The pensioner died 7 years ago, but Phu Yen Social Insurance agency still paid benefits with a total amount of nearly 400 million VND.

On the afternoon of August 15, Phu Yen Province Social Insurance announced that Ms. Huong (residing in Tuy Hoa City) is eligible for monthly pension and receives money through her personal account. The payment is made through the postal system.

On January 29, 2016, Mrs. Huong passed away. Her family reported her death to the ward People's Committee but did not go to the social insurance agency to complete the procedures for burial expenses and one-time death benefits. Because they could not confirm Mrs. Huong's death, the post office continued to regularly pay her pension through her account.

Recently, when implementing the citizen identification code, Phu Yen Social Insurance discovered that Ms. Huong had passed away. From February 2016 to June 2023, the post office transferred 89 months of pension (more than 4.4 million VND per month) to her personal account with a total amount of 392.2 million VND and 2.8 million VND in Tet gifts from the Provincial People's Committee (400,000 VND per year).

At the time of discovery, Ms. Huong's account was "short" more than 150 million VND compared to the amount the post office had paid, due to relatives withdrawing it for use. After working with the authorities, her son agreed to complete the procedures to pay the funeral expenses and one-time death benefit for his mother and return the amount the post office had overpaid.

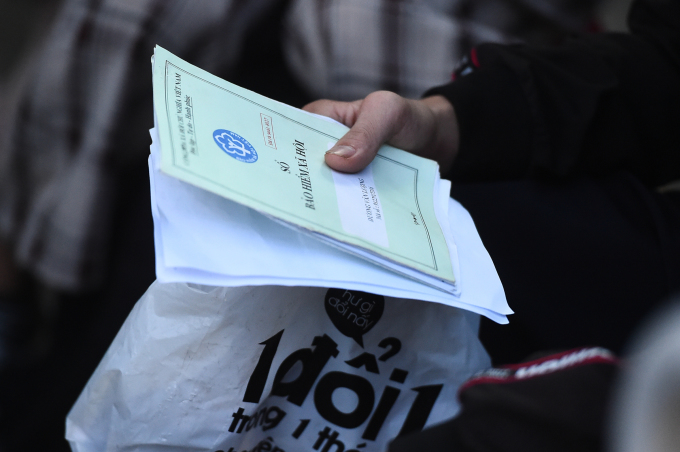

People who have participated in social insurance for enough years, when they reach retirement age, will be guaranteed a pension until they die. Photo: Dinh Van

Responding to VnExpress , Mr. Tran Van Toan, Director of Phu Yen Social Insurance, said that he has asked the post office to recover the wrongly paid amount. The agencies are coordinating to assess the cause and procedures for issuing death certificates. Once clearly identified, the insurance side will have a basis to consider calculating interest on the amount paid.

From Ms. Huong's case, Phu Yen Social Insurance reviewed all pensioners to ensure they are eligible to continue receiving their pensions. This is to both learn from experience and avoid similar mistakes.

Not only Phu Yen, pension payments to deceased people occur in other localities. The social insurance agency stated the reason is the lack of regulations requiring pensioners to confirm their eligibility to continue receiving pensions with the paying unit.

Currently, pension payments are paid by insurance through the postal system in three forms: cash payment at the post office, bank account, and authorization for another person to receive on behalf of the beneficiary, depending on the beneficiary's needs.

In the terms of coordination in pension payment between Vietnam Social Security and Vietnam Post Corporation, there is a requirement that postal staff must periodically check the status of pension recipients every year. In addition, local post offices that have signed contracts with communes and wards must notify the system to stop when receiving information about the death of a pension recipient.

Mr. Tran Dung Ha, Deputy Director of Ho Chi Minh City Social Insurance, said that despite the regulations, there are still cases where the deceased are still paid pensions, mainly falling into the group that registered to receive through bank accounts or authorized others to receive on their behalf. Ho Chi Minh City has more than 251,000 pensioners, and some cases have been discovered and then had to be collected.

The reason is that the beneficiary moves to other localities, dies but relatives do not report the death to the place of permanent residence, or goes to settle abroad... so post office staff and commune and ward officials cannot manage it.

According to Mr. Ha, although the deceased pensioner will receive a funeral allowance equal to 10 months of basic salary (currently 18 million VND), a one-time or monthly death benefit. However, it is not excluded that relatives may find "receiving a monthly pension more beneficial than other benefits, so they do not declare it".

Direct pension payment at Phu Nhuan post office, August 14, 2023. Photo: An Phuong

To "plug" this loophole, previously, the Ho Chi Minh City Social Security required pensioners to receive pensions through bank accounts or authorization every 6 months or a year to go to the nearest social security agency or the commune or ward where they reside to confirm their eligibility to continue receiving benefits. This method has been effective and is being implemented by the Vietnam Social Security nationwide.

However, according to Mr. Do Ngoc Tho, Head of Policy Implementation Department (Vietnam Social Security), this approach has been criticized by many people because they think that the social insurance agency is making things difficult for people, and the insurance industry does not have the right to issue documents requesting people to report. Therefore, the request for pensioners to periodically confirm their eligibility for benefits has been abolished.

According to Mr. Tho, there are more than 3.3 million pensioners nationwide, so management is challenging. Recently, social insurance agencies in some localities discovered that some deceased people were still receiving pensions and had to collect both principal and interest.

To overcome this, Mr. Tran Dung Ha proposed that in this revision of the Social Insurance Law, it is necessary to include a regulation that at least once a year or six months later, pensioners must contact the social insurance agency or the locality where they reside to check information and upload data to the system. This regulation is similar to the monthly requirement that workers must go to the employment service center to declare their job loss status in order to continue receiving unemployment benefits.

* The character's name in Phu Yen has been changed.

Bui Toan - Le Tuyet

Source link

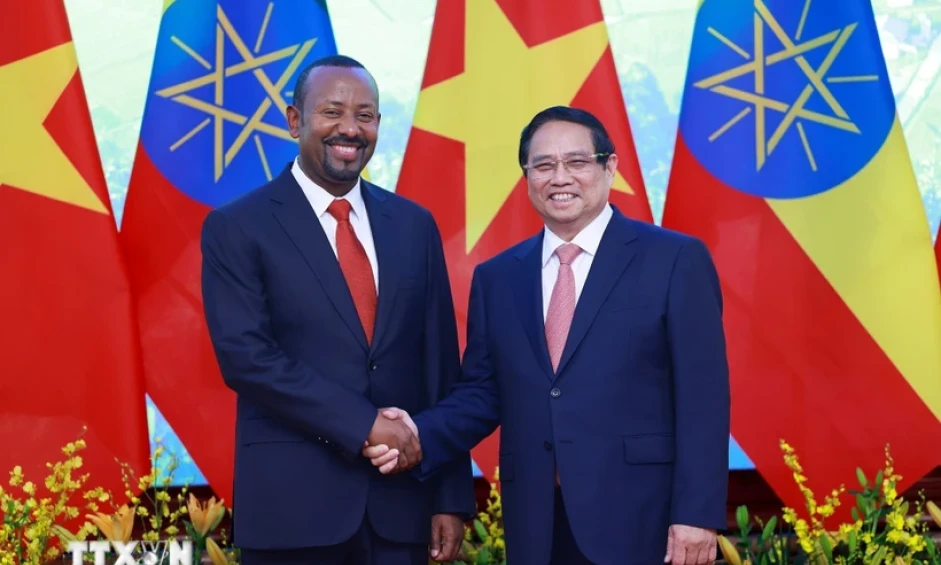

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)