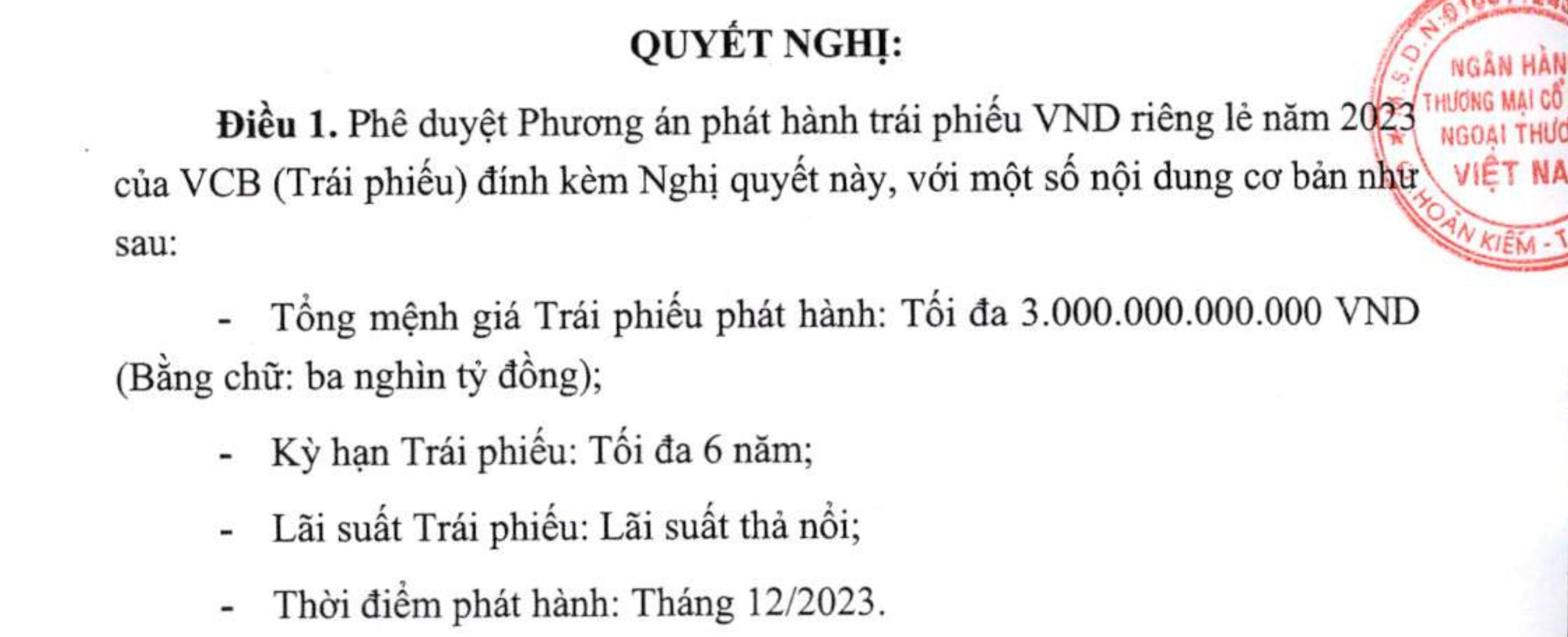

The Board of Directors of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank - HoSE: VCB) has just approved the plan to issue individual VND bonds in 2023. Specifically, Vietcombank expects the total face value of the bond issuance to be a maximum of VND 3,000 billion.

The bond term is up to 6 years with a floating interest rate. Vietcombank plans to issue the bond lot in December 2023. This is the first time the bank has announced a bond issuance in 2023.

According to information from the Hanoi Stock Exchange, the last bond lot mobilized by Vietcombank is the bond lot code VCBH2232007 issued on August 24, 2022, 10-year term, expected to mature on August 24, 2032.

The bond lot is issued in the domestic market. The issuance volume consists of 90 bonds, with a face value of 1 billion VND/bond, equivalent to a total issuance value of 90 billion VND.

Vietcombank's Board of Directors approved a plan to issue up to 3,000 individual bonds in 2023.

On the other hand, in the last two months of the year, Vietcombank spent VND1,300 billion to buy back bonds before maturity. In early December, Vietcombank bought back the VCBH2128006 bond lot with a face value of VND1 billion/bond, total value of VND600 billion.

The bonds have a term of 7 years, the issuance date is December 3, 2021 and will not mature until December 3, 2028. This is a non-convertible corporate bond, without warrants and is not secured by assets.

Bonds are issued individually in the form of book entries through an underwriting organization as prescribed.

The purpose of issuing the bond lot is to increase Tier 2 capital to supplement operating capital and meet Vietcombank's medium and long-term lending needs for socio-economic development. At the same time, the bond issuance aims to improve the bank's financial capacity, ensuring safety according to the regulations of the State Bank .

Source

![[Photo] President Luong Cuong receives Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/337e313bae4b4961890fdf834d3fcdd5)

![[Photo] Hundred-year-old pine trees – an attractive destination for tourists in Gia Lai](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/25a0b7b629294f3f89350e263863d6a3)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] President Luong Cuong receives UN Deputy Secretary General Amina J.Mohammed](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/72781800ee294eeb8df59db53e80159f)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)