USD/VND exchange rate skyrocketed

The banking system has continuously lowered the deposit interest rate. This will create room for cheaper lending interest rates, thereby helping businesses overcome difficulties.

But on the other hand, lower interest rates are believed to put pressure on exchange rates.

Since the beginning of August, many banks have once again implemented a policy of reducing deposit interest rates. In response to this decision, the USD/VND exchange rate has been on a rising trend in both the banking and free markets.

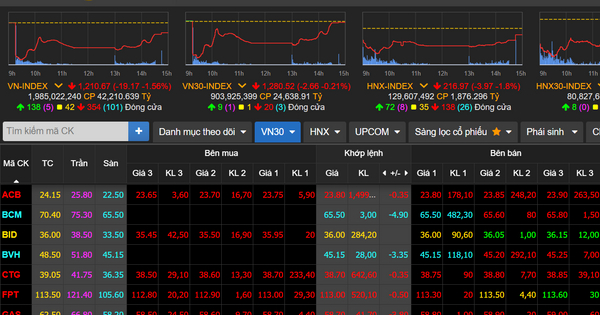

Joint Stock Commercial Bank for Foreign Trade of Vietnam is listing the USD/VND exchange rate at 23,560 VND/USD - 23,900 VND/USD, an increase of 40 VND/USD in both buying and selling compared to the end of yesterday.

The USD/VND exchange rate skyrocketed in both the banking market and the free market. Illustrative photo

At the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), the USD/VND exchange rate is: 23,595 VND/USD - 23,23,895 VND/USD. The Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank) buys and sells USD at: 23,559 VND/USD - 23,899 VND/USD.

Vietnam Export Import Commercial Joint Stock Bank (Eximbank) listed the USD/VND exchange rate at: 23,580 VND/USD - 23,890 VND/USD, up 50 VND/USD in both directions.

The USD/VND exchange rate at Vietnam Technological and Commercial Joint Stock Bank is trading at: 23,568 VND/USD - 23,903 VND/USD, up 36 VND/USD.

In the free market, the US dollar also increased sharply.

In Hang Bac and Ha Trung - the "foreign currency streets" of Hanoi, the USD/VND exchange rate is commonly traded at: 23,700 VND/USD - 23,750 VND/USD, an increase of 50 VND/USD in both buying and selling directions compared to the end of yesterday.

Previously, in July, the US dollar had increased significantly.

According to data released by the General Statistics Office, the price of the US dollar fluctuated between increases and decreases worldwide as inflation in the US cooled down and was affected by positive information from the US labor market.

As of July 25, 2023, the US dollar index in the international market reached 101.07 points, down 1.86% compared to the previous month. Domestically, the average US dollar price in the free market was around 23,787 VND/USD. The US dollar price index in July 2023 increased by 0.53% compared to the previous month; decreased by 1.71% compared to December 2022; increased by 1.04% compared to the same period last year; the average increase in the first 7 months of 2023 was 2.39%.

Struggling in Asian markets

The dollar struggled to gain ground on Wednesday after Fitch downgraded the U.S. government’s top credit rating, raising questions about the fiscal outlook for the world’s largest economy, although it received some support from a slew of relatively solid economic data.

Ratings agency Fitch on Tuesday downgraded the US rating to AA+ from AAA in a move that drew an angry response from the White House and surprised investors, despite a resolution on the debt ceiling crisis two months ago.

That pushed the greenback lower, lifting the euro toward $1.10. The currency was last up 0.11% at $1.0996, after earlier hitting a session high of $1.1020.

Similarly, sterling rose 0.05% to $1.2782, while the US dollar index was last 0.09% higher at 102.09, after slipping following the Fitch news.

On the flip side, the dollar was supported by economic data on Tuesday showing US job openings remained at levels consistent with tight labor market conditions, even as they fell to their lowest in more than two years in June.

A separate report showed US manufacturing likely stabilized at a weaker pace in July amid a gradual improvement in new orders, although factory employment fell to a three-year low.

Elsewhere, the Japanese yen was about 0.1% stronger at 143.21 per dollar.

Minutes of the Bank of Japan's (BOJ) June policy meeting, released on Wednesday morning, showed BOJ leaders agreed on the need to maintain ultra-loose policy for the time being.

The Australian dollar rose 0.12% to $0.6621, reversing some of the sharp 1.57% drop in the previous session after the Reserve Bank of Australia (RBA) kept interest rates unchanged.

The New Zealand dollar fell 0.23% to $0.6136, after data on Wednesday showed the country's unemployment rate hit a two-year high in the second quarter.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs the regular Government meeting in March](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/8393ea0517b54f6791237802fe46343b)

![[Photo] Military doctors in the epicenter of Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/fccc76d89b12455c86e813ae7564a0af)

![[Photo] Quang Binh: Bright yellow vermicelli flowers in Le Thuy village](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/6/80efad70a1d8452581981f8bdccabc9d)

Comment (0)