Update the latest bank interest rates today

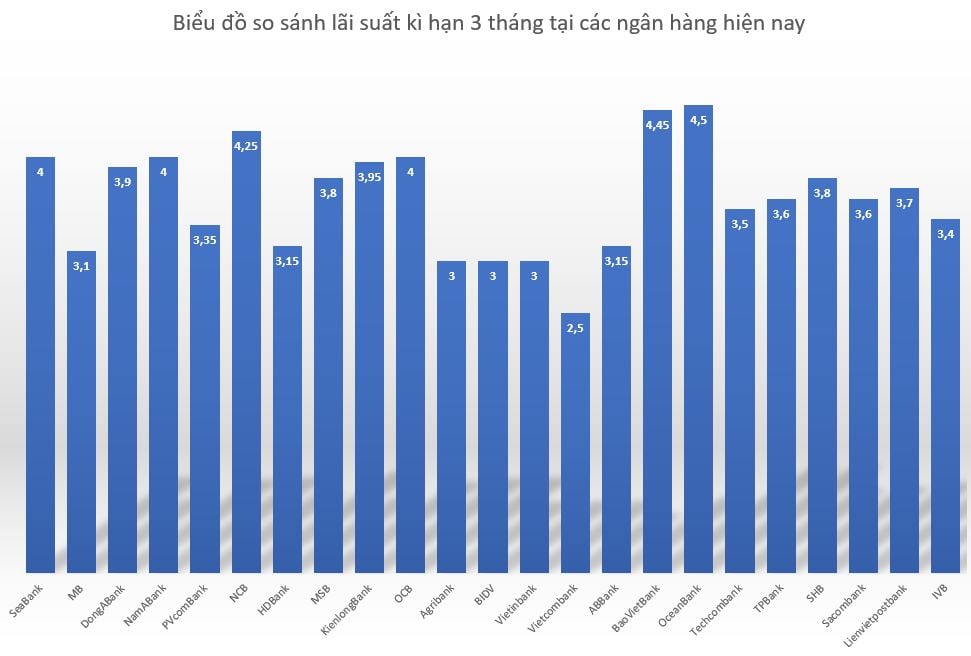

According to Lao Dong reporter (9:00 a.m. on December 18, 2023) at more than 20 banks, the savings interest rate table for individual customers fluctuates around 2.5 - 10.5%, depending on the term and applicable conditions.

In which, the top banks with high interest rates are: PVcomBank, HDBank, NCB, NamABank, OceanBank, SHB...

Specifically, for the 3-month savings term, the group of banks with high interest rates includes BaoVietBank (4.45%), OceanBank (4.5%), NCB (4.25%), NamABank, OCB (4.0%). In contrast, Vietcombank is listing the lowest 3-month term interest rate, at 2.5%.

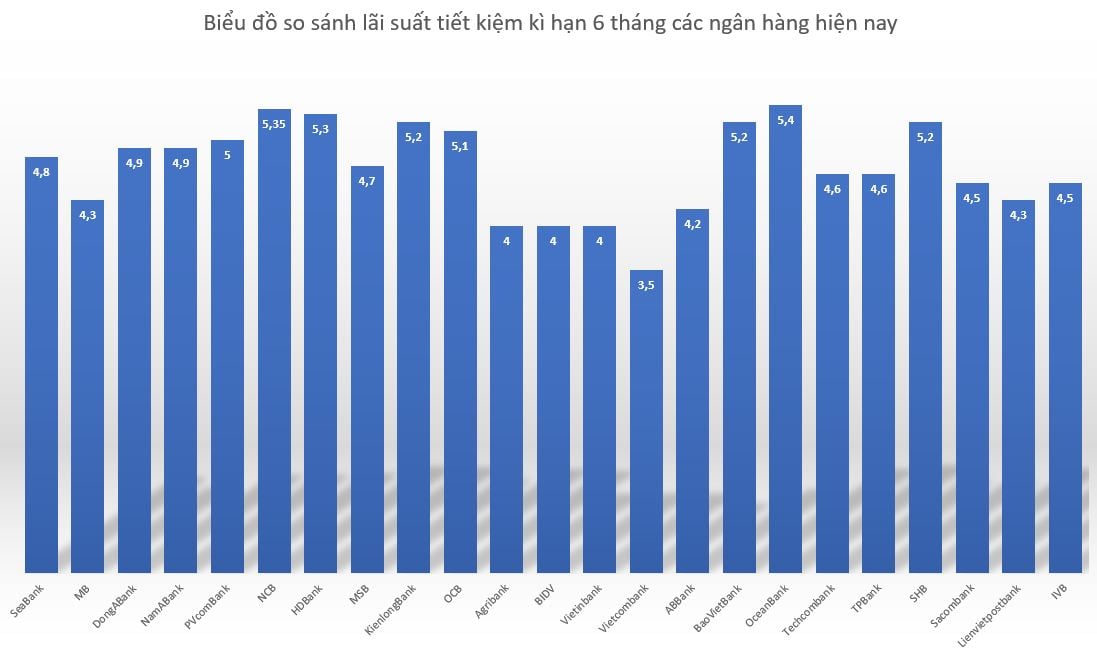

For the 6-month savings term, the group of banks with high interest rates includes: OceanBank (5.4%), HDBank (5.3%), NCB (5.35%), SHB (5.2%), BaoVietBank (5.2%). For this term, Vietcombank listed the lowest interest rate, at 3.5%.

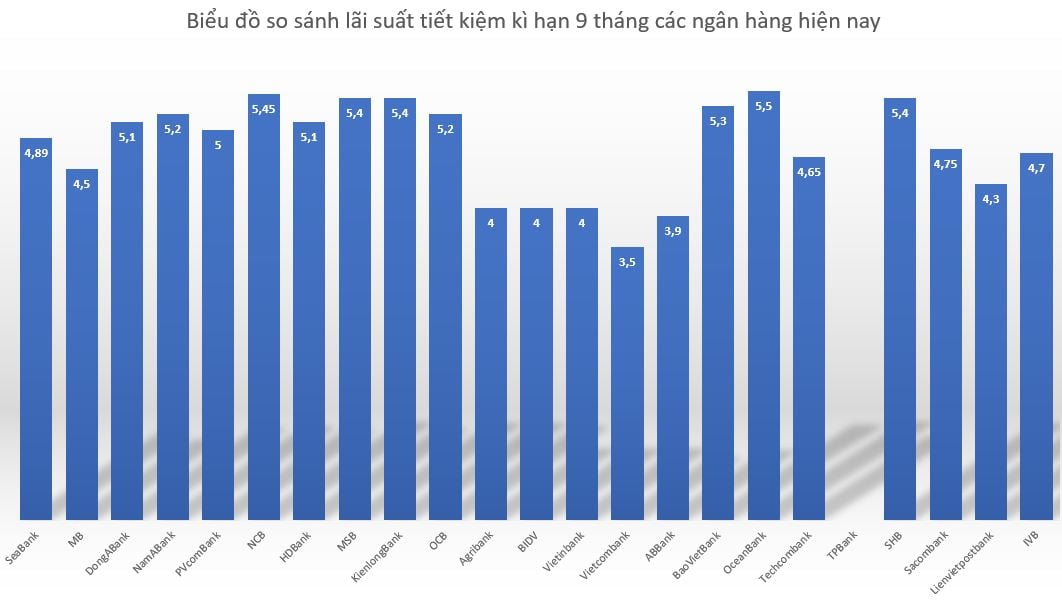

For the 9-month savings term, the highest interest rate is 5.5%, listed by OceanBank. Next is NCB, with an interest rate of 5.45%. MSB, SHB, and KienlongBank also listed an interest rate of 5.4% for this term.

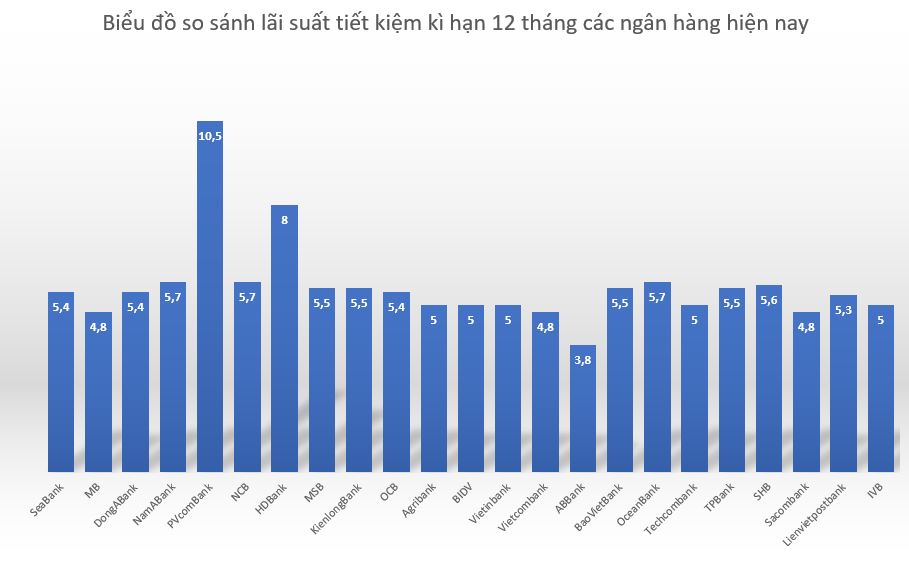

12-month bank savings term, highest interest rate listed by PVcomBank, up to 10.5%. Conditions apply to customers opening a book at the counter, new deposit amount from 2,000 billion VND or more. Next is HDBank, with an interest rate of 8%, the applicable condition is new deposit amount from 300 billion VND or more.

In addition, other banks listed high interest rates without conditions such as: NCB, OceanBank (5.7%). On the contrary, the lowest interest rate for this term is 3.8%, listed by ABBank.

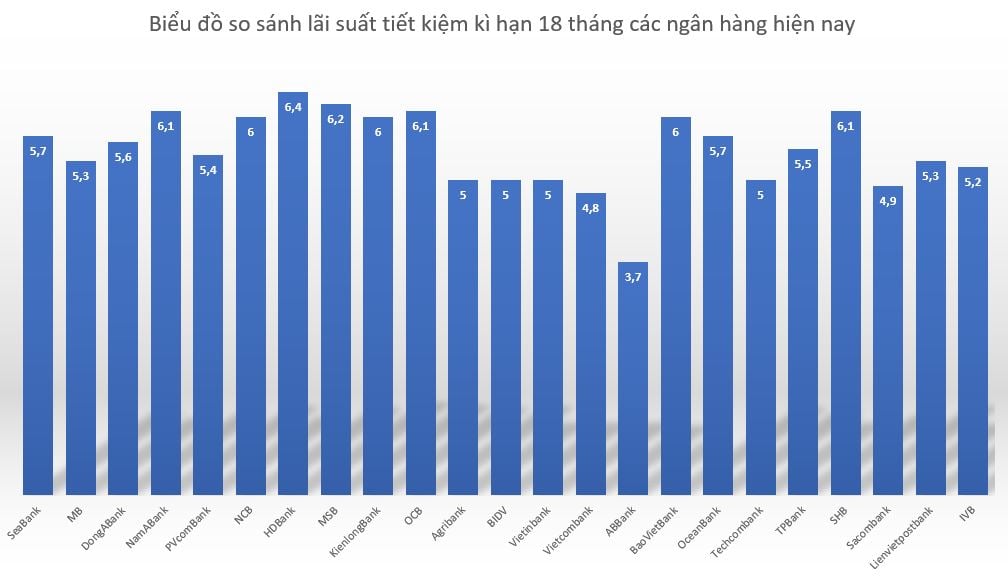

At the 18-month savings term, the highest savings interest rate is 6.4%, listed by HDBank. Next are MSB (6.2%), SHB (6.1%), OCB (6.1%).

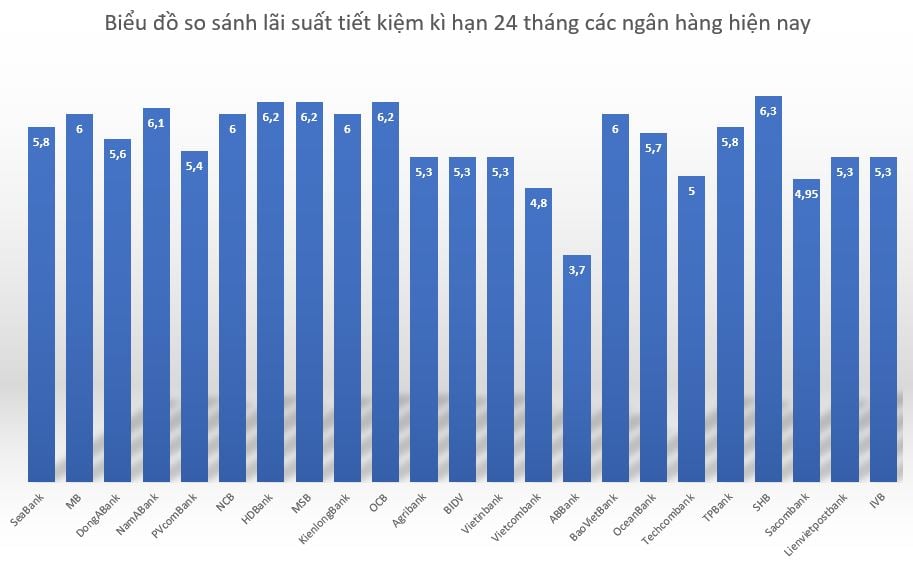

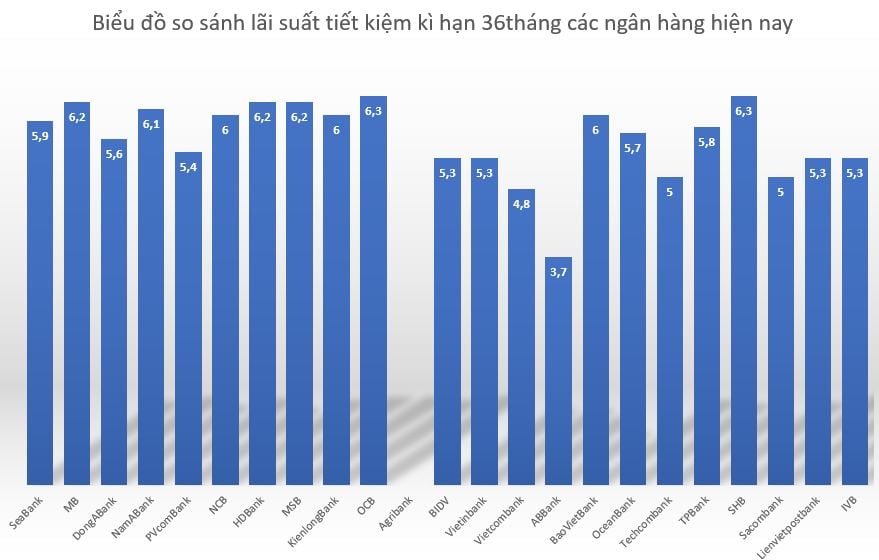

For 24-month and 36-month terms, SHB is leading the comparison table of bank deposit interest rates. Currently, SHB lists an interest rate of 6.3%.

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more information about interest rates HERE.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

Comment (0)