.

|

| Top 10 stocks affecting VN-Index. |

Some other large stocks such as FPT, MSN, HPG... also increased in price well. FPT increased by more than 1%, HPG increased by 1.5%. Particularly in the steel group, many stocks received good momentum at the beginning of the session, however, strong selling pressure appeared at the end of the session, causing many stocks to reverse. Of which, VGS decreased by 1.5% despite increasing by 2.6% at times. NKG and HSG both ended the session at the reference price.

In the securities group, some stocks such as BSI, SHS, VIX, VDS... attracted investors' attention when they all increased sharply in price. BSI increased by 4.6%, SHS increased by 3.9%, VIX increased by 2.9%. The State Securities Commission officially announced information about Circular 68/2024/TT-BTC recently issued by the Ministry of Finance, which states that foreign institutional investors are allowed to place orders to buy stocks without requiring sufficient money from November 2.

However, the differentiation in the securities group was stronger at the end of the session, in which VCI reversed and decreased by 0.5%, SSI also decreased by nearly 0.4%, and FTS retreated to stand at the reference level.

Cash flow also circulated in the banking group when CTG, VPB, HDB, TPB or MBB decreased in price in today's session. CTG decreased by 1.22% and took away the most from VN-Index with 0.59 points. VPB decreased by 1% and took away 0.39 points.

At the end of the trading session, VN-Index increased by 4.26 points (0.33%) to 1,292.2 points. The entire floor had 270 stocks increasing, 125 stocks decreasing and 76 stocks remaining unchanged. HNX-Index increased by 1.14 points (0.49%) to 236.05 points. The entire floor had 97 stocks increasing, 72 stocks decreasing and 59 stocks remaining unchanged. UPCoM-Index could not maintain the green color but decreased by 0.28 points (-0.3%) to 93.28 points. The stocks that put great pressure on UPCoM-Index were DNH, MCH, ACV and BSR.

|

| Foreign net buying is one of the bright spots of the market. |

Total trading volume on the HoSE reached 982 million shares, worth VND21,891 billion, up 34% compared to the previous session. Of which, negotiated transactions accounted for VND1,500 billion. Trading value on the HNX and UPCoM reached VND2,225 billion and VND987 billion, respectively.

Not only the increase in liquidity, another bright spot of the session was that foreign investors returned to net buying nearly 700 billion VND on the HoSE floor alone. Of which, this capital flow net bought the most TCB code with 360 billion VND. FPT was also net bought 329 billion VND. VHM and MWG were net bought 174 billion VND and 164 billion VND respectively. In the opposite direction, HDB was net sold the most with 95 billion VND. VPB was behind with a net selling value of 88 billion VND.

Source: https://baodautu.vn/vn-index-tiep-tuc-that-bai-truoc-moc-1300-diem-d226331.html

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

Comment (0)