How much is 1 USD in VND today?

State Bank USD exchange rate is at 23,956 VND.

Vietcombank USD exchange rate is currently at 24,200 VND - 24,570 VND (buy - sell).

The Euro exchange rate is currently at 25,508 VND - 27,086 VND (buy - sell).

The current Japanese Yen exchange rate is 159.44 VND - 169.87 VND (buy - sell).

The British Pound exchange rate is currently at 29,925 VND - 31,405 VND (buy - sell).

Today's Yuan exchange rate is at 3,310 VND - 3,475 VND (buy - sell).

USD price today

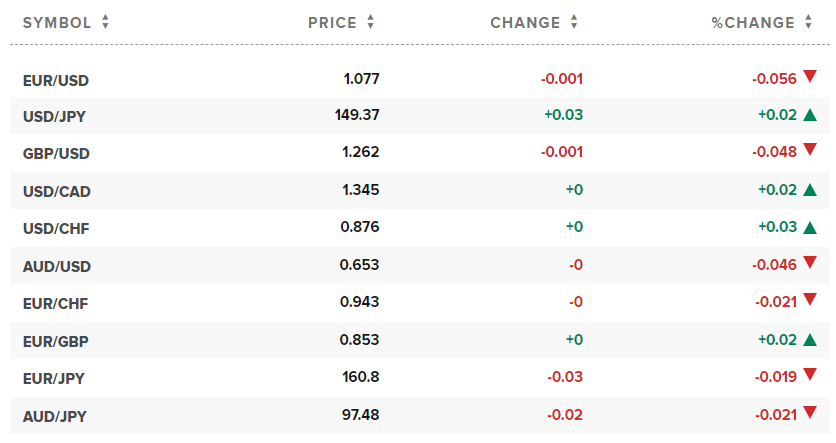

The US Dollar Index (DXY) measures the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recording at 104.16 points.

JPY/USD hits 150. Trading remains subdued in Asian forex markets due to Lunar New Year holidays. On the other hand, markets remain cautious ahead of the upcoming US consumer price index data.

The Yen exchange rate is currently at 149.39 JPY/USD, approaching 150. This is a level that is believed to cause Japan to intervene in the foreign exchange market to prevent the Yen from losing value.

The JPY/USD exchange rate has risen more than 5% since the beginning of 2024. The exchange rate has been under pressure due to the US Federal Reserve's policy. The downward trend of the Yen is also due to speculation that the Bank of Japan will not raise interest rates strongly.

“It’s a yield story,” said Tony Sycamore, market analyst at IG. “U.S. yields are at their highest level in 2024, which is weighing on JPY/USD. Spreads are also a factor given the low volatility.”

The euro fell 0.03 percent to $1.0768, while the pound fell 0.07 percent to $1.262.

The market focus this week is on the US inflation report for January, which is likely to provide further clarity on when and how much the Fed may cut interest rates this year.

A string of strong US economic data, particularly a blistering jobs report earlier this month, has raised expectations that US interest rates are likely to stay high for longer.

The Fed is expected to cut interest rates by 110 basis points in May.

The New York Federal Reserve said in its January Consumer Expectations Survey that one-year inflation is expected to be 3 percent, while five-year inflation is expected to be 2.5 percent.

“Clearly, the US dollar has really benefited from the US economic data. This has further strengthened the greenback's position,” said Kyle Rodda, senior financial markets analyst at Capital.

The USD Index edged up 0.02%.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)